How to Score in Trading the World's Key Commodity Markets

Commodities / Commodities Trading Jul 03, 2014 - 10:14 PM GMTBy: EWI

If you've ever tried your hand at futures trading, and if you've been watching the 2014 World Cup, you've probably thought to yourself -- Yup. This looks like how it feels to invest in commodities.

If you've ever tried your hand at futures trading, and if you've been watching the 2014 World Cup, you've probably thought to yourself -- Yup. This looks like how it feels to invest in commodities.

Hey, if the cleat fits!

The world of commodities trading is competitive and cutthroat. The action is nonstop. Passes happen in the blink of an eye. There are no commercial breaks, or half times. And those on the field never stop paying attention to price charts, scanning and waiting for opportunity to strike.

And then comes the moment to act. You're the last guy in a penalty shootout. All that stands between you and the goal is the ticking of the clock, fatigue, and doubt.

And then comes the moment to act. You're the last guy in a penalty shootout. All that stands between you and the goal is the ticking of the clock, fatigue, and doubt.

But if you make it, the reward is like nothing else.

Everybody wants to make it.

Whether you actually do is a different story.

Elliott Wave International's Chief Commodity Analyst Jeffrey Kennedy is tirelessly committed to ensuring the odds of doing just that are in your favor.

Jeffrey spent years training with the world's greatest Elliott wave analysts before becoming one himself. His skill and discipline on the field of technical forecasting is matched only by his patience off of it -- Jeffrey's #1 rule is: Wait for price action to confirm your wave count before making a play.

Seeing Jeffrey in action is kinda like seeing James Rodriguez's "wonder volley" in the World Cup's Colombia vs. Uruguay game.

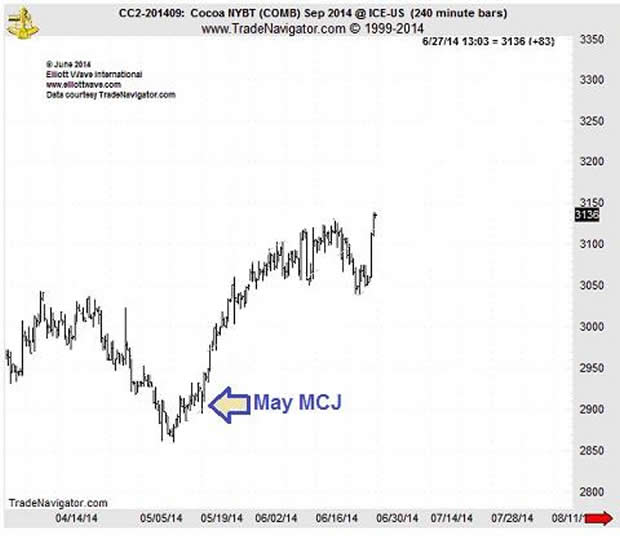

In the "Featured Market" video of his May 2014 Monthly Commodity Junctures, Jeffrey stepped onto the near-term field in cocoa. The pressure was high. Prices had been sideways-bound since the start of the year. And, the mainstream "commentators" told investors to keep holding until there was a break in the fundamental backdrop.

"Traders weigh poorly received Chinese and U.S. economic data against the crisis in the Ukraine and unrest in Libya." -- May 30 Associated Press

But for Jeffrey, a clear shot to near-term opportunity in cocoa was wide open. Watch this clip from his Monthly Commodity Junctures video below so you can hear the bullish forecast in "high def":

The next chart shows you an instant replay of what happened: Cocoa prices broke out of their sideways trend and surged to the 3-year high we see today.

So, while the mainstream experts stayed on the sidelines, a near-term opportunity passed them by.

The best part about Jeffrey's video is that it's not just about watching a pro in action. Jeffrey is first and foremost a coach. He walks you through every forecast from top to bottom, explaining the what and why of every price target and wave pattern.

In the end, you come away with timeless lessons on how to apply Elliott wave analysis to actionable set-ups. Learn how to get Jeffrey's latest video update on Cocoa for free below!

New Video Forecast: Watch Kennedy's Latest Cocoa Update -- FREEIn this new update from Jeffrey Kennedy's Commodity Junctures Weekly Wrapup, he shows you what to expect next from Cocoa prices. Kennedy shows you:

To access this video forecast now for free, all you have to do is become a Club EWI member. There are no strings attached and it takes just 30 seconds to sign up. |

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.