Gold Price Rally Could Fail Due to COT Extreme

Commodities / Gold and Silver 2014 Jul 14, 2014 - 08:49 AM GMTBy: Clive_Maund

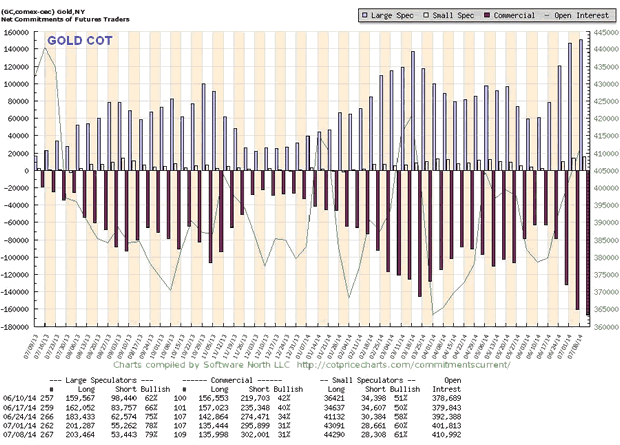

Whilst acknowledging that "this time it could be different" we have no choice but to call gold and silver lower on the basis of their latest extraordinary COT charts, which reveal that the normally wrong Large specs are already "betting the farm" on this rally.

Whilst acknowledging that "this time it could be different" we have no choice but to call gold and silver lower on the basis of their latest extraordinary COT charts, which reveal that the normally wrong Large specs are already "betting the farm" on this rally.

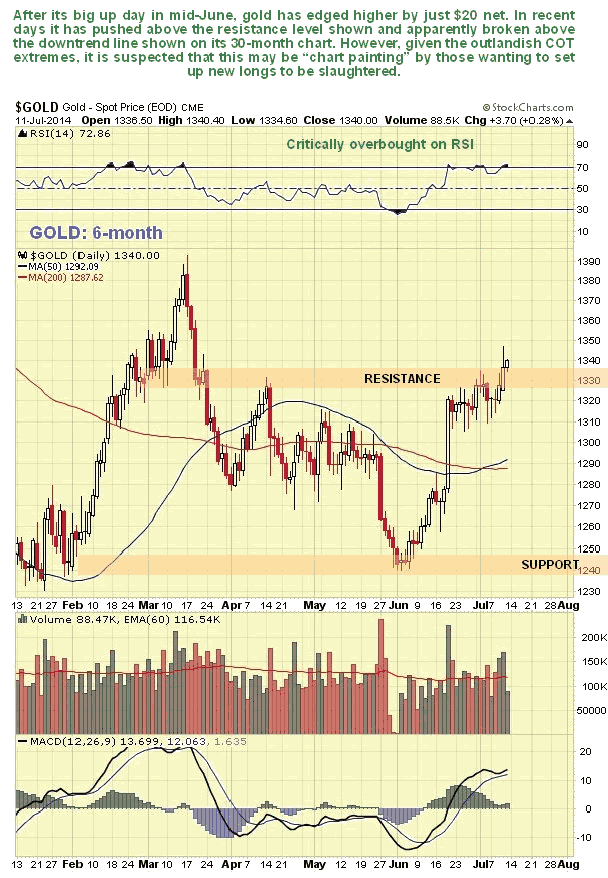

Let's start by looking at the latest 6-month chart for gold. On this chart we can see that following its big up day in mid-June gold has only managed to creep about $20 higher.

