Stock Market Rally Gets Manic/Depressive

Stock-Markets / Stock Markets 2014 Jul 17, 2014 - 07:19 PM GMTBy: PhilStockWorld

You never know what you are going to wake up to in this market.

You never know what you are going to wake up to in this market.

This morning, the market is depressed, giving up all of yesterday's gains in the Futures. So much so that we took a long poke on the Russell (/TF) Futures that we had been shorting from 1,160 – at the 1,135 line. That's down 3% since we began shorting them at 1,170 on Monday.

We're also taking a long poke on the Dow (/YM) off the 17,000 line and /NQ off the 3,900 line simply because they are good supports and offer good lines to stop out at with limited losses – certainly not because we think the equity indexes are cheap!

We're simply taking advantage of the wild gyrations in the market to make some short-term money, while we wait for our long-term premises to pay off.

Even if you missed my call in our Live Member Chat Room (which you can join by subscribing here) and waited until you can read this post for free later in the day, you can still join in the fun by picking up the Russell Futures (/TF) when they cross over 1,140 or 1,145 and you'll only miss $500 or $1,000 of the gains but you still might pick up $300-500 over 1,145 before it turns back around (and we'll likely short it again when it does).

Speaking of shorting – we haven't been playing oil lately as we lost interest in shorting it below $100 but this morning it's back to $102.50, so we're going to take a poke at shorting /CL again at what should be about $37.75 on USO.

Very simply, per our 5% Rule™, we have a drop from $107.50 (which we predicted) to $99 (8%) in the last 3 weeks but $100 was our support line ($37 on USO) so call it a $7.50 drop and we expect a 20% (of the drop) weak bounce of $1.50 to $101.50 and a 40% strong bounce of $3 to $103.

Since oil did, in fact, fall to $99, we'll take a poke at $102.50 but quickly get out if it gets over and then short with more conviction at $103, or if we cross back under $102.50 – because then momentum would be back on our side. If you don't play the Futures, you can buy some USO puts, like the Aug $39 puts, which should be about $1.40 this morning – we'll likely add those to one or two of our Member Portfolios.

We were 4 for 4 with our earnings trade ideas yesterday – that's getting us off to a very good strart and encourages us to get a little more aggressive with our picks, Here's an example of how we played YUM in yesterday's Live Member Chat Room:

I don't see YUM clearing $85 with a current p/e over 33 and very high expectations built in after an over 10% run since May. I think selling the Aug $82.50 calls for $2.50 against the Jan $82.50/87.50 bull call spread at $2.20 is fun as it's a .30 credit and you have $5 of cushion and, if YUM does go lower, you keep the .30 plus whatever is left on the long spread. If the premiums were better I'd like it for the STP but they're not so I don't.

Yum's earnings we in-line but revenues were soft and it certainly wasn't good enough to sustain those lofty valuations so they are down about $2 this morning and we'll see how the spread looks this morning but certainly a nice winner already.

We remained very skeptical of yesterday's "rally" since the intraday move was the same low-volume BS that we've been seeing since we first hit 1,950 on the S&P. We had a gap up on NO VOLUME in the Futures, followed by a volume sell-off in the morning, then again on no volume we move up in the afternoon into volume selling into the close.

That last, big volume move right at the close is your IRA, 401K and ETF money that is FORCED to buy at the day's closing price at or just after the bell – in other words, the suckers' money!

