Bitcoin Price Sign of Reversal?

Currencies / Bitcoin Jul 12, 2014 - 03:39 PM GMTBy: Mike_McAra

In short: we still support long speculative positions in the market, stop-loss at $550.

In short: we still support long speculative positions in the market, stop-loss at $550.

The long-spoken-about Bitcoin ETF is slowly nearing SEC approval, Bloomberg reported:

It looks increasingly that the Winklevoss Bitcoin Trust (COIN) will actually launch.

(…)

There's still no guarantee COIN will be approved by the Securities and Exchange Commission. There are more than a thousand prospectuses for ETFs sitting with the SEC, and hundreds of reserved tickers sitting with stock exchanges. And this approval would be the first of its kind -- a virtual asset.

That said, the latest updates to the prospectus show two positive signs. First, the ticker, COIN, suggests the Winklevii are serious about making this about bitcoin and not about them. These are the people that gave an index tracking the price of bitcoin the name "Winkdex," so they might have chosen a gimmicky, self-referential ticker like VOSS or WNKL for their ETF.

Second, there were several very specific changes added to the risk section of the prospectus. That's worth noting, since plenty of ETFs are filed with the SEC but don't get updated (or reserve tickers). One change warns that core developers could stop maintaining the bitcoin protocol unless they're paid. Another notes that bitcoin is banned by the Bolivian central bank -- not a risk most people worry about, granted, but a risk. This looks a lot like somebody working closely with the SEC to dot their i’s.

The development of a Bitcoin ETFs is certainly a positive sign for the Bitcoin market. For starters, the fund might help in making Bitcoin more appealing to mainstream investors, by offering a proxy for the currency available on a large exchange (NASDAQ). Secondly, a Bitcoin ETF might be a great way to improve liquidity for short-term traders – for many investors it might be easier and quicker to open and reverse positions using their broker account rather than setting up Bitcoin wallets and exchanging bitcoins for, say, dollars.

In many ways this is similar to the advantages gold ETFs offer.

For now, let’s focus on the charts.

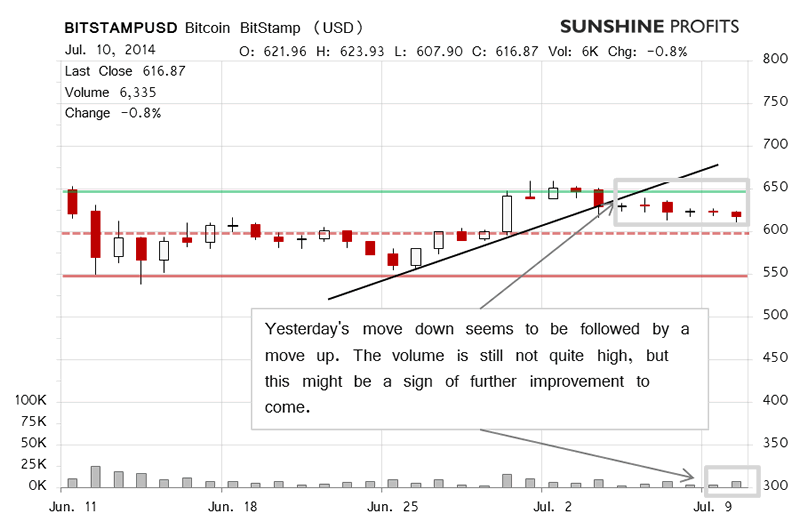

On BitStamp, we saw depreciation yesterday. You were probably worried by Bitcoin going down in light of the bullish short-term outlook, and so were we. We were trying to figure out the direction in which Bitcoin were to move just as much as you did. Yesterday, we came to the following conclusion:

In case you’re still wondering, it seems to us that the depreciation we’ve seen today is nothing more than a part of a consolidation phase and we’re still inclined to bet on Bitcoin going up.

This has turned out correct today (this is written before 12:00 p.m. EDT), with Bitcoin going up to around $630 – still below $650 (solid green line on the chart) but further away from $600 (dashed red line). The volume is not very significant but not exactly weak either (compared with recent days).

As much as we enjoy seeing this positive sign, we don’t want to put your positions at excessive risk, so we don’t increase the size of the suggested long position. One day of appreciation on moderate volume is not enough to get wildly optimistic about long positions so we prefer to keep you safe at this time.

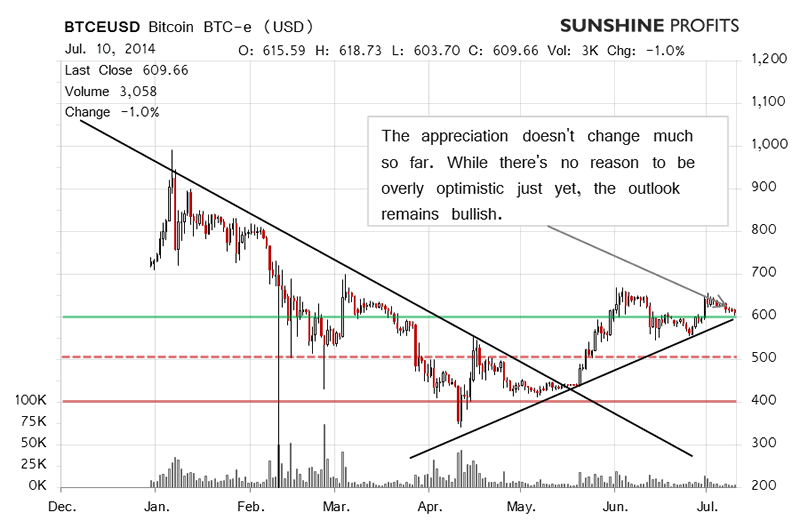

On the long-term BTC-e chart we see one interesting development. The upward sloping medium-term trend line is now very close to the current price level, which in turn is close to $600 (green line). Today, Bitcoin seems to have bounced off this level as it has appreciated.

The move up itself is by no means strong, just as was the case with previous depreciation. We haven’t seen significant volume levels either so the outlook is not decidedly more bullish than it was just yesterday. It is bullish, but again, we don’t want to put your potential positions at excessive risk, so we stick with our previously outlined position as the situation has not been clarified to a satisfactory extent just yet. None of this changes the fact that the outlook is still bullish for the short term. We understand the temptation you might feel to increase your position but we don’t think taking on such a risk is worth it just yet.

Summing up, in our opinion long speculative positions might become profitable in the Bitcoin market.

Trading position (short-term, our opinion): long, stop-loss at $550.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.