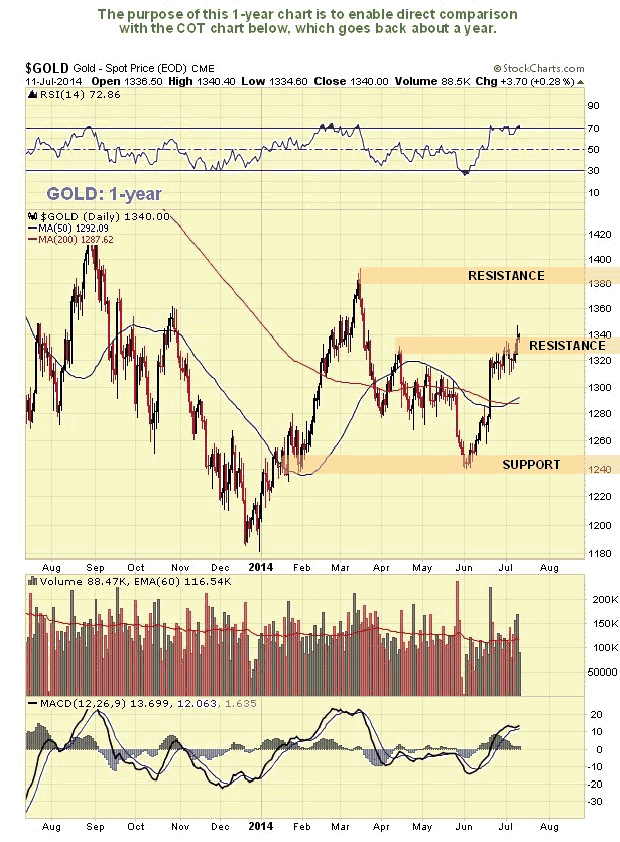

The 1-year chart will enable us to make a direct comparison with the latest COT chart placed right below it, which goes back about a year...

By comparing these 2 charts we can see how the peak and troughs in the gold price have a strong correspondence with the peaks and troughs in Large Spec long positions. They didn't want to touch gold last December, right before a big rally, but when the rally peaked in March, they were falling over themselves to go long. So what do you think is likely to happen now that they have stampeded in and built their long positions to at least a 1-year record? The picture for silver is even more extreme.

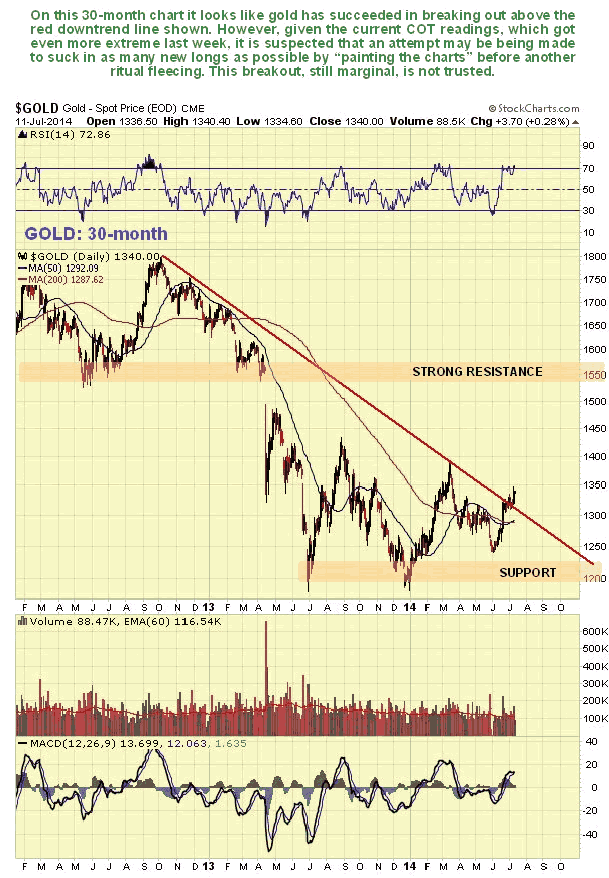

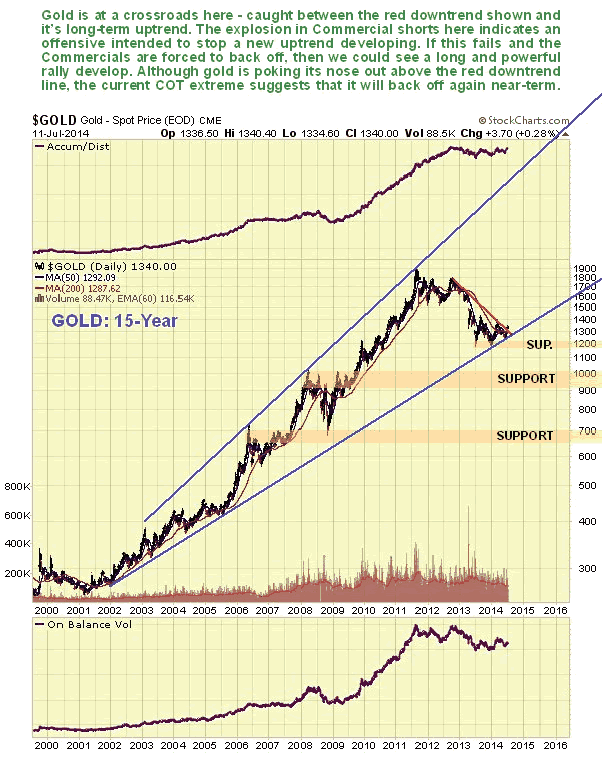

On its 30-month chart it looks like gold has broken out from the downtrend shown, but here we should be careful, because it is clear that if they want to snare the biggest number of traders and then fleece them, the thing to do is to "paint the chart" to make it look like gold has broken out.

