Silver Up 10.3% YTD - Outperformance To Continue

Commodities / Gold and Silver 2014 Jul 11, 2014 - 05:00 PM GMTBy: GoldCore

Today we look at silver and why it is an important allocation in all portfolios

Today we look at silver and why it is an important allocation in all portfolios

- Why Silver is in a Bull Market and How High Could it Go?

- Is Silver About Returns Or A Hedge Against Inflation & Systemic Risk?

- Silver: Very Small Global Supply

- Silver: Increasing Technological and Industrial Demand

- Silver: Medical Demand

- Silver’s Unique Properties

- Silver: Increasing Investment Demand

- Silver Undervalued Versus Gold

- Conclusion

Today’s AM fix was USD 1,336.50, EUR 981.78 and GBP 779.39 per ounce. Yesterday’s AM fix was USD 1,343.25, EUR 985.22 and GBP 784.61 per ounce.

Goldclimbed $8.10 or 0.61% yesterday to $1,335.80/oz and silver rose $0.27 or 1.28% to $21.38/oz.

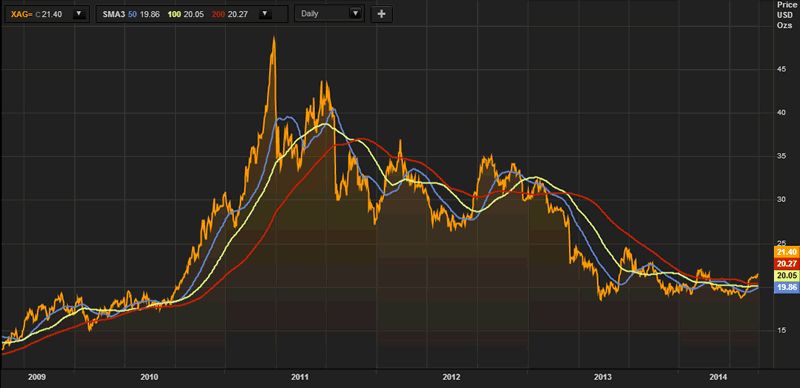

Silver In U.S. Dollars and 50, 100, 200 Simple DMA - 5 Years (Thomson Reuters)

Silveroutperformed yesterday again, surging to as high as $21.575 and ended with a gain of 1.28%.

Silver is heading for a sixth consecutive week of gains, something it has not done since its price surge in 2011.

Gold retained sharp overnight gains to trade near a 16-week high today and was poised to

post its sixth weekly rise in a row, as troubles at one of Europe’s largest banks hammered equities and bonds and led to safe haven demand for bullion.

Among other precious metals, platinum and palladium were both headed for their fourth straight weekly gains.

CME Group Inc. and Thomson Reuters Corp. will run the new 117-year-old silver fixing benchmark that’s ending in August, the LBMA or London Bullion Market Association said.

Testing is set for early August to go live on August 15, the LBMA said in an e-mailed statement today. The London Metal Exchange (LME), Autilla Ltd., Bloomberg LP, Intercontinental Exchange Inc., ETF Securities Ltd. and Platts had also proposed alternatives last month.

Gold and silver saw gains yesterday on concerns about instability in the Middle East and the risk of contagion coming from Espirito Santo, the large Portuguese bank. A possible default has sent government bonds of Europe’s most indebted nations and bank and other stocks tumbling, showing how fragile confidence in the Eurozone banking system and sovereign debt markets is.

European and U.S. stock markets fell, and bond yields of Europe's southern nations rose as investor fears over financial troubles at Banco Espirito Santo and of contagion spilled across markets and borders.

Meanwhile, India surprised bullion markets by keeping the import duty on gold and silver unchanged at 10% in its budget. The move could limit overseas purchases and official imports by the second-biggest bullion buyer but further encourage smuggling.

Gold In U.S. Dollars and 50, 100, 200 Simple DMA - 5 Years (Thomson Reuters)

Gold surged above strong resistance at $1,334/oz yesterday and is looking better and better from a technical perspective. There was strong chart resistance at $1,334/oz as this was the 61.8% retracement of the March to June retreat.

Traders bought gold once we breached that level and there was an acceleration in gold and silver’s move higher.

Silver and gold have now broken above the key 50, 100 and 200 day moving averages (see chart).

The move higher yesterday was accompanied by silver and gold futures trading volumes at much higher levels than recently. Gold futures trading volume in London was at 62% above the average for the past 100 days which is quite bullish.

