Gold and Silver Price Positive Developments

Commodities / Gold and Silver 2014 Jul 11, 2014 - 12:15 PM GMTBy: Alasdair_Macleod

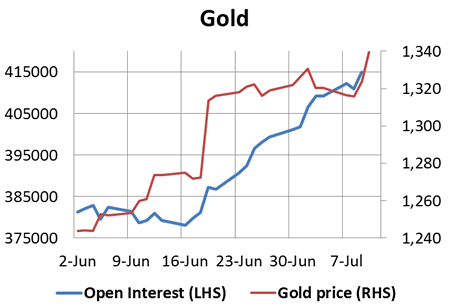

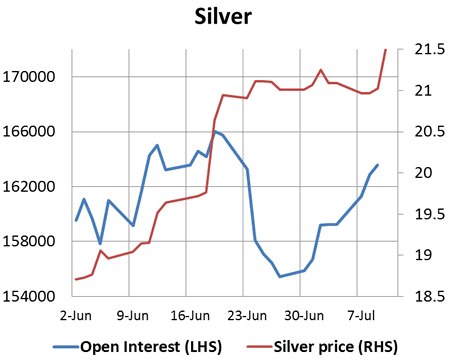

Gold and silver had a good week after the US holiday last Friday. From a low of $1312 on Tuesday, gold rose to a high point of $1345 yesterday, and silver from $20.84 to $21.60. Open interest is climbing too for both metals, as shown in the following charts.

Gold and silver had a good week after the US holiday last Friday. From a low of $1312 on Tuesday, gold rose to a high point of $1345 yesterday, and silver from $20.84 to $21.60. Open interest is climbing too for both metals, as shown in the following charts.

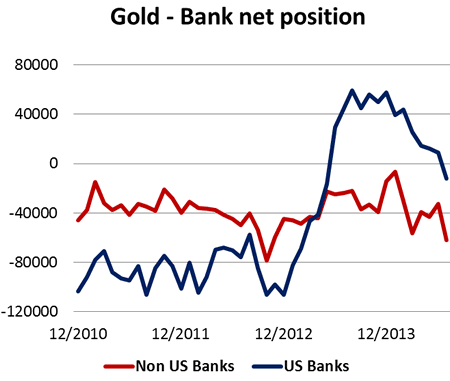

This is healthy and indicates that the uptrend has some wind behind it. However, the Bank Participation Report for 1 July shows a sharp deterioration in the banks' positions, illustrated in our third chart.

The net long position of the US banks for the past year have gone, and they are now short a net 12,324 contracts, while the Non-US banks are short a net 62,099 contracts.

Neither position is extreme, but how should we read this? Well, trading patterns altered this week, with the gold market strong outside US trading hours and softening during New York's trading. This obviously indicates demand is from Asia and Europe, giving some short-term traders in the US an opportunity for profit-taking. Buying is therefore likely to be for physical metal rather than derivatives, which should tighten the market overall.

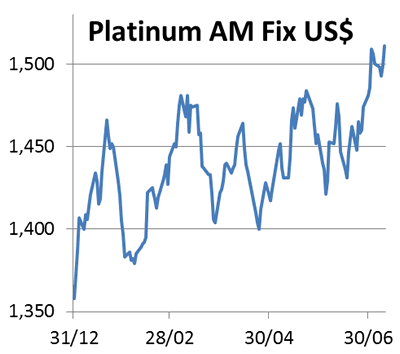

Additionally it should be noted that platinum has been exceptionally strong, rallying nearly $200 (15%) from its December low. In practice there is little or no short-term correlation with the gold price, but platinum often leads the precious metals group over the medium term. Platinum this year is shown in our last chart, which is refreshingly bullish.

So overall, precious metal markets feel better based, but beware of whipsaws in New York trading because the banks will want to close their bears by marking gold and silver prices sharply down to trigger stops. But gold has now broken above resistance at $1320-30, which should now offer some support before a possible attempt on the $1355+ territory.

Confirmation of why Europeans might be buying physical gold arises from concerns over the financial health of Portugal's Banco Espirito Santo, which has undermined share prices of the entire Eurozone banking sector. The ghost of the Cyprus bail-in may be returning to the financial stage. Also this week Germany reminded us that large deposits are going to be subject to bail-ins if a bank fails, because the German cabinet resolved to put forward the necessary legislation for the New Year.

Talking of Germany, BaFin, the bank regulator, has asked all German banks and investment intermediaries to hand over details of their clients' dealing in precious metals derivatives, according to Goldreporter.de. This follows its investigation into Deutsche Bank's precious metal dealings which coincided with DB's withdrawal from the gold and silver fix. This may be a developing story worth monitoring.

Monday. Japan: Capacity Utilisation, Industrial Production. Eurozone: Industrial Production

Tuesday. UK: CPI, Input Prices, Output Prices, ONS House Prices. Eurozone: ZEW Economic Sentiment. US: Empire State Survey, Import Price Index, Retail Sales, Business Inventories. Japan: BoJ Overnight Rate.

Wednesday. UK: Average Earnings, ILO Unemployment Rate. Eurozone: Trade Balance. US: PPI, Net Long-Term TICS Flows, Capacity Utilisation, Industrial Production, NAHB Builders Survey.

Thursday. Eurozone: HICP. US: Building Permits, Housing Starts, Initial Claims, Philadelphia Fed Survey.

Friday. Eurozone: Current Account. US: Leading Indicator.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.