Capital in the Twenty-First Century Flawed Theory That's Torching the Best-Seller List

Stock-Markets / Financial Markets 2014 Jul 03, 2014 - 12:57 PM GMTBy: Money_Morning

Peter Krauth writes: I really do hate to say this, but the government threat to your assets is growing... again.

Peter Krauth writes: I really do hate to say this, but the government threat to your assets is growing... again.

We've seen it happen in Cyprus, where bank accounts were "raided" to bail-in the country.

We've seen it in Argentina, Poland, Hungary, and other nations where private pensions were nationalized to help the countries' ballooning debts and deteriorating sovereign credit ratings.

I even warned you that the new MyRA accounts could be a shrewd way to get at your savings, and that the IMF was floating the idea of a "capital levy - a one-off tax on private wealth..."

Well, now a French "economist" is using his best seller as a platform to advance a tax "plan" centered on your wallet...

The Flawed Theory That's Torching the Best-Seller List

A new book, Capital in the Twenty-First Century by Thomas Piketty, has already spent 74 days in the top 100 as an Amazon.com best seller. Despite reaching its fourth printing, it's still regularly selling out.

That's not something you can often say about a book on economics.

Piketty spent 15 years accumulating and researching data on wealth inequality. The nearly 700-page tome was well-received in the U.K. and America.

His work even earned him the title of "rock star" economist, and his book tour landed him a meeting with Treasury Secretary Jacob Lew, a lecture at the IMF (surprise), and a talk to Obama's Council of Economic Advisers.

So what could he be saying that's perking up so many high-profile ears?

Well, his theories lead him to conclude that under capitalism, the rich consistently get richer and that this inequality is perpetuated and inevitable.

His solution to this problem is simple: Eat the Rich.

How? Impose rates of 80% on anyone earning $500,000 or more, 50% to 60% on incomes starting at $200,000, an annual wealth tax of 10% on large fortunes, and a one-time assessment up to 20% on smaller accumulations of existing wealth.

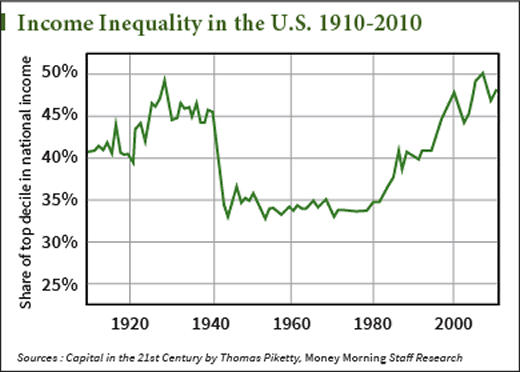

One of the most relevant charts from his book looks at the proportion of wealth owned by the top 10% of Americans from 1910 to 2010.

Co-founder and former CEO of Cambridge Associates (a global investment firm), Hunter Lewis, offered his thoughts about the data:

"What we actually see are two peaks for high earners, right before the crash of 1929 and again before the crash of 2008. These are the two great bubble eras in which government printed too much new money, which led to a false and unsustainable prosperity. These were also crony capitalist eras, as rich people with government connections used the new money to become even richer or benefited from other government favors."

Interestingly, and perhaps not so surprisingly, Capital in the Twenty-First Century was not well-received in his home country of France.

I'm guessing that's because of their recent experience with Piketty-like reforms. Socialist President Hollande imposed a 75% tax on millionaires which, despite being challenged in court, just needed tweaking to be considered legal.

Thanks to a 2011 one-time levy on incomes for French households with assets over 1.3 million Euros, 8,000 families paid taxes exceeding 100% of their income. Another 12,000 paid over 75%.

Famed actor Gerard Depardieu fled France to become a citizen of Russia, causing then-Prime Minister Jean-Marc Ayrault to call him "unpatriotic."

Here's What's Really Disturbing... and What to Do About It

But perhaps what's most disturbing about Piketty's work is the doubt about his data's integrity.

An investigation by the Financial Times found "data problems and errors in Professor Piketty's work. These include unexplained entries in his spreadsheets, cherry-picking data sources, and transcription errors. Taken together, these problems seem to undermine his conclusion that wealth inequality is rising in the U.S. and in Europe."

Piketty, it seems, casts aside the fact that in a capitalist system people deal with each other on a voluntary basis, leading him to disregard the laws of economics to reach his desired conclusions.

If you're concerned about Piketty's causal relationships (with their damaging impact on people's perception of "appropriate" fiscal policy), here's what you can do...

Once again, you need to take appropriate steps to safeguard your assets against both inflation and confiscation:

- Own and invest in hard assets like gold, silver, energy, and real estate

- Hold plenty of cash

- Diversify internationally

The risk with high-profile opinions to establish a global wealth tax is what I like to call "repetition fatigue."

Eventually, after enough reiterations, ideas like this become increasingly mainstream and acceptable - a dangerous outcome.

In the end, if common sense doesn't prevail, the immutable laws of economics will.

I think Margaret Thatcher summed it up best when she said:"The problem with socialism is that you eventually run out of other people's money."

Source : http://moneymorning.com/2014/07/03/stop-this-threat-to-your-income-in-its-tracks/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.