QE: Quantitative Easing or Questionably Effective

Stock-Markets / Stock Markets 2014 Jul 09, 2014 - 06:48 AM GMTBy: DeviantInvestor

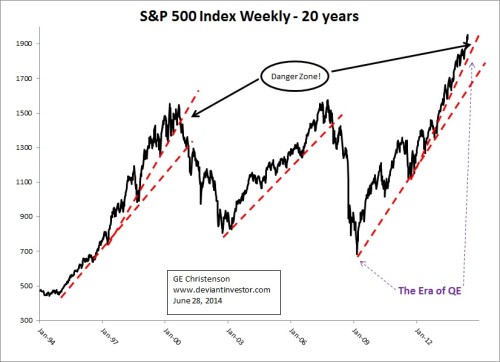

We all know the S&P 500 Index has been on a 5+ year rally to all-time highs – thanks to ultra-low interest rates and the levitating wonder of “printing money” via QE – Quantitative Easing. Examine the following chart of the S&P for the past 20 years.

We all know the S&P 500 Index has been on a 5+ year rally to all-time highs – thanks to ultra-low interest rates and the levitating wonder of “printing money” via QE – Quantitative Easing. Examine the following chart of the S&P for the past 20 years.

S&P 500 Index – 20 Years

If you were a member of the top 5 – 10% and had a large investment in the stock market, you increased your nominal net worth. However, if you were in the bottom 90%, then the wonders of QE did not “trickle down” to you and your family, except as higher prices.

Pension and retirement funds benefitted to the extent of their stock investments but they were hurt by generational low interest rates in their bond portfolios. Simply put, the stock market rally benefitted a narrow band of society – mostly the political and financial elite and upper middle class.

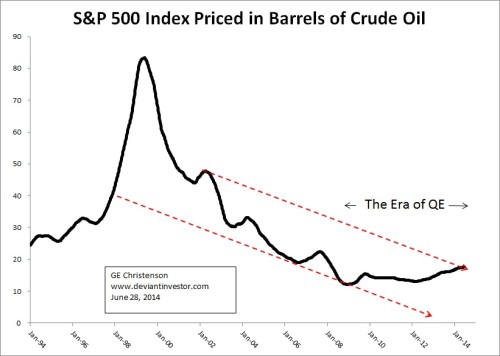

But how does the massive rally in the S&P look when priced in barrels of crude oil? Examine the following chart of weekly S&P divided by weekly Crude Oil prices – both smoothed with a 52 week moving average.

S&P Priced in Bbl of Crude Oil

That rally in the S&P, when priced in barrels of crude oil, does not look nearly as impressive. Remember – a small percentage of people benefit from higher stock prices, but everyone pays when oil prices rise. The price of crude oil affects food prices, gasoline prices, shipping costs, home heating costs, mining and manufacturing costs, and so many more.

When we look at the S&P in terms of crude oil, we see:

1) The ratio is DOWN over 75% from its peak.

2) The ratio has been essentially unchanged since 2006.

3) The price of crude has risen for the last 14 years – much more rapidly than the S&P, along with a massive increase in debt and the money supply.

4) A few people benefitted from the nominal rise in the S&P and most people were hurt by the rising costs of energy, gasoline, manufacturing, food, and so on.

5) The overall US economy seems to be sputtering, unless you believe what financial television is “selling.”

So, have QE and the ballooning debt been a fantastic success or a Questionably Effective policy designed to recapitalize banks and the financial elite at the expense of most others, including pension funds, retirement accounts, savers, and bond funds?

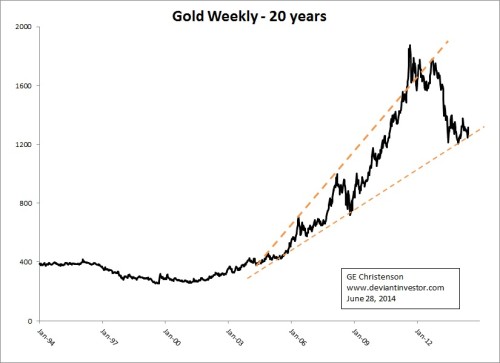

QE looks like it produced a toxic cloud of dangerous mal-investment, debt and currency bubbles, higher consumer prices, and a weakened economy. But there is a golden lining in that toxic cloud.

Gold Prices – 20 Years

The price of gold has increased over the past 15 years, and will, thanks to the good folks who are bringing us more debt and QE, probably increase much more in the next few years.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.