Planning for Future Interest Rate Hikes: What Can History Tell Us that the Fed Won’t?

Interest-Rates / US Interest Rates Jul 02, 2014 - 12:11 PM GMTBy: F_F_Wiley

It stands to reason that when the Fed eventually lifts interest rates, we’ll see the usual effects. After a sustained rise in rates, you can safely bet on:

It stands to reason that when the Fed eventually lifts interest rates, we’ll see the usual effects. After a sustained rise in rates, you can safely bet on:

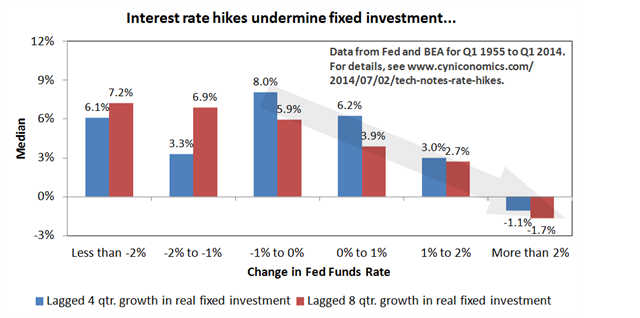

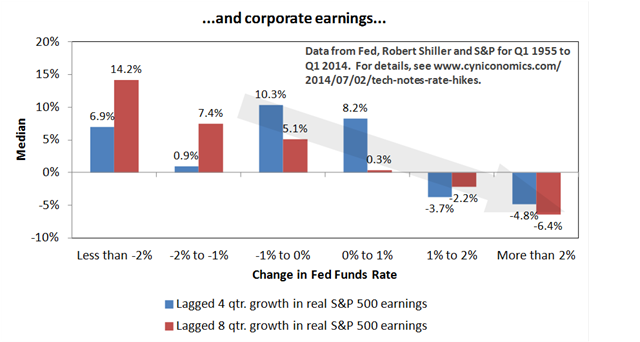

- Fixed investment and business earnings dropping sharply

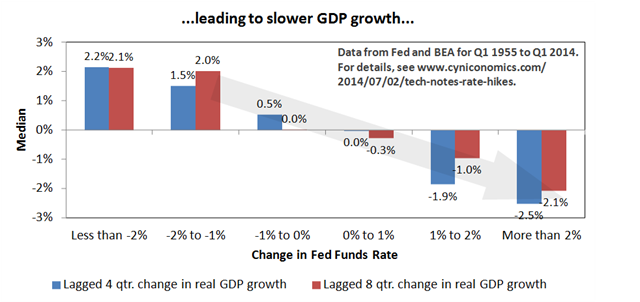

- GDP growth following investment and earnings lower

- Many people losing their jobs

- Risky assets performing poorly

These consequences follow not only from the arithmetic of debt service and present value calculations, but also from the mood swinging psychology of entrepreneurs, lenders and investors.

Yet, policy economists claim that interest rates can be “normalized” at no cost.

For example, while speaking last week about the fed funds rate, St. Louis Fed President James Bullard said the economy was strong enough to “tolerate at least a little bit of the central bank getting back to a more normal stance.”

And how should we interpret “a little bit”?

According to FOMC projections, a little bit of normalization gets underway sometime next year and then leads to a steady pace of policy adjustments that doesn’t stop until the fed funds rate reaches almost 4%. These projections are accompanied by predictions for an improving economy as policy tightens.

Escape velocity or escape from reality?

The FOMC simply doesn’t acknowledge the time-tested effects of rising interest rates noted above. Instead, central bankers argue that today’s monetary stimulus will produce such economic vitality that there’s no sting in tomorrow’s tightening. In other words, they forecast an “escape velocity” where the economy is presumed immune to monetary restraint.

But is there any basis for their beliefs in the economy’s actual workings?

Or, is escape velocity merely a convenient story for central bankers predisposed towards easy money and short-term thinking?

We’ve argued that the Fed’s current policymakers have exactly this predisposition, and that there’s no such thing as escape velocity. We’ve also shared historical evidence supporting our views – in “M.C. Escher and the Impossibility of the Establishment Economic View,” for example – and take another look at history in this post.

