Why Seattle’s Minimum Wage Hike Matters to Seniors

Economics / Wages Jul 09, 2014 - 07:04 AM GMTBy: Don_Miller

The US is gearing up for mid-term elections this November 4—so much so that Rolling Stone announced the relaunch of the “Rock the Vote” campaign last month (according to one of the younger members of my team). And just like clockwork, minimum wage is making headlines again too. It’s déjà vu all over again.

The US is gearing up for mid-term elections this November 4—so much so that Rolling Stone announced the relaunch of the “Rock the Vote” campaign last month (according to one of the younger members of my team). And just like clockwork, minimum wage is making headlines again too. It’s déjà vu all over again.

At a breakfast some 20 years ago, I sat next to a prominent, high-ranking US senator now long retired. He showed us data from the Bureau of Labor Statistics indicating that every time the minimum wage went up, more unemployment followed. Businesses were forced to ship jobs offshore—whether they wanted to or not—and started looking for ways to automate low- or unskilled jobs.

This senator and I talked one-on-one later in the day. Annoyed that politicians continued to do something that flat out doesn’t work, I asked him the rhetorical “Why?” He grinned and responded that politicians from all parties pander to the voters—and are more than willing to hurt Americans to get elected. Of course, I already knew that.

Swiss voters made the sane choice recently when they voted down a 22-franc (nearly $25) minimum wage. 76% voted to reject what would have been the world’s highest minimum wage. If only Seattle’s city council were as clearheaded as the Swiss! That city’s new $15 per hour minimum wage—the highest in the nation—will be phased in beginning next April.

The current federal minimum wage is $7.25 per hour. 22 states currently have higher minimum wage rates, and Washington’s wage floor (no surprise here) is the current high at $9.32 per hour. Not for long, though: Vermont just passed legislation that will raise its minimum wage to $10.50 per hour by 2018; Massachusetts is closing in on an $11 per hour rate. And earlier this year Connecticut, Hawaii, and Maryland passed $10.10 per hour minimum wage legislation.

More Jobs for Seniors That Still Don’t Pay That Much

Chances are you don’t live in any of those states. Maybe you even live in a place like Louisiana or South Carolina with no state minimum wage to speak of. Still, these increases affect us all by way of increased production costs and the like, which businesses ultimately pass on to consumers.

Minimum wage increases and the accompanying price hikes disproportionately affect seniors as a group. If you’re still working, your wages should increase with prices. But if you’re not, your income might not keep up, particularly if you depend on Social Security. Simply put, Social Security’s cost of living increases do not keep up with, well, the cost of living. Each time minimum wages go up, they push the buying power of a fixed income down.

Does raising the minimum wage force seniors out of jobs? No, actually. The percentage of seniors in the workforce is rapidly increasing as they look for post-retirement jobs, often in the only place they can find them: low on the totem pole.

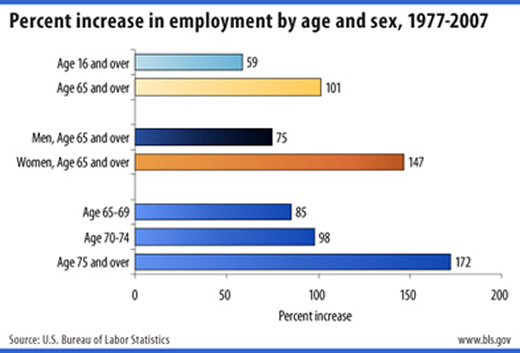

The chart below shows the marked increase in the percentage of employed seniors compared to other age groups.

Walk into any Walmart, McDonald’s, Home Depot, or other big-box store and you’ll see a lot of seniors waiting on you with a smile… albeit sometimes forced. Businesses can move manufacturing jobs offshore, but they have to staff in-person retail jobs with live bodies right where their stores are.

Still, retailers have to cut back to cover minimum wage increases as best they can. My wife and I recently went into a fast-food restaurant and stood in line for 10 minutes. Talk about a redefinition of fast food: McDonald’s reported in April that their same-store sales rose 1.2%, and yet their lines and wait times have increased a lot more than that.

And it’s not just fast food. We just went to two different Home Depots to buy an inexpensive area rug and struggled to find a clerk in both. When we finally did, there were lines of antsy customers in front of us three people deep. We stood in line and waited our turn.

Of course, a senior earning minimum wage has a different perspective. Any 70-year-old in Seattle earning $10 per hour must be awfully excited about a 50% pay bump. As the saying goes, though, there is good news and bad news.

At one time, the minimum wage was meant to be “apprentice” pay for young people entering the work force. Young people, however, have the highest rate of unemployment: 15% for workers age 16-24. While this is an ongoing trend—before the 2008 recession, one in eight young workers was unemployed, according to a 2010 joint congressional report—higher minimum wages aren’t helping.

Ask any owner or manager of a retail store whom he or she would rather hire: a young person with no job experience or a senior? The senior wins out almost every time. Employers consider them to be more diligent, harder workers and more likely to show up consistently and on time. With fewer and fewer unskilled jobs out there and a larger labor force to choose from, seniors have a real advantage.

Higher Mandatory Wages Spur Automation

The other side of the coin is that higher minimum wages give retailers a greater incentive to automate unskilled tasks. How many of us now find the self-checkout at Home Depot or the grocery store faster and easier? One retail clerk can look over five to six customers checking out and assist them as needed.

Would you rather folks have jobs paying $10 per hour or this?

I have great empathy for a friend who, at 80 years old, went back to work in a retail store earning minimum wage. He had to in order to make ends meet. He worked 20-25 hours a week and came home exhausted. Certainly another $5 per hour would have helped; it might add $100-125 per week to his take-home pay. From his perspective, the push for a higher minimum wage is certainly understandable.

But consider this: He and his wife live in a small condo in a modest 55-plus community. Once a week, an army of workers descends on the condominium complex to mow the grass and perform the maintenance for the entire community. Those workers would also have to be paid more, and those costs would be passed on to my friend and his neighbors via their association dues.

No matter where they go to spend money—the grocery store, the occasional restaurant, or the gas pump—prices will reflect the minimum wages of others, and the cycle will continue. Soon, $15 per hour will mean the folks in Seattle are no better off than they were before. And what’s worse, young people who need job experience are not going to get it.

Sad to say, the few seniors I know who must work were never poor during their first careers. Many enjoyed excellent salaries, but they never learned to live within their means. Now that lifestyle has caught up with them.

Moreover, nearly every politician running during the upcoming mid-term elections (and every other election) seems to have a plan to “fix” Social Security. That’s a code for reducing benefits, making the minimum wage and subsequent price increases all the more relevant to seniors living on fixed incomes.

Meanwhile, the minimum wage will continue to rise. Some may benefit in the short term, but working seniors and retirees alike will all watch their cost of living rise. My team of Miller’s Money Forever analysts and I have a solution, though: a singular investing approach specifically curated for seniors and savers who want a higher monthly income stream without taking on post-retirement jobs or undue financial risks.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.