In depth Market Wrap - US Economy, Stocks, Bonds and Currencies - China Crisis

Stock-Markets / Global Stock Markets Mar 06, 2007 - 12:08 AM GMTBy: Douglas_V_Gnazzo

The Economy - The Commerce Department reported that gross domestic product last quarter rose at a 2.2% annual rate. New home sales plunged, while orders for durable goods slid the most since October.

Personal Income was up 1.0%, while personal spending was up 0.5%. If the figures are correct, such is a good thing, as less was consumed then produced and earned, which allows for savings.

The ISM Manufacturing index was up 3 points to 52.3. Prices paid were up 6 points to 59. Production and new orders both increased by almost 5 points.

Confidence among U.S. consumers fell last month from a two-year high as fuel prices ate into personal income, and employment weakened.

The Reuters/University of Michigan's final index of sentiment fell to 91.3 from 96.9 in January. The unemployment rate rose to 4.6% in January.

New-home sales fell in January by the most in 13 years, putting to rest the notion that the real estate bubble is anywhere near being over.

Reserve Chairman Ben S. Bernanke stated that globalization could cause the U.S. inflation rate to rise. Who would have figured?

Federal Reserve Bank of St. Louis President William Poole said that there "could be a recession, but that one isn't likely." Who should have figured?

The Week That Was - Last week was the week that was, and many an investor cherishes the relative calm of the markets being shut down for the weekend. It is time to regroup and to go over one's investment strategy, now that the game has changed somewhat.

Nothing has changed fundamentally with any of the markets. What has changed is the psychological perception of the markets: more specifically the psychological view of risk versus reward: greed versus fear.

Prior to last week caution had been thrown to the wind. Everyone had their hair down and their six guns blazing. The only fear was the fear of being left out of the next get rich scheme. Speculation ran rampant. Greed ruled the roost.

Not quite so anymore, as a realty gut check occurred last week. Three desperados rode into town: liquidity, the Yen carry trade, and China. And they came packing for a fight.

Stock markets, currency markets, and commodity markets around the world got whacked but good. No quarter was given - none was asked. Prisoners were not taken. The first hombre to arrive in town was China.

China's central bank, unlike Mr. Greenspan, knows a bubble when it sees one, and they are not afraid to take action to try to prevent the bubble from growing larger, and hence more dangerous.

Last week the People's Bank of China raised the reserve requirements of their banking industry, requiring the banks to hold 9.5% cash on reserve, as opposed to the then prevailing rate of 9%. Such action dwarfs the raising of interest rates, which is simply raising the cost of money.

Raising reserve requirements literally reduces the amount of money or credit available in the system to be loaned out. Raising rates is a slap on the hand; raising reserve requirements is a slap in the face with a 2 x 4. The markets reacted accordingly.

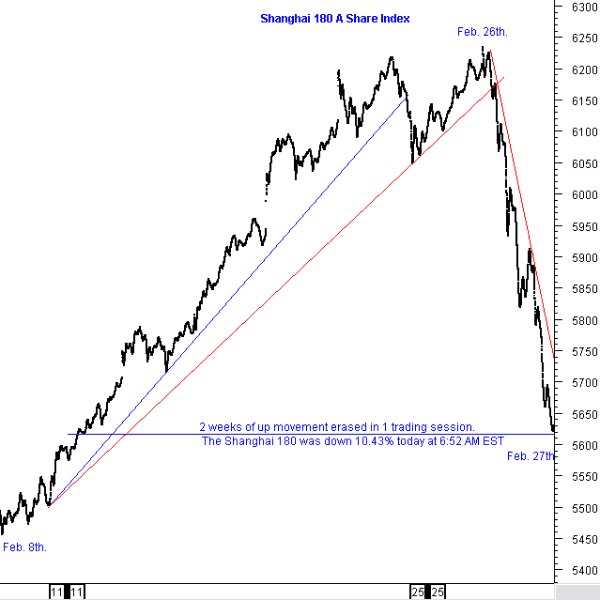

First to go down from the blow was China's stock market, which fell almost 10% in one day. From there the contagion spread around the world like a game of dominos gone bad.

Morgan Stanley's Capital International AC World Index, which covers developed and emerging markets around the world, fell 4.7%. Europe's Dow Jones Stoxx 600 Index dropped 3%. Japan's Nikkei 225 Stock Average dropped 5.3% for the week, and Malaysia's Kuala Lumpur Composite Index fell 9.3%.

Altogether it is estimated that the global rout vaporized more than $1.5 trillion of stock-market value in a matter of hours. The U.S. markets did not escape unscathed. The Dow lost 4.2% for the week, and the S&P 500 was down 4.4%. The Transports were whacked for a 7.3% loss. The Utilities fell 1.8%. The Transport's action is most disturbing.

