Stock Market Breakdown

Stock-Markets / Stock Markets 2014 Jul 10, 2014 - 06:58 PM GMT The Pre-market (delayed) is down .8% as I write, while the futures are down over 1%. This puts SPX below the hourly mid-Cycle support at 1957.39. Try as hard as I might, I could not get an impulse out of this week’s decline in the SPX, although the other indexes may easily be impulses. There are five declining waves, but the third is the smallest, which is a no-no in Elliott Wave parlance. The alternative to a Minute Wave (a) is a probable extended Minor Wave 1. Yesterday’s bounce did not overlap, suggesting impulsive qualities that could lend to an extended decline.

The Pre-market (delayed) is down .8% as I write, while the futures are down over 1%. This puts SPX below the hourly mid-Cycle support at 1957.39. Try as hard as I might, I could not get an impulse out of this week’s decline in the SPX, although the other indexes may easily be impulses. There are five declining waves, but the third is the smallest, which is a no-no in Elliott Wave parlance. The alternative to a Minute Wave (a) is a probable extended Minor Wave 1. Yesterday’s bounce did not overlap, suggesting impulsive qualities that could lend to an extended decline.

Initial jobless claims beat their estimates, so what could be wrong with this picture? The answer lies with Espiritu Santo, a major Portuguese bank that has been on the ropes for several months.

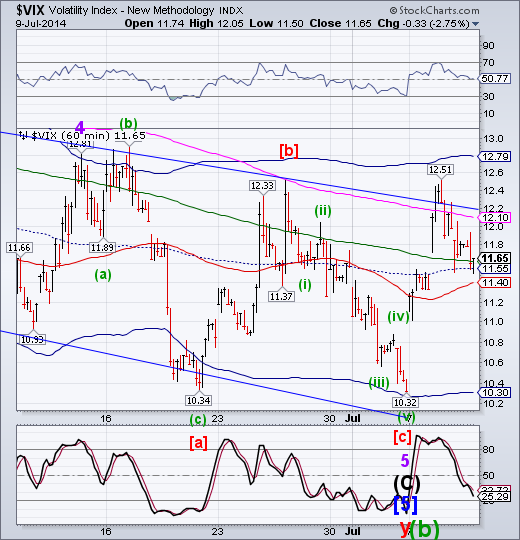

But... but... the VIX said everything is ok, and European rates were the lowest they have been in centuries... How can something possibly go wrong?

It just did.

Isn’t it nice to be warned of a trend change before it happens? This morning’s futures suggest VIX may have broken above its prior highs and appears to be challenging Cycle Top resistance at 12.79. This is nearly a 10% move just in the morning futures.

Remember, the Hi-Lo index remained onits sell signal throughout yesterday’s bounce.

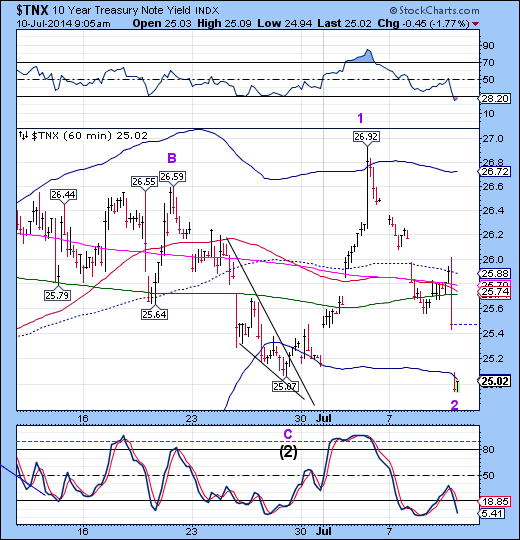

TNX did not make a new low, despite the frenzied commentary to the contrary. This is a very deep correction, but stikk a correction, nonetheless, until proven otherwise. If this is a false flag, then it will only trap more investors on the wrong side of a larger move yet to come.

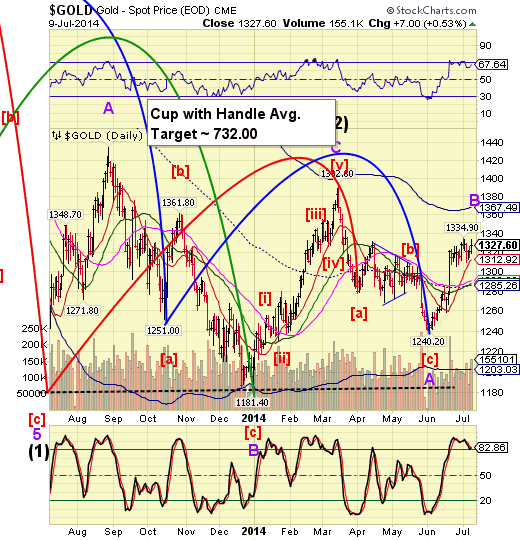

Gold futures ramped to 1346.10 this morning. This may be another false flag for investors who have been doggedly waiting for their rally to save them from their losses. Yesterday was a Pivot day. The next Pivot will be over the weekend. We are is some sort of extension that can happen in a Wave B. I am not expecting a breakout above the 1392.60 high.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.