The technicals and fundamentals are increasingly aligned and this sets the stage for a rally to test resistance at $22/oz and 1,400/oz. Geopolitical risk from the Middle East, both Iraq, Iran and Israel, continues to be under appreciated.

As ever, it is impossible to pinpoint singular financial and economic breaking news or developments and point to them as the factor driving prices in the short term but it seems likely that the BES bond sell off and bond rout in Portugal may be creating jitters in European and wider markets.

There have been many bullish developments in the precious metal markets in recent weeks which have failed to ignite prices however the fundamentals appear to be re exerting themselves.

Most analysts and participants in the gold and silver markets are bearish now. This is of course bullish from a contrarian perspective. Most analysts, particularly in banks, were bearish from 2001 until very late in the first phase of the bull market. We believe that they will be surprised again when the intermediate top at $50/oz and $1,911/oz in September 2011, is passed, likely by the end of 2015

Gold is 11% higher this year as the Fed said it would continue ultra loose monetary policies and keep interest rates low for a “considerable time,” amid growing conflict in the Middle East and tension between Russia, China and the U.S. and western powers.

Macroeconomic, systemic, geo-political and monetary risks have been ignored in recent months but financial and economic reality has a way of catching up with investors ...

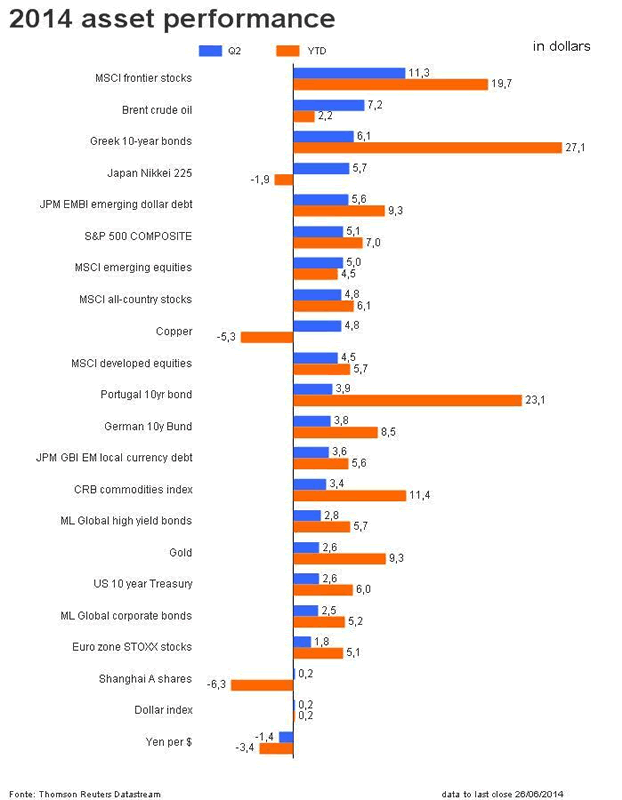

Silver Up 10.3% YTD - Should Continue To Outperform Gold And Other Assets

Silver has been one of the top performing markets in recent months. Silver has risen to $21.41/oz and is up more than 10.3% year to date.

It is important to remember that silver rose to a recent nominal closing high $48.41/oz on April 28, 2011. This means that silver is nearly 60% below its record nominal high of just over three years ago.

After more than 3 years of a brutal correction and subsequent consolidation, we believe silver is set to rise above that record nominal high in the coming months. We continue to be bullish on gold, platinum, palladium and particularly silver.

We believe that silver will likely surpass its non inflation adjusted high near $50 per ounce and its real high or inflation adjusted high of some $140 per ounce in the coming years.

2014 Asset Performance Year To Date (Thomson Reuters)

At the start of the year, silver was trading at $19.41/oz and most analysts were calling for further price falls. Sentiment today remains very poor.

Very few market participants and investors know about silver’s outperformance as silver gets little or no media attention. There is a huge focus given to the record highs in U.S. and some other stock markets. Therefore, silver remains the preserve of relatively few contrarian investors and store of wealth buyers.

Silver remains very undervalued on an historical basis (charts below), is undervalued against gold (chart below) and most stock and bond markets which are now at record highs. Yet, we believe silver is in the intermediate stage of a bull market that will rival or surpass that of the 1970s.

Why Silver is in a Bull Market and How High Could it Go?

Up until 2010 and 2011, precious metals had been the best performing asset classes in recent years with gold and silver outperforming equities, property and most asset classes over a 3, 5 and 10 year period.

