Silver Best Investment Opportunity of Your Life

Commodities / Gold and Silver 2014 Jul 14, 2014 - 07:21 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: "There's a situation in the silver market now that we absolutely must take advantage of," I told my True Wealth subscribers last month.

Dr. Steve Sjuggerud writes: "There's a situation in the silver market now that we absolutely must take advantage of," I told my True Wealth subscribers last month.

"It is the best opportunity to buy silver in over a decade – and possibly one of the best times you will ever see in your life."

"Silver is down by 60% from its peak in April 2011," I explained. "Compare that to gold... and you can see just how extreme the bust in silver has been."

Take a look:

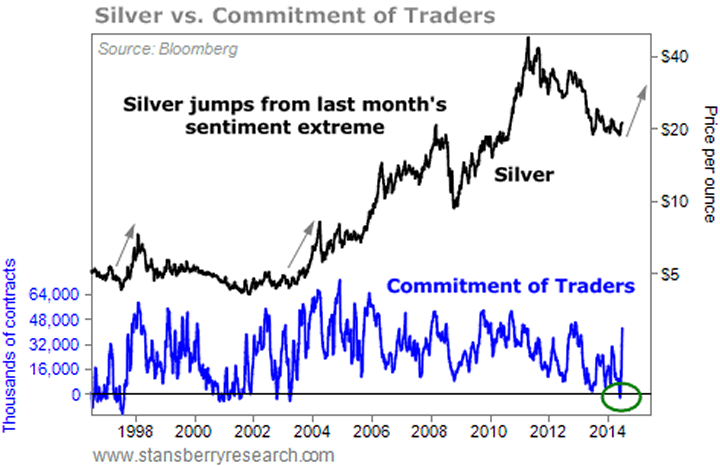

As you might imagine, when an asset falls by 60%, investors give up on it. And that's exactly what happened with silver...

I like to look at "real money" bets on commodities and currencies to gauge investor sentiment. One way I do this is by looking at the government's Commitment of Traders report. It shows what real futures traders are doing with their money.

When I wrote to my subscribers last month about silver, I said: "based on the real money, silver is more hated today than any time in the last decade."

Looking back over history, silver had been this hated three times: 1997, 2001, and 2003. In two of those three cases (1997 and 2003), the price of silver roughly doubled in about a year.

I told my paid subscribers: "I'm optimistic that silver bottomed in late May, and the next move up has started... I'm perfectly happy to buy silver today – at the most hated point in over a decade."

For years, my plan has been to focus on the stock market while the getting is good – and then start to move more toward "real assets" as the stock market booms nears its end.

I still believe we have time to make money in stocks... But I couldn't pass up the opportunity to buy up a legitimate precious metal at its most hated level in over a decade.

My friend, I believe you will want to own precious metals over the long run...

We are in an epic struggle between inflation and deflation – as I have explained over the last week (with examples from Jim Rickards' excellent book The Death of Money).

One of these two will win out... But will we see uncontrollable inflation? Or punishing deflation? Today, it is hard to tell... But one of the interesting conclusions from Jim's book is that the price of gold will likely soar in either outcome...

If gold soars, without a doubt, silver will soar, too.

My call last month on silver was exactly right for my paid subscribers. But I don't believe you've missed it yet at all...

Silver has rallied a bit... but you can still buy silver today at late-2010 levels... Silver doubled in price in less than a year after that.

Also, you can trade silver today... You could buy the silver exchange-traded fund today, the iShares Silver Fund (SLV), and set a stop-loss at this year's lows (around $18). As I write, that's only about 12% below today's price. So you could set up a trade with significant upside potential, but only roughly 12% downside risk.

Silver today is no longer as hated as it has been in a decade... but I think it's still a good trade to make today...

And based on Jim Rickards' conclusions about inflation and deflation, I want to own precious metals for the long run. The upside potential – if Rickards is right – is tremendous. And today is about as attractive an entry point as you will get on silver...

Don't miss it...

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.