The NASDAQ gave back 6.2%, while the Broker/Dealers index dropped 7.6%. The HUI Gold index was decimated for a 9.5% loss. Ouch!

The Trade - The second desperado to ride into town was the yen carry trade. Japan has become infamous for its zero interest rate policy. Until quite recently, the interest rate to borrow money in Japan was literally zero percent. Within the past year they have gotten tough, raising rates first to .25% and now to .50%. Give me a break.

What this zero interest rate policy did, and continues to do, is to advertise that Japan is giving money away for free. Speculators circled like vultures. The name of the game was to borrow yen on the short side of the trade, and to then go long with a higher interest rate returns on the other side, the preferred beast being U.S. Treasury Bonds; or to go long any of the commodities, including gold or silver. The U.S. had a similar ploy - the Greenspan put.

Thus was born the Yen Carry Trade - a creature born of desire, suckled by greed. It was the cheap yen that provided much of the liquidity that has fueled many of the global asset bubbles. That and the oceans of paper fiat debt-money the Fed has made the leading export of the United States.

Liquidity - Next to ride into town was liquidity, a very nasty hombre, as many of the wannabe gunslingers found out. This dude is bad to the bone - knows not the meaning of quarter.

By China raising reserve requirements - again, speculators started getting nervous. The game was now getting harder to play. Rules were starting to appear. Dodge was no longer an "open" town.

China is considered to be one of the driving locomotives of the global economy, if it slows down, conventional wisdom has the world economy reacting by slowing down. Profits would be harder to come by. The days of easy money might be drawing to a close.

Doubt now entered the picture, where before denial ruled supreme. Weak hands started selling, and suddenly everyone was rushing for the exit. Stocks fell - hard.

This in turn caused losses to mount, those buying on margin learned why such is a two edged sword. Margin calls started to go out - now you had to pay to play. Liquidity now becomes tantamount.

Cash was needed and needed fast, as the margin clerks are not patient fellows, being the enforcers of the house. Anything and everything of value goes up for sale, as long as it raises cash - liquidity to pay the vig. Fear hung in the air - you could smell that smell - the smell that hangs around.

The Good, The Bad, and the Ugly - During such panics the baby gets thrown out with the bath water. The best investments are sold to pay for those gone bad: a pretty site it was not. Even gold and silver, and the precious metals stocks were sold, as they had been some of the best performers, and thus raised the most liquidity - as cash was King for a day.

One market remain untouched by the contagion - above all the rest: the bond market, and most specifically: the United States Treasury bond market. Fascinating how the bond market, which is the debt market - is the safe haven during a liquidity crisis that is born from debt. But that is another story for another time.

I would point out, however, that there are many a carry trade that has yen on one side, and bonds on the other. Caveat Emptor, as they may not retain their virginity.

The first chart below belongs the main culprit in last week's debacle: China's Shanghai 180 Stock Index. As you can see the market had quite a fall from grace.

China's Shanghai 180 Stock Index

Stocks - Stock markets around the world reacted by falling precipitously, some more than others. The U.S. markets suffered the same fate. The S&P 500 fell 4.4% to 1387.17. The Dow Industrial Average declined 4.2% to 12,114.10. The Nasdaq Composite Index fell 5.9%, closing at 2368.

Below is the S&P 500 chart, which shows several key markers. First, is the fact that the market had not undergone an intermediate term correction since last June - July of 2006, or over seven months ago. The market was due for a downdraft and one finally occurred. If it were not China - it would have been something else that triggered the long overdue correction.

Put to call ratios have risen and are still rising fast, and most likely will for a while. That's what happens when fear takes over and panic reigns supreme. Until the put to call ratio gets into overbought territory, and then rolls over, there will not be any sustainable rally forthcoming.

The chart below shows a blow-off move that broke right out of its rising trend channel, before correcting back down to just inside the channel. RSI shows negative divergence, as well as a big move down. MACD has put in a negative cross over.

The Nasdaq 100 shows several negative divergences. The VIX presaged the correction by dropping below 10. This indicator will have to move back up before a sustainable rally is possible.

What had recently been support is now overhead resistance, as the market closed below the 1750 level. Look for breadth to run bearish - reaching oversold levels, with volatility increasing as well.

Next is a chart comparing the Nasdaq and the Dow industrials that illustrates the Dow outperforming the Nasdaq, which is an indication that investors are becoming more risk conscious - seeking out the larger cap and well establish Dow stocks and shunning the newer and riskier Nasdaq stocks.

A lot of players got caught on the wrong side of the trade. These individuals will most likely sell into any rallies that first occur. Hence, there is now significant overhead supply or resistance to be worked off.

It will take time to mend, and it will not happen overnight. A violent short covering spike or mini-run may be in the offing before further downside action occurs. Approximately $837 billion dollars of equity disappeared in just one day. The broker/dealer chart shows the effect upon those whose business it is to sell stocks.