They then became overvalued in the short term and were subject to sharp sell offs in 2011 and again in 2013. It is important to note that there were similar sell offs in the 1970s bull markets prior to the primary secular trend reasserting itself.

The fundamentals for gold and particularly silver are very bullish. The primary reason for our bullish outlook on silver is due to the following:

i) The continuing and increasing global macroeconomic, systemic, geo-political and monetary risks

ii) Silver's historic role as money and a store of value

iii) The declining and very small supply of silver

iv) Significant industrial demand and perhaps most importantly significant and increasing investment demand.

Favourable supply and demand factors and concerns regarding the emergence of inflation and stagflation as the massive global monetary and fiscal reflation affects the value of fiat currencies all point to higher silver prices in the long term.

In the 1970s silver rose from under $1.50/oz in 1970 to nearly $50/oz in 1980.

Thus, silver rose by more than 25 times or by more than 2,400%. Were silver to replicate its performance in the 1970s, it would have to rise by more than 25 times again. The average price of silver in 2001 was $4.37/oz and 25 fold increase would result in silver rising to over $110/oz.

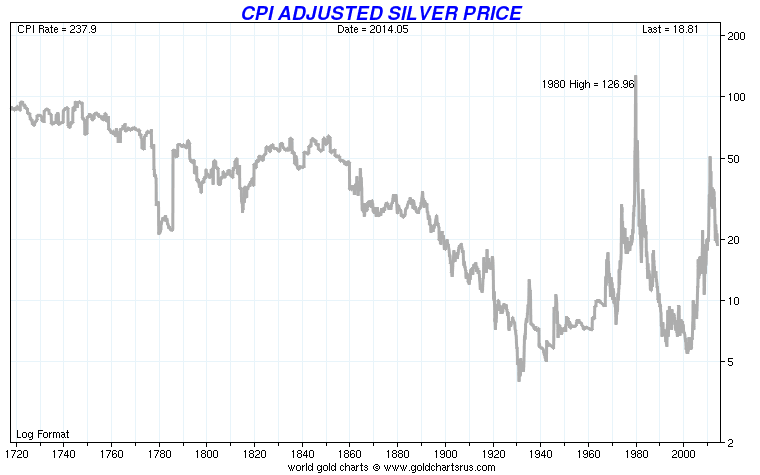

While this price target may seem outlandish to some, it is worth remembering that silver's record high in 1980 adjusted for inflation (according to U.S. government inflation figures) was some $130/oz.

Real Silver Price 1720 To Today To Today (CPI Inflation Adjusted)

A picture or a chart truly is worth a thousand words and the chart above showing silver prices adjusted for inflation shows how undervalued silver remains from a historical perspective.

Most assets in the world are now multiples of their price since the year 2000 and 20, 50, 100 years ago. Many markets and assets are at or near record levels. Silver remains well below record levels.

Admittedly, the final phase of the 1970s silver blow off was a speculative bubble as the billionaire Hunt brothers attempted to corner the silver market. In 1979, there were very few billionaires in the world. Today there are hundreds of billionaires, many multi billionaires, thousands of millionaires, hedge funds and many sovereign wealth funds. Small allocations by any of these to silver will see sharp price gains.

Indeed, the silver market is so small that it could very easily be cornered again - as could other precious metal markets. Indeed, this risk does not come just from private investors. There is also the possibility that resource nationalism and currency wars could see states seek to corner important strategic precious metal markets.

Is Silver About Returns Or A Hedge Against Inflation & Systemic Risk?

Silver is a hedge against macroeconomic, systemic, geopolitical and inflationary risk with the attractive added potential for significant capital gains.

Real asset allocation and prudent diversification would be an important reason to have an allocation to silver. Silver is highly correlated to the safe haven of gold and is in effect a leveraged sister of the precious yellow metal. Silver like gold is for wealth preservation purposes but silver has the potential to deliver substantial returns.

Silver: Declining Supply

In 1900 there were 12 billion ounces of silver in the world. By 1990, the internationally respected commodities-research firm CPM Group say that figure had been reduced to around 2.2 billion ounces of silver.

Incredibly today, that figure has fallen to less than 1.3 billion ounces in above ground refined silver (World Silver Survey 2014 P36-43). Thats means that all the refined silver in the world that is available for industrial and investment purposes is worth just over $26.5 billion. Much less than the Federal Reserve prints every month even after the recent tapering.

It is estimated more than 90% of all the silver that has ever been mined has been consumed by the global photography, technology, medical, defense and electronic industries.

