Fossils, Fuels and Zombies

Commodities / Energy Resources Jul 11, 2014 - 10:34 AM GMTBy: Raul_I_Meijer

As fear begins to scare the vanguard of the herd into what may develop into a rampage, the eurocrisis is back with a vengeance. Portuguese bank Esperito Santo leads the way down through missed payments, bringing the Lisbon exchange to its knees with a -4.5% plunge as I write this, with northern EU exchanges showing -1.5% losses and southern ones -2.5%. Markets start to realize than all PIIGS now have much higher state debts than before the crisis started, and that they still are very much big risks, no matter what Draghi and his never fired bazooka say. The same Draghi who, by the way, reiterated once again that Brussels should be given more – and more centralized – power. As if the May election never happened. Of course EU finances were always a mess; it’s just that now we can see it.

As fear begins to scare the vanguard of the herd into what may develop into a rampage, the eurocrisis is back with a vengeance. Portuguese bank Esperito Santo leads the way down through missed payments, bringing the Lisbon exchange to its knees with a -4.5% plunge as I write this, with northern EU exchanges showing -1.5% losses and southern ones -2.5%. Markets start to realize than all PIIGS now have much higher state debts than before the crisis started, and that they still are very much big risks, no matter what Draghi and his never fired bazooka say. The same Draghi who, by the way, reiterated once again that Brussels should be given more – and more centralized – power. As if the May election never happened. Of course EU finances were always a mess; it’s just that now we can see it.

So, that taken care of, let’s turn to another mess: energy. Ambrose Evans-Pritchard has a nice piece out in which he labels the oil, gas and coal industry “the subprime of this cycle”. And as always, he has a lot of interesting data, and undermines them with his own analysis. It’s what he does. Still, if we simply ignore his personal views, there is plenty to “enjoy”. It’s not as if The Automatic Earth hasn’t but the energy market, especially shale, down to size sufficiently, but it’s always nice to have some new numbers, certainly when they’re absurdly large:

Fossil Industry Is The Subprime Danger Of This Cycle

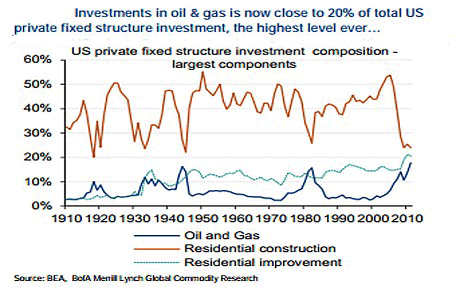

The epicentre of irrational behaviour across global markets has moved to the fossil fuel complex of oil, gas and coal. This is where investors have been throwing the most good money after bad. [..] Data from Bank of America show that oil and gas investment in the US has soared to $200 billion a year. It has reached 20% of total US private fixed investment, the same share as home building.

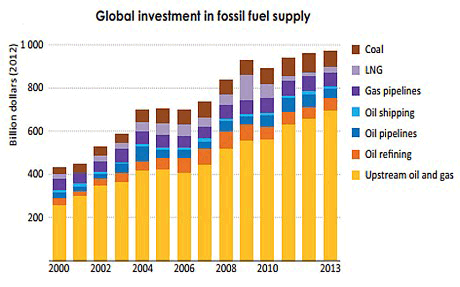

This has never happened before in US history, even during the Second World War when oil production was a strategic imperative. The International Energy Agency (IEA) says global investment in fossil fuel supply doubled in real terms to $900 billion from 2000 to 2008 as the boom gathered pace. It has since stabilised at a very high plateau, near $950 billion last year.

All that investment looks for production that more and more vanishes beyond a receding horizon. That’s why there is so much of it: it gets more expensive, fast, to find new reserves that can actually be produced. Whether they can, if they are found at all, be produced at an economically viable level is quite another question, and one to which answers are mostly kept conveniently opaque. Big Oil is in a big bind, but oil and gas is what they do, whether it’s available or not. These companies are fighting a bitter fight just to stay alive, and given their economic and political power, that fight is sure to get very ugly.

The cumulative blitz on exploration and production over the past six years has been $5.4 trillion, yet little has come of it. Output from conventional fields peaked in 2005. Not a single large project has come on stream at a break-even cost below $80 a barrel for almost three years.