As mentioned in the opening of this report, the yen carry trade was a major contributing factor in the global rush towards liquidity. Anything and everything that could be sold to raise cash was sold. Consequently, the yen experienced a strong rally against all major currencies, as many (but not all - very important distinction to remember) carry trades were unwound.

The chart below illustrates the rebound the yen had versus the euro, which is one of the strongest performing currencies, while the yen is one of the weakest.

Some of these carry trades have accumulated over years. In other words they are not going to be unwound overnight. It will take time - lots of time.

Bonds have been rallying of late, however, there are huge carry trades with the yen on one side and US bonds on the other. A further move up in the yen will cause bond prices to go down. Yesterday they were a safe haven - next month they may be notes of confiscation.

Up next is the chart of the yen on its own. The long-term bottom trend line is easily distinguishable. It was breached and then price spiked back up and above with the recent stock market mayhem and the unwinding of yen carry trades: causing the yen to be bought.

Notice the levels of the stochastic indicator and the MACD indicator whenever the yen made an intermediate to long-term bottom. Negative divergence is now present, and we have not yet reached the previous stochastic levels that rallies have started from in the past.

Below is the euro chart that shows the euro approaching overhead resistance. RSI is far from the overbought level, and the MACD is starting a positive cross over. The euro has been one of the best performing world currencies.

The chart pattern may be forming a cup with a handle - one of the most bullish chart patterns there is.

The U.S. dollar is one of the weakest currencies in the world. As the next chart indicates, the dollar has been in a long-term steady decline. Several times the dollar has rallied up to its 200 day moving average, only to be repelled back down.

Presently the dollar is oversold and is flashing positive divergences, which may lend support to a short-term rally. The MACD indicator has also just made a positive cross over.

Intermediate and long term we are very bearish on the dollar. It is an accident waiting for a time and place to happen.

Bonds - U.S. Treasury bonds remain in a secular bear market, regardless of the recent rally and flight to safety. Treasury bonds had their largest rally of the past five months, as investors sought a safe harbor from the loss of over $1.5 trillion dollars in global equity markets.

Two-year yields plunged 27 bps to 4.53%. The five-year Treasury fell 22 bps to 4.44%, and the 10-year yield was down 17 bps to 4.50%. Long-bond yields gave back 14 bps to 4.50%. The spread between the two-year and the ten-year decreased 10 bps this week to close inverted by 3 bps.

So, the Fed lessened the slope of the yield curve, while still maintaining an inverted rate of 3 bps. The Fed has been masterful thus far - the operative words being: thus far. Time will tell if messing with the markets is compatible with free markets and sound monetary policy.

Up first is the ten-year Treasury Note Yield chart. It shows rates falling quite steadily since February.

Next is a chart comparing the 30-year bond yield versus the 90-day Treasury bill yield. As unbelievable as it is - 90-day paper is yielding 4.97%, while 30-year paper is yielding 4.65%. Only in paper fiat land - where debt is money, and money is debt.

Fed Foreign Holdings of Treasury Debt rose $6.8 billion to a record $1.83 trillion. Custodial holdings have increased almost 20%. International reserve assets, excluding gold, expanded to another new record of over $5 trillion dollars.

Next is a chart comparing the 30-year bond with the 5-year note. The chart shows that overhead resistance is approaching quite fast. A break above the resistance line would mean higher interest rates. This chart bears watching.

The chart below of the 30-year Treasury bond price shows the recent move up in bond prices, as yields went down. It also shows the bottom trend line, which is not far away. If that trend line gets broken to the downside - interest rates will be trending higher.

Credit-Default Swaps - U.S. bonds were not the only debt market that fared well in last week's equity debacle. European bonds rallied to their highest level in almost two years. Not only did money from stocks flow into bonds, but money from emerging market bonds also found its way into safer government bonds.

A sign of the times, or perhaps of things to come - was the sudden rise last week in credit-default swap trading, which increased to a record 200 billion euros ($263 billion). Investors were once again seeking a safe haven to ride out the storm.

Three times the average weekly volume of credit-default trading transpired. Credit-default swaps are supposed to protect bondholders against default, by paying the buyer the face value of the bond, in exchange for the underlying securities - if the business in question cannot honor its debt obligations. They work somewhat like a bookie laying off risk.

Summary - As always, interest rates are key. As go interest rates, so goes the bond market and the dollar market. As goes the bond market, so goes the mortgage market.

More money, or should we say credit and debt, are tied up in the housing market then in any other market. If the housing market goes, the economy will go with it. Interest rates are thus key.

The question on everyone's mind is: what are the world's stock markets going to do, and specifically what is the U.S. market going to do. We wish we knew. All we can do is to offer the most likely scenarios and try to plan accordingly. Forewarned is forearmed. Expect the unexpected and be prepared.

