A Second Quarter U.S. GDP Bounce-Back May Not Be Bullish

Economics / US Economy Jun 28, 2014 - 05:52 AM GMTBy: Sy_Harding

No one, or at least hardly anyone, expects the U.S. economy is sliding into a recession, which would require two straight quarters of negative growth.

No one, or at least hardly anyone, expects the U.S. economy is sliding into a recession, which would require two straight quarters of negative growth.

The sharp plunge in first quarter GDP, to negative 2.9%, should reverse to a positive reading of some degree in the second quarter. You get no argument from me on that score.

The rest of the popular opinion is that therefore the bull market will continue to be fine.

However, the high risk of a correction, which has had corporate insiders selling heavily, and smart money types like George Soros, Mohamed El-Erian, and economist Robert Shiller, warning of the risk since last year, has not been about the economy possibly sinking into a recession. The unexpected plunge in Q1 GDP only adds another level of discomfort.

The warnings have also not been due to the possibility of rising inflation. That potential just popped up two weeks ago, and only adds another consideration.

The concerns have been the excesses that are in need of correcting back to normal; high market valuation levels, the extreme level of investor complacency, record margin debt, and other conditions usually associated with significant market tops. They also include the length of the aging bull market, the pattern risk of unfavorable annual seasonality and the Four-Year Presidential Cycle, the familiar ‘this time is different’ refrain of confident investors, and so on.

It’s interesting that most of the previous significant market tops took place when the economy was booming, 1929, 1987, 1998, 2000, 2007, to name a few. The market obviously does not need a recession, or even a one-quarter GDP scare, as a catalyst to begin a correction once valuations become high and excesses need correction.

However, it is also interesting that when market top conditions are present, an unexpected quarterly plunge in GDP, even if quickly recovered the next quarter, is not necessarily a positive, which seems to be the current expectation.

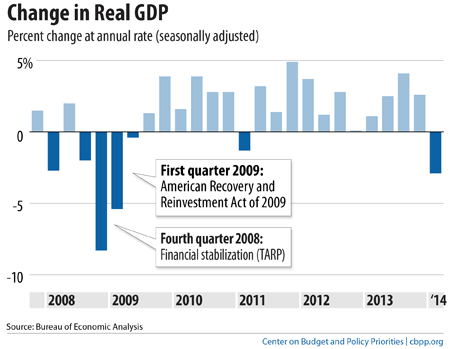

Take a look at this GDP chart of the last seven years.

In the first quarter of 2011, GDP was negative by half as much as it was in the first quarter of this year. The S&P 500 plunged 19% in the next quarter, the decline only halted when the Fed rushed in with QE2.

The previous occasion, in 2008, GDP was negative for just one quarter, but bounced back the next quarter. But that was way too late. The severe 2007-2009 bear market was already underway. The economy and market didn’t recover until well after the Fed, Treasury Department, and the rest of government rushed in with the most massive and costly stimulus efforts in history.

This time around it’s unlikely the Fed will rush immediately to the rescue, not after last week’s FOMC meeting, its assessment that the economy is just fine, and its decision to continue tapering back QE stimulus. But even when the Fed jumped in immediately the last two times, it was not in time to prevent 19%+ plunges by the S&P 500.

So the market’s main risks have not changed. It is potentially overvalued. Investor sentiment and participation are at extremes of complacency and bullishness. Corporate insiders are selling heavily. And, the Fed is now potentially behind the curve with its assurances and optimism. That’s all it normally takes.

However, the plunge in GDP in the first quarter is a potential additional negative. A bounce back in the second quarter will not likely be the positive investors currently believe, at least until after the overvaluation levels and other excesses have been corrected.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.