Islamic Extremism and Emerging Market Stocks

Stock-Markets / Stock Markets 2014 Jul 05, 2014 - 03:50 PM GMTBy: EWI

By By Mark Galasiewski,

By By Mark Galasiewski,

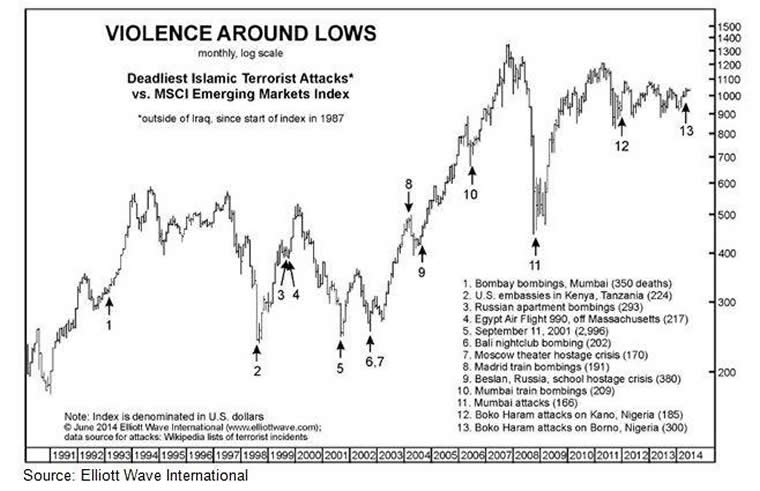

We have for many years observed a relationship between extremism and bear markets in the stock markets of Muslim nations. For example, this chart shows the deadliest Islamic terrorist attacks graphed against the MSCI Emerging Markets Index since the start of the index on December 31, 1987. Notice that many the attacks occurred near lows in the index.

Islamic extremist groups are mainly based in four of the five regions that make up the MSCI Emerging Markets Index. Those regions are Africa, the Middle East, Eastern Europe, and Asia. (Latin America is the exception.) Our April 2014 Asian-Pacific Financial Forecast showed how stock markets in these five regions have generally followed a similar pattern in recent decades. So the MSCI Emerging Markets Index serves as a good proxy for stock markets in Islamic nations collectively -- and their lows in particular. The chart suggests that the extreme negative sentiment toward the ends of major corrections has influenced the timing of the deadliest Islamic terrorist incidents over the past 25 years.

Terrorist incidents have become a fact of contemporary life in many nations to such a degree that many smaller attacks have no correlation to the index. However, our study focuses on the largest incidents by number of people killed. It also excludes Iraq, where the sectarian violence has been ongoing for about a decade now and shows no consistent relationship to the emerging markets index. It also finds one exception, the 2004 Madrid train bombings (No. 8 on the chart), which occurred near a peak in the index.

The most violent Islamist group by far during the correction in the MSCI Emerging Markets Index of the past few years has been Boko Haram of Nigeria. The group turned violent following the 2009 lows in global markets and has accelerated its campaign of violence in recent years. The Wall Street Journal reports that the group has killed 7,000 people over the past two years alone, citing data from the Council on Foreign Relations. As we go to press (June 6), the group still holds hostage more than 275 schoolgirls it kidnapped in April and May.

Boko Haram's most lethal individual attacks followed the 2011 and 2014 lows in the MSCI Emerging Markets Index. The group slaughtered at least 300 people in a town in the Nigerian state of Borno in early May 2014 and, as we go to press, has reportedly killed hundreds more people in another large attack in the state.

As with other large-degree Islamic terrorist attacks, these most recent attacks appear to have marked the end of a significant

Read more from EWI's international markets expert, On March 23, 2009, Asian-Pacific Financial Forecast Editor Mark Galasiewski issued a special interim report to alert subscribers to an amazing opportunity -- the start of a bull market in India that would likely last around 15 years. See how he made such a stunning forecast more than five years ago -- when we were in the depths of the 2008-2009 financial crisis. |

correction in emerging markets overall, including emerging Asian markets.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.