The recent action by China's central bank, and the reaction of its and other global stock markets, suggest similar future action by the central bank, as it does want to try to control the asset boom presently going on.

The $64 dollar question is: can they do it? No they can't. Period. Paper fiat is paper fiat, whatever the name is stamped on it. As such it is junk - junk that eventually destroys itself by debasement and loss of purchasing power: it is what paper fiat currencies do: self-destruct.

So we do expect the stock markets to go down again, and rather significantly as well. When - we have no idea. We don't believe it will be next week, although it is possible. It is more likely to see a short-term rally and a move down later this spring, but there are many other scenarios as well. The markets can remain irrational much longer then we can stay solvent.

Stuff that when you drop it on your foot you go "ouch" are the preferred investments at this juncture, especially gold, silver, and energy. One lesson of this past week was that when the overall stock market takes a hit, it's like the fox raiding the hen house - the fox usually gets ALL the chickens, which means that precious metal stocks are NOT immune to significant downdrafts - even if they have been stellar performers.

Like any piece of paper - gold and silver stocks are subject to general market risk. And as we saw last week - a sub-plot to general market risk is LIQUIDITY .

DO NOT under estimate the POWER of liquidity. Currency flows just like water flows. Currency can have droughts and floods just like water flows: they're called money flows; and they are huge volumes of money and credit sloshing around the world searching for yield. If you get in the way - it will wash aside like a sprig from a tree.

Physical gold and silver are somewhat safer, although when liquidity is needed anything and everything is sold to raise cash. Caveat Emptor.

So what's a good investor to do? Be patient. Keep it simple. Focus on the preservation of capital - the return of your money, not the return on your money. Cash can't hurt right now. Booking profits cannot hurt right now.

We plan on buying more pm stocks on weakness that holds support, but that could change any day. We also plan on taking profits whenever they are offered. We remain cautious but ever vigilant for what the market offers.

The last several weeks we have mentioned sub prime loans that could spread into the rest of the markets. New Century Financial Corp. disclosed that the SEC is pursuing a criminal probe into the company's improper lending policies regarding mortgages issued to borrowers that had no qualifications to support paying off a mortgage. This is NOT an isolated case.

There still remains a LOT of carry trades to be unwound - and unwound they will be. Before all is said and done (2010?) the words derivatives and carry trade will be household words. We wish it was not so, but are afraid it is. Hopefully we will be wrong - and thankful for it.

It will not be pretty. The only thing that can possibly stop it is Honest Money - gold and silver coin as mandated by the Constitution. We must return to the Constitution and the ideals it espouses: freedom, liberty, and justice FOR ALL.

We The People ordain the government. The government only exists by our approval. We our sovereign - the government is merely our representative body politic.

All powers vested in Congress were and are granted by We The People. We The People come first - the Constitution comes second, government last. This seems to be forgotten by many. It is time to wake up and sound the clarion call for a new and brighter future that we will feel safe leaving our children behind to grow up in; and to raise families of their own. Do not leave behind a legacy of debt. Vote for Honest Money - of gold and silver coin. Vote for Congressman Ron Paul for President.

Invitation - Stop by our website and check out the complete market wrap, which covers most major markets. There is also a lot of information on gold and silver, not only from an investment point of view, but also from its position as being the mandated monetary system of our Constitution - Silver and Gold Coins as in Honest Weights and Measures.

There is also a live bulletin board where you can discuss the markets from people around the world and many other resources too numerous to list. Drop by and check it out. Good luck. Good trading. Good health. And that's a wrap.

By Douglas V. Gnazzo

Honest Money Gold & Silver Report

Douglas V. Gnazzo is the retired CEO of New England Renovation LLC, a historical restoration contractor that specialized in the restoration of older buildings and vintage historic landmarks. Mr. Gnazzo writes for numerous websites, and his work appears both here and abroad. Just recently, he was honored by being chosen as a Foundation Scholar for the Foundation of Monetary Education (FAME).

Disclaimer: The contents of this article represent the opinions of Douglas V. Gnazzo. Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Douglas V. Gnazzo is not a registered investment advisor. Information and analysis above are derived from sources and using methods believed to be reliable, but Douglas. V. Gnazzo cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. This article may contain information that is confidential and/or protected by law. The purpose of this article is intended to be used as an educational discussion of the issues involved. Douglas V. Gnazzo is not a lawyer or a legal scholar. Information and analysis derived from the quoted sources are believed to be reliable and are offered in good faith. Only a highly trained and certified and registered legal professional should be regarded as an authority on the issues involved; and all those seeking such an authoritative opinion should do their own due diligence and seek out the advice of a legal professional. Lastly, Douglas V. Gnazzo believes that The United States of America is the greatest country on Earth, but that it can yet become greater. This article is written to help facilitate that greater becoming. God Bless America.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.