Economic Gross Output: J.M. Keynes versus J.-B. Say

Economics / Economic Statistics Jun 24, 2014 - 04:00 PM GMTBy: Steve_H_Hanke

In late April of this year, the Bureau of Economic Analysis (BEA) at the U.S. Department of Commerce announced that it would start reporting a new data series as part of the U.S. national income accounts. In addition to gross domestic product (GDP), the BEA will start reporting gross output (GO). This announcement went virtually unnoticed and unreported — an unfortunate, but not uncommon, oversight on the part of the financial press. Yes, GO represents a significant breakthrough.

In late April of this year, the Bureau of Economic Analysis (BEA) at the U.S. Department of Commerce announced that it would start reporting a new data series as part of the U.S. national income accounts. In addition to gross domestic product (GDP), the BEA will start reporting gross output (GO). This announcement went virtually unnoticed and unreported — an unfortunate, but not uncommon, oversight on the part of the financial press. Yes, GO represents a significant breakthrough.

A brief review of some history of economic thought will show just why GO is a big deal. The Classical School of economics prevailed roughly from Adam Smith’s Wealth of Nations time (1776) to the mid-19th century. It focused on the supply side of the economy. Production was the wellspring of prosperity.

The French economist J.-B. Say (1767-1832) was a highly regarded member of the Classical School. To this day, he is best known for Say’s Law of markets. In the popular lexicon — courtesy of John Maynard Keynes — this law simply states that “supply creates its own demand.” But, according to Steven Kates, one of the world’s leading experts on Say, Keynes’ rendition of Say’s Law distorts its true meaning and leaves its main message on the cutting room floor.

Say’s message was clear: a demand failure could not cause an economic slump. This message was accepted by virtually every major economist, prior to the publication of Keynes’ General Theory in 1936. So, before the General Theory, even though most economists thought business cycles were in the cards, demand failure was not listed as one of the causes of an economic downturn.

All this was overturned by Keynes. Kates argues convincingly that Keynes had to set Say up as a sort of straw man so that he could remove Say’s ideas from the economists’ discourse and the public’s thinking. Keynes had to do