Listen, the crux of our argument is this. If this apparent new uptrend has got legs, then COT positions, both Commercial short and Large Spec long positions should build up steadily as the uptrend proceeds towards an eventual peak when the uptrend is mature - not explode to huge levels right at the get-go. There is an argument that "this time it's different" and that on this occasion the Commercials are wrong, and when they realize that they are, they are going to rush to cover and create a meltup. The chances of this being the case are considered to be low, and you need to be brave, and perhaps stupid to place bets on the basis of it. We should not forget that the Commercials have unlimited ammo to throw at the paper price to make sure that their will prevails.

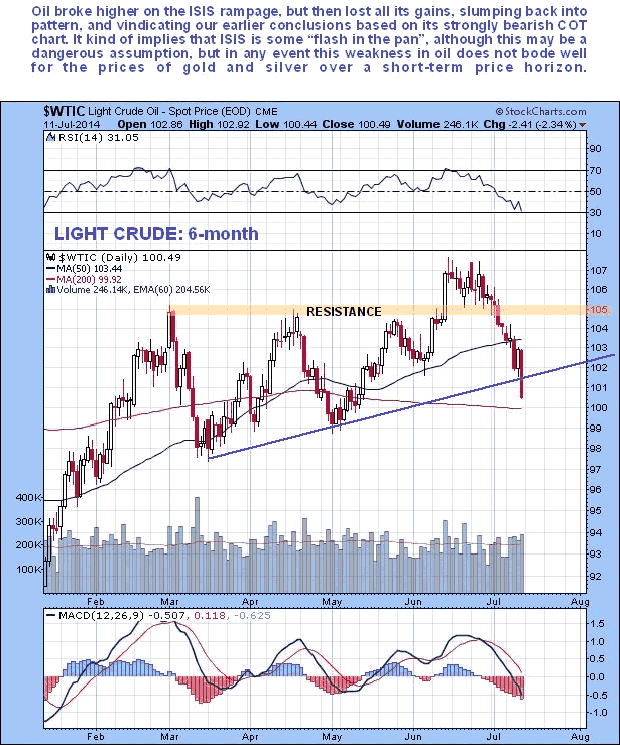

One supposed fundamental reason for a big rally in gold and silver is the spread of anarchy and chaos in the Mid-East, due in particular to the activities of ISIS, but if that's the case why has the oil price just taken a hit? On its 6-month chart below we can see how it broke out upside from a Rising Triangle when the ISIS rampage in Iraq was in the spotlight, but then the breakout aborted and it has since slumped back towards its 200-day moving average, so that it is now well below its price before most anyone had even heard of ISIS. The increasingly bearish COT for oil presaged all this and was highlighted in the last Oil Market update. We cannot therefore expect the prices of gold and silver to draw support from this source, at least not in the foreseeable future.

The long-term chart for gold continues to look promising, so one scenario here is that gold now backs off one last time towards its lows, before the expected major new uptrend begins.

We will end by making one important point. The general situation across markets now is very similar to the one we were in 2007 - 2008, except that it is much worse. As we know the problems exposed by the crisis and market crash of 2008 were never addressed or corrected, but simply papered over with printed money in a classic exercise in can kicking. Now we are arriving at the point where the can cannot be kicked further down the road. We are on the verge of another severe global bearmarket which could make the one in 2008 look like a "walk in the park". There will be a lot of talk about "wealth destruction" in a year or two, but real wealth won't be destroyed of course, only the intrinsically worthless paper claims that investors have insisted on bidding higher and higher in the face of zero interest rates, such as bonds, debt instruments of all kinds, currencies themselves and derivatives. Real wealth is agricultural land, factories, commodities, and especially gold and silver. To survive financially, and maybe prosper, all you have to do is make sure your capital is invested in real wealth.

This is why Big Money investors in gold don't give a toot about its price in Fiat, and couldn't care less about the shenanigans at the Comex. They've got their gold safely stashed away in secure locations, and when all this fiat rubbish and worthless trash like bonds goes up in flames in one of the biggest bonfires in history, which could be a lot closer at hand than many realize, they will be completely insulated from the chaos and mayhem afflicting the masses, and when the dust starts to settle will be able to move in and buy up many assets at pennies on the dollar. So as this time approaches, make sure you allocate whatever capital you have into "real wealth" and take whatever steps you have to, to secure access to essentials in the event of systemic collapse.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2014 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.