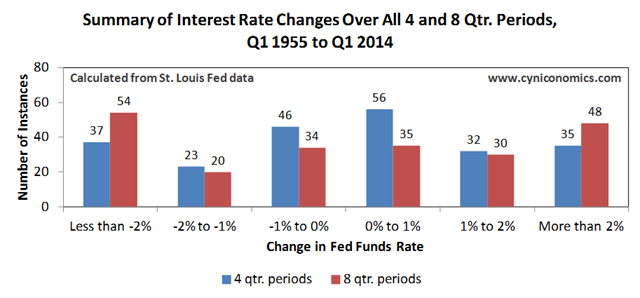

Our analysis starts with a breakdown of interest rate changes over all 4 and 8 quarter periods since 1955:

We then review economic outcomes conditioned on the rate buckets above, recording the median outcome for each bucket. In most cases, we compare interest rate changes to outcomes for subsequent (lagged) 4 and 8 quarter periods.

(See this technical notes post for further detail. Also, look for a future follow-up post where we’ll contrast the history shown below to the Fed’s forecasts.)

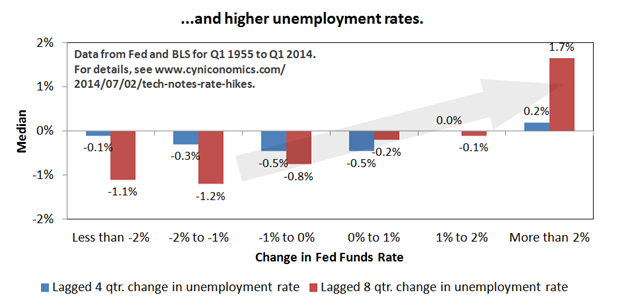

Here are the results for fixed investment, corporate earnings, GDP and unemployment:

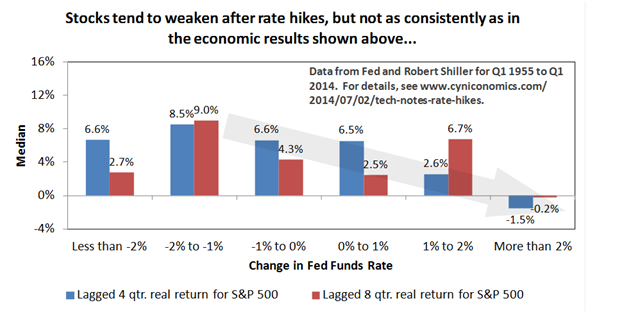

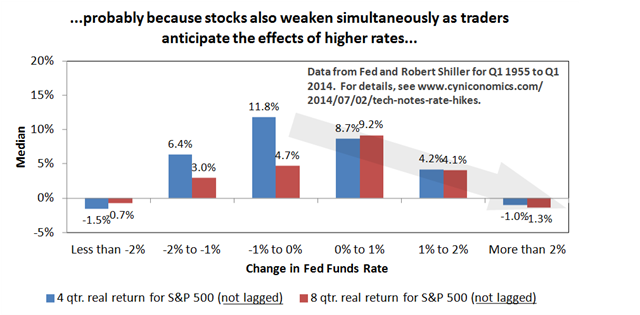

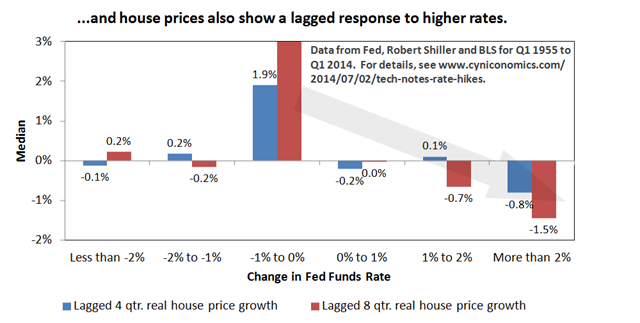

And here are charts showing the effects of changing interest rates on stock and house prices:

Now, many readers will surely dismiss these results by insisting that “this time is different.” We beg to differ. By our estimates, the economy and financial markets are as vulnerable to higher rates as they’ve ever been. Here are a few reasons:

- The present expansion is weaker than any other post-World War 2 expansion, suggesting that it won’t take much of a slowdown to push the economy into recession.

- Monetary policy has been exceptionally loose for longer than ever before, allowing financial markets more time to become overpriced and complacent.

- There are many more risk-takers in the global economy who’ve learned how to exploit cheap dollar policies than there were in, say, 1955, the start of the period shown in the charts.

- Most importantly, aggregate debt is at or near record levels, not only in the U.S. but also in other large economies.

Bottom line

Our conclusion is to reject forecasts calling for the economy to power right through interest rate hikes without stumbling. A more likely scenario is that policy “normalization” leads us directly into the next bust. Alternatively, the Fed might abort its planned rate hikes, allowing economic and financial market imbalances to continue growing. Either way, we can expect recurring booms and busts until our monetary approach is rebuilt on stronger policy principles.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.