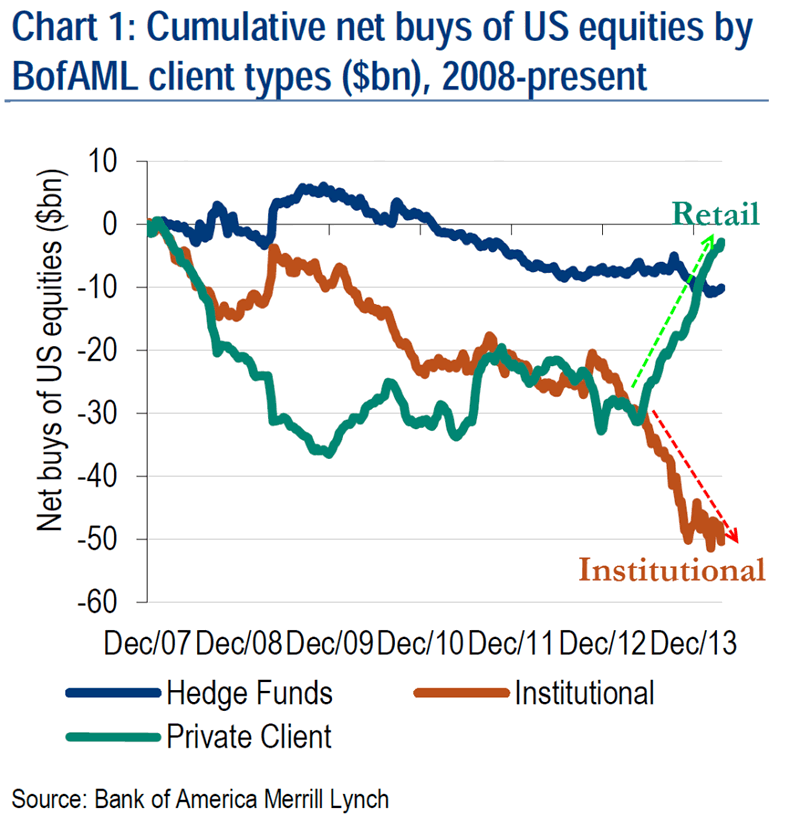

The "smart money," on the other hand, has been reducing their positions in equities at a faster pace than even in the last financial crisis while the MSM herds the retail bag-holders right back in:

I can only show you what is happening and tell you why these things make me nervous and urge you to be cautious – the rest is up to you!

No one believed me in 2007 (see any of my 250 posts) or early 2008 (another 125 posts) and yes, I was too early to the point where I would post pictures of Chicken Little to illustrate how I felt. By the summer of 2008, I was sick of being "wrong," even though the S&P was, in fact, down 2,000 points from it's high, and I stopped warning people. THAT was a mistake!

In fact, here's my "too early"comment from Aug 3rd, 2007:

I could go on and on but I’m sure you get the idea. Both sectors buy properties and develop them. Builders speculate on land, brokers speculate on stocks. Both try to buy low and sell high but both got caught in the same trap of buying more and more at the top until their entire portfolio was filled with the most expensive properties in history at exactly the time that people began losing their taste for them.

This is just a variation of my Roach Motel Theory that is just now (much later than I predicted) starting to affect big oil and, while I hate to go out on an early limb with the brokers, I have to think the same forces are at work in that sector as well. I was too far ahead of the curve last September when I said Amaranth was just the tip of a very large iceberg and that the real speculators in the commodities game were MS, GS, CSR, DB, C and JPM.

I got killed in the fall shorting those guys because I forgot the words of the great John Maynard Keynes who said: “The market can remain irrational longer than you can remain solvent.”

Longer than we can remain solvent perhaps – but not forever!

I was a year too early - but was I wrong?

So forgive me if I am a little boring as I keep banging the warning drums. I simply do not trust this rally and I think it's important that you know that. Not that it stops us from making money, our main Long-Term Portfolio has 16 bullish positions and is up 19.1% for the year – despite being cashed out in May. It is protected by our Short-Term Portfolio and even that is up 9% for the year, as we've learned to go with the flow.

Heck, we started this post with our bullish plays from our Live Member Chat Room this morning and, even as I'm writing this, the Russell Futures are popping 1,140 for a $500 per contract gain already and the /YM Futures are 17,030 for $150 per contract and /NQ is 3,905 for $100 per contract – and the Egg McMuffins are paid for!

Maintaining a bit of skepticism is healthy. It helps us feel good about taking those quick profits off the table and it keeps us alert to those very frequent sentiment shifts and, most importantly, it keeps us from chasing the peaks too high – and it keeps us from chasing the dips too low. In short – we have CONTROL of the market because we don't let it control us!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.