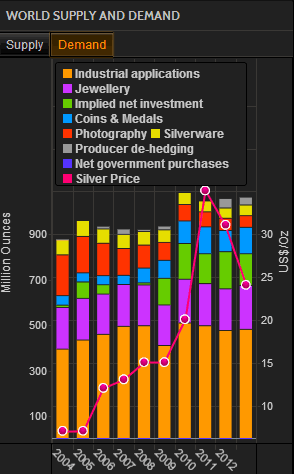

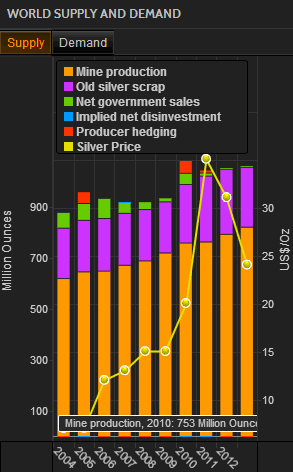

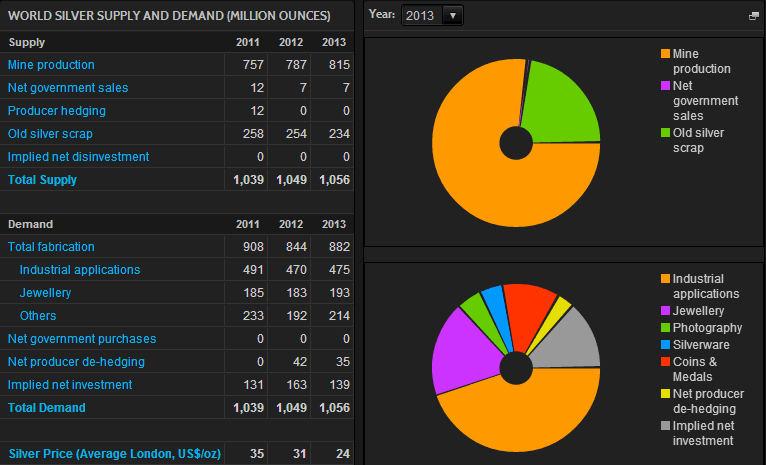

Silver World Demand, 2004-2013 (GFMS via Thomson Reuters)

On current supply and demand trends, the amount of above ground refined silver is projected to shrink to even lower levels in the coming years. Demand has been outstripping mining supply for most of the last 20 years, driving above ground supplies to historically low levels. Few in the investment world are aware of this important fact.

Silver World Supply, 2004-2013 (GFMS via Thomson Reuters)

Total global silver supply from both production and scrap has only increased marginally in recent years (see chart) despite silver’s price gains. Meanwhile demand has been increasing, particularly investment demand.

This hasn't resulted in significantly higher prices yet because the world has been able to fill the gap from inventories and official government stockpiles.

However, today the U.S. government's stockpile is all but gone, and sales from other official sources, such as China, Russia and India, have ended. The decline in refined silver stocks, from around 2.2 billion ounces in 1990 to around 1 billion ounces today means that silver stocks are near an all time low.

The rigging or manipulation of the silver price has likely also contributed to silver’s failure to achieve higher prices.

Very importantly, silver is very unusual as its supply is inelastic.

This means that silver production will not ramp up significantly if the silver price returns to the record nominal highs near $50 per ounce or higher.

Silver - World Supply and Demand (Thomson Reuters)

Supply didn't increase significantly in the 1970s when silver rose more than 35 fold in price - from $1.40/oz in 1971 to a high of nearly $50/oz in 1980.

Importantly, silver is a byproduct metal and some 80% of mined silver is a byproduct of base metals. Higher prices for silver will not cause copper, nickel, zinc, lead or other base metal miners to increase their production.

In the event of a global stagflationary or deflationary slowdown, demand for base metals would likely fall thus further decreasing the supply of mined silver.

There are only a handful of pure silver mines remaining - many with depleting reserves. This inflexible supply means that we cannot expect significant mine supply to depress the price after silver rises in price.

It is extremely rare to find a good, service, commodity or investment that is price inelastic. This is another powerfully bullish aspect unique to silver.

Silver: Increasing Technological and Industrial Demand

Industrial applications for silver have always been significant but have increased significantly in recent years.

Silver uses have expanded to include iphones, ipads, cell phones, flat-screen televisions and many other modern high tech devices. It is used in film, mirrors, batteries, medical devices, electrical appliances such as fridges, toasters, washing machines.

Silver is used in solar energy and photovoltaic cells and this is another growth sector for silver industrial demand.

Growing middle classes in China, India and many other countries are now demanding the quality of life and standard of living enjoyed by many in the West. Technological demand for silver may increase.

Silver: Medical Demand

Silver is known as the 'healthy metal' and has many and increasing medical applications.

In a world that is showing increasing concern about the spread of diseases and pandemics such as various flus, ebola and other viruses, silver is being increasingly tapped for its biocidal properties.

Research is ongoing on the use of silver and its compounds for therapeutic uses and on its potential use as a disinfectant in hospitals and other medical facilities.

Increasingly, silver's antimicrobial and antibacterial qualities are seeing it being used in all sorts of medical applications and this looks set to become a very significant source of demand in the coming years.

Silver’s Unique Properties

Silver has many unique properties which make it ideal and indeed essential in global industry - especially in the global photography, technology, medical, defense and electronic industries. Yet, silver is a finite resource and the supply of silver is increasing only very incrementally.

Silver, unlike gold, is heavily used in industry and because of gold's much higher value, it gets recycled and all the gold mined in the world ever is still with us but a huge amount of silver has been used in photography, mirrors and other industrial uses in the last 200 years. The low price of silver makes recovery and recycling uneconomic.

Unlike gold, silver is like oil - as it is consumed in these many industrial applications it is gone forever.

Silver: Increasing Investment Demand

Investment demand for silver has risen in recent years as investors concerned about the value and safety of property, equities and deposits allocated funds to the finite commodities and currencies of silver and gold. More recently, there are increasing concerns about the value of paper currencies themselves (voiced by many including Alan Greenspan, John Paulson and George Soros) which is leading to further diversification into hard assets and precious metals.

U.S. Mint Silver Eagle

There has been a marked increase in investment demand for silver in recent years.

Last year, there was a shortage and rationing of both American Silver Eagles from the U.S. Mint as well as so called junk silver -90% and 40& silver bullion bags, pre-1965 U.S. dimes, quarters, and half dollars. There is no shortage this year, but robust demand continues from so called ‘silver stackers’. Silver stackers remain the prudent and smart money.

Investors in silver bullion coins and bars are hedging themselves against the monetary risks. They are protecting themselves against rising inflation, possible currency devaluations and still very prevalent geopolitical and macroeconomic risks.

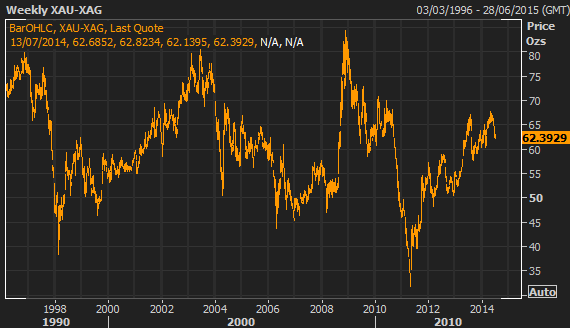

Silver Undervalued Versus Gold

Silver is undervalued versus gold with the gold silver ratio at 62:1 ($1,330oz/$21.40/oz).

This is particularly the case on a long term historical basis. The long term historical average gold to silver ratio is 15:1 and this is because it is estimated that geologically there are some 15 parts of silver in the ground for every one part of gold.

In 1980 the ratio nearly reached 15 ($850oz/$50oz=17) and the average in the 20th century has been around 40:1.

At silver’s intermediate price peak in April 2011, the gold silver ratio fell to nearly 30 to 1.

Gold Silver Ratio, 20 Years (Thomson Reuters)

We believe that silver's ratio to gold will revert to its mean average in the latter half of the 20th century below 40:1 as it did in 1998 and again in 2011.

Conclusion

Silver is unique in terms of being both an industrial metal and an investment and store of value.

Silver is priced at less than $22/oz today. The average nominal price of silver more than 34 year ago, in 1979 and 1980, was $21.80/oz and $16.39/oz respectively.

In today's dollars and adjusted for inflation that would equate to an inflation adjusted average price of some $60/oz and $44/oz in 1979 and 1980.

Given the very strong demand and supply fundamentals, we believe silver will be valued at well over $50/oz in the coming years.

Silver remains one of the most attractive investment opportunities today and those who own physical coins and bars in a segregated and allocated manner, will protect and grow their wealth in the coming years.

We are now offering a silver price match guarantee and will match prices offered by bullion dealers internationally >> Bullion Coin And Bar Price Match Guarantee

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.