Will Stock Market Investors Get Out In Time This Time?

Stock-Markets / Stock Markets 2014 Jul 18, 2014 - 06:59 PM GMTBy: Sy_Harding

It is normal and understandable that investor confidence grows as paper profits in a long rally or bull market pile up. It’s therefore normal and inevitable that investor sentiment will be at its most bullish for that cycle by the time a rally or bull market tops out.

It is normal and understandable that investor confidence grows as paper profits in a long rally or bull market pile up. It’s therefore normal and inevitable that investor sentiment will be at its most bullish for that cycle by the time a rally or bull market tops out.

However, it is also true that as the old Wall Street legend goes, ‘They don’t ring a bell at the top’. So how can investors who want to avoid the next meltdown, and have told themselves that this time they will, know when it’s time to act?

Since they don’t ring a bell at tops for either public investors or for so-called ‘smart money’ corporate insiders, institutional investors, and billionaire hedge-fund managers, the data shows that the latter begin to sell when they consider risk has become too high, selling on the way up. They even use the degree of public investor sentiment as one of their tools in determining when risk becomes too high, along with valuation levels, and other factors.

Meanwhile, most market technicians tend to buy on the way down, but hopefully very near the top. Most use trend-following strategies, such as the breaking of support levels as a guide. So they also tend to be bullish and fully invested at market tops, but have an exit strategy that will hopefully get them out without giving too much back.

However, history shows the majority of public investors do not seem to have any strategy at all, for getting out - or back in.

As a result, the data shows a repeating pattern of public investors coming into the market very timidly and late in bull markets, pouring increasing amounts of money in as their confidence grows, and then being hammered by the bear markets.

As the Vice-President of the Securities Investor Protection Corporation (SIPC) said in 2001, “We have been at this for over 50 years, and see the same problem over and over again. Investors are enticed in during bull markets, but then don’t know what to do when things turn sour later.”

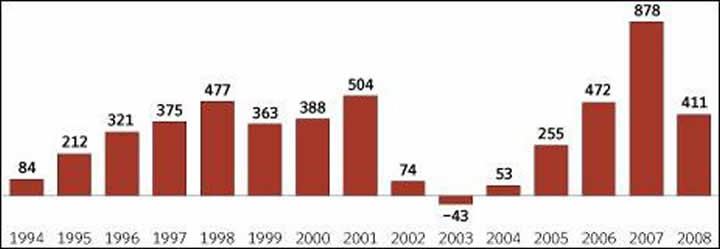

The Investment Company Institute published this graph in 2009. It shows how investors not only poured more money into stock mutual funds and etf’s in 2000, as the severe 2000-2002 bear market began, but continued to do so at a then record pace in 2001, even as the market plunged still further in the second year of that bear market, apparently ‘buying the dips’.

It was not until after the bear market ended that they pulled money out of the market, in 2002, 2003, and 2004, missing the first three years of the 2002-2007 bull market.

The same pattern repeated in the next cycle. It was not until 2005 that public investors began timidly putting money back into the new bull market. The inflow then increased, reaching a new record in 2007, as the severe 2007-2009 bear market began. Investors continued to pour money in at a robust pace in 2008 as that bear market meltdown worsened.

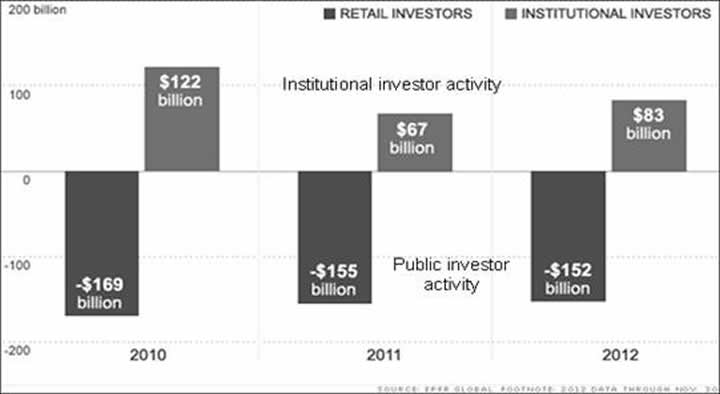

If we fast forward to the next graph, we see that it was not until after the current bull market began in 2009 that investors began pulling money out of the market, and continued to do so in 2010, 2011, and 2012, even as institutional investors were pouring money back in.

More recently, investors began pouring money back into the market in the second half of 2012, and did so at a near record pace last year.

I was surprised to see a report this week from Bloomberg News and the Investment Company Institute that investors flooded ten times as much new money into stock mutual funds and etf’s over the last 12 months as over the previous 12 months.

The market is up roughly 6% for the year so far, and no support levels have been broken.

However, we do know that so-called ‘smart money’ corporate insiders and many of the big-name institutional managers have been selling and warning of risk being as high as at previous market tops. But they began doing so more than a year ago, and have been wrong so far.

Yet that is their typical pattern, to be early, wrong for the short-term, but very successful over the long-term.

One has to wonder, with risk so typical of previous market tops, if the historical pattern for public investors is setting up again, or will they do a better job of getting out on time this time.

One thing we do know is that it’s more important to have the discipline or a strategy to sell near tops. Doing so, even if some money is left on the table, pretty much takes care of the problem of being depressed and fearful at market bottoms. Having taken profits near a top, avoiding the losses others experience in bear markets, does wonders for having the cash and confidence to re-enter at the lows.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.