Knock, Knock. It's Deflation. Deflation Who? Video

Economics / Deflation Jul 15, 2014 - 10:03 AM GMTBy: EWI

The Elliott Wave Financial Forecast warns that the contracting U.S. economy signals deflation ahead

The Elliott Wave Financial Forecast warns that the contracting U.S. economy signals deflation ahead

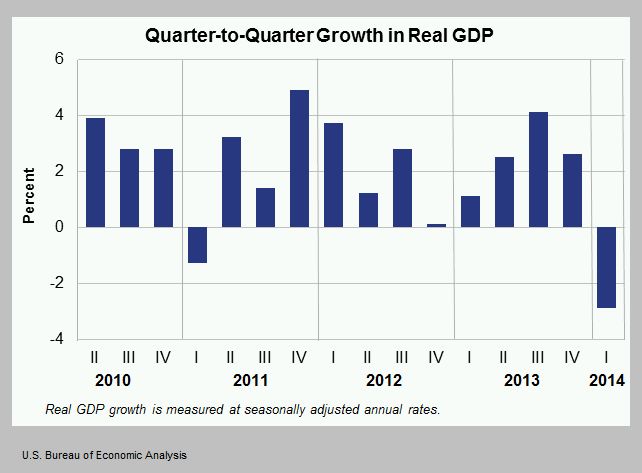

In June, the U.S. government, revising its previous number, reported that the economy shrank by 2.9% in the first quarter of 2014.

The steep plunge caught the bulls by surprise.

It was substantially worse than the preliminary forecast for a 1.0% contraction, which itself was a far cry from the initial 0.1% growth forecast in April.

As you can see on this chart, the last time the economy shrank was Q1 of 2011 (a 1.3% dip).

The [2.9%] decline was the sharpest since growth tumbled 5.4% in the first quarter of 2009 during the Great Recession. It was also one of the worst falloffs outside of a recession since 1960.

USAToday, June 25

The Elliott Wave Financial Forecast, the monthly report issued by Elliott Wave International, the world's largest financial forecasting firm, which is well-known for calling into question many mainstream forecasting methods, holds a drastically different outlook from the government. If you too don't trust the government projections, EWI is a good source of contrarian-minded research and analysis.

Financial Forecast co-editors Steve Hochberg and Peter Kendall warn that investors are dangerously discounting the potential for a market selloff. They say the economy is slowly contracting and winding its way toward outright deflation, and the recent government revision is evidence of deflation in action. In their recent issues of the Financial Forecast, they have documented more than two dozen measures of extreme investor optimism, a classic reversal indicator for technical analysts.

After the government's Q1 revision, the stock market hovered in positive territory. What's more, the Consumer Confidence Index registered a six-year high.

But Hochberg and Kendall believe, in spite of all the optimism, that this latest revision should raise concerning questions among investors about the sustainability of today's exuberant psychology -- especially now that economic growth is inconsistent with the prevailing psychology. When so many sentiment indicators align in one direction, it's a good time to check in on what the opposite side of the trend might look like. After all, markets never go in the same direction forever, and they tend to reverse alongside extremes in sentiment. Investors who are aware of and prepare for such turning points dramatically increase their chances of surviving them.

For specific forecasts and analysis from Hochberg and Kendall's latest, July Financial Forecast, click here. You will get free access to a big chunk from their latest issue, complete with labeled technical charts.

This article was syndicated by Elliott Wave International and was originally published under the headline (Video) Is That Deflation Knocking on the Door?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.