“What is shocking is that upstream costs in the oil industry have risen threefold since 2000 but output is up just 14%,” said Mark Lewis, from Kepler Cheuvreux. The damage has been masked so far as big oil companies draw down on their cheap legacy reserves. “They are having to look for oil in the deepwater fields off Africa and Brazil, or in the Arctic, where it is much more difficult. The marginal cost for many shale plays is now $85 to $90 a barrel.”

Upstream costs are up 200%, output rose just 14%. That’s just plain nasty. A few days ago we saw a report that said a joint Shell and Aramco gas project in Saudi Arabia, which cost tens of billions of dollars, came up utterly empty handed, despite the fact that the IEA claims there are trillions of cubic feet in reserves “available” there. That’s the kind of issue Big Oil runs into. And then they invest more. I think it was the Marcellus play that saw its estimates cut by 95% or so recently. Much of the industry runs on insanely optimistic estimates these days, lest nobody wants to fund their exploits any longer. You better look good than feel good.

A report by Carbon Tracker says companies are committing $1.1 trillion over the next decade to projects that require prices above $95 to break even. The Canadian tar sands mostly break even at $80-$100. Some of the Arctic and deepwater projects need $120. Several need $150. Petrobras, Statoil, Total, BP, BG, Exxon, Shell, Chevron and Repsol are together gambling $340 billion in these hostile seas.

Martijn Rats, from Morgan Stanley, says the biggest European oil groups (BP, Shell, Total, Statoil and Eni) spent $161 billion on operations and dividends last year, but generated $121 billion in cash flow. They face a $40 billion deficit even though Brent crude prices were buoyant near $100, due to disruptions in Libya, Iraq and parts of Africa. “Oil development is so expensive that many projects do not make sense,” he said.

The word “gambling” is well chosen. Thousands of billions are laid out on the crap table. Big Oil wants nothing more than rising gas prices. But western economies – plus China, Japan – would implode if prices went even “just” to $150 a barrel. The price itself would increase their profits, but the economic collapse it would cause would take those profits away again.

… the sheer scale of “stranded assets” and potential write-offs in the fossil industry raises eyebrows. IHS Global Insight said the average return on oil and gas exploration in North America has fallen to 8.6%, lower than in 2001 when oil was trading at $27 a barrel.

A large chunk of US investment is going into shale gas ventures that are either underwater or barely breaking even, victims of their own success in creating a supply glut. One chief executive acidly told the TPH Global Shale conference that the only time his shale company ever had cash-flow above zero was the day he sold it – to a gullible foreigner.

The Oxford Institute for Energy Studies says the Eagle Ford Dry Gas field, the Marcellus WC T2 and “C” Counties, Powder River, Cotton Valley, among others, are all losing money at the current Henry Hub spot price of $4.50. “The benevolence of the US capital markets cannot last forever,” it said.

In 2001, when prices were a quarter of what they are, profit margins were higher. That’s how much production costs have gone up in just 13 years. Many if not most shale plays are already losing money, kept alive by financial speculation, not energy returns. But it may take a while before people understand how that works: shale is still lauded as the big savior. Even Ambrose begs to differ:

This does not mean shale has been a failure. Optimists still hope it will reach a “positive inflexion point” in five years or so, the typical pattern for a fledgling industry. … the low-hanging fruit has been picked and the costs are ratcheting up. Three Forks McKenzie in Montana has a break-even price of $91.

Nor does it mean that America has made a mistake. Shale has been a timely shot in the arm, helping the US economy achieve “escape velocity” from the Great Recession, unlike Europe, which lurched back into a double-dip recession. It has whittled down the US current account deficit, now just 2% of GDP. Cheap gas costs – a third of EU prices and a quarter of Asian prices – has brought US industry back from near death, perhaps for long enough to give America another two decades of superpower ascendancy. But making money out of shale is another matter.

Ambrose needs to read up on depletion rates for shale wells. Shale is a financial play, not an energy source. At least, not for more than a few years. “Another two decades of superpower ascendancy” is just silly. And he himself quoted the Oxford Institute for Energy Studies, which states very clearly why that is: “The benevolence of the US capital markets cannot last forever.” Nor the benevolence of other capital markets, for that matter.

Then he turns to another issue that faces Big Oil:

Even if the fossil companies navigate the next global downturn more or less intact, they are in the untenable position of booking vast assets that can never be burned without violating global accords on climate change. The IEA says that two-thirds of their reserves become fictional if there is a binding deal limit to CO2 levels to 450 particles per million (ppm), the maximum deemed necessary to stop the planet rising more than two degrees centigrade above pre-industrial levels. It crossed the 400 ppm threshold this spring, the highest in more than 800,000 years.

“Under a global climate deal consistent with a two degrees centigrade world, we estimate that the fossil fuel industry would stand to lose $28 trillion of gross revenues over the next two decades, compared with business as usual,” said Mr Lewis. The oil industry alone would face stranded assets of $19 trillion, concentrated on deepwater fields, tar sands and shale.

Now those are numbers! Now we’re getting somewhere. Can anyone imagine Shell and ExxonMobil giving up on $1.4 trillion in revenue, year after year, for 20 years? I sure can’t. Look, Germany is supposed to be this green economy, but they’ve increased their – brown – coal use substantially recently, to make up for lost nuclear power. It’s nice to talk about ideals, Obama is increasingly chiming in, but legislating Big Oil out of existence is a whole other thing. And so is collapsing your own economy through $15 a gallon prices at the pump.

By their actions, the oil companies implicitly dismiss the solemn climate pledges of world leaders as posturing, though shareholders are starting to ask why management is sinking so much their money into projects with such political risk. This insouciance is courting fate. President Barack Obama’s new Climate Action Plan aims to cut US emissions by 30% below 2005 levels by 2030. His Clean Air Act is a drastic assault on coal-fired power plants, “industrial sabotage by regulatory means” in the words of the industry lobby.

China too is trying to break free of coal after anti-smog protests across the cities of the Eastern Seaboard. It is shutting down its coal-fired plants in Beijing this year. There is a ban on new coal plants in key regions. The Communist Party’s Five-Year Plan aims to cap demand at 3.9 billion tonnes a year up to 2015. Since the country consumes half the world’s coal supply, this has left Australia’s coal industry high and dry, Exhibit number one of assets stranded by a sudden policy change. Peak coal demand is in sight.

Sounds nice, and – almost – believable, but what are we, and our leaders, going to do when these measures raise energy prices beyond affordability? What will be our priority? Cleaner and poor, and richer and dirty? At best, we won’t know the answer to that until we’re forced to provide it; answering it today, from a position of affluence, doesn’t count. As for coal: the harder it gets to find more oil, the more attractive it will seem to switch to the most abundant fossil to keep our feet and our children warm.

In any case, staggering gains in solar power – and soon battery storage as well – threatens to undercut the oil industry with lightning speed, perhaps in a race with cheap nuclear power from a coming generation of molten salt reactors. The US National Renewable Energy Laboratory has already captured 31.1% of the sun’s energy with a solar chip, but records keep being broken. Brokers Sanford Bernstein say we are entering an era of “global energy deflation” where gains in solar technology must relentlessly erode the viability of the fossil nexus, since it goes only in one direction.

Deep sea drilling will become pointless. We can leave the Arctic alone. Once the crossover point is reached – and photovoltaic energy already competes with oil, diesel and liquefied natural gas in much of Asia without subsidies – it must surely turn into a stampede. My guess is that the world energy landscape will already look radically different in the early 2020s.

Sure, renewables are developing, but there are so many issues left to conquer that evoking an 10 year timeline for a “radically different energy landscape” looks wild. Our economies, which are very far from healthy, would need to cough up tens of trillions of dollars to build both equipment and infrastructure, and we don’t and won’t have that kind of money available; we’d need to borrow it, and add to our Andes-high pile of existing debt. The switch, if it ever happens, will take much longer, so long that it’s highly doubtful it will ever happen.

And besides, as mentioned above, who among us is going to tell Big Oil, and all of its major shareholders and highly-placed supporters in Congress and other parliaments, that they’re going to have to leave $28 trillion on the table and walk away? And what do we think their answer will be? They’re zombies, but they have a direct line into the blood of both you and the people you vote for.

it’s nice and all to think up cute little scenarios of how we’re all going to have solar panels and windmills and live in a blessed clean world, but in the real world we live in today, there are deeply entrenched economic and political power divisions and equally deeply vested interests that are not simply going to walk peacefully into the sunset and leave the world’s biggest fortune behind, just so we can do what we want. Reality is always dirtier, and in more than one way, than we like to think.

More importantly, we simply don’t have the wealth left that would allow us to make “the switch” from fossils to renewables. The plunging US markets I see now that I’m finishing this piece are just one more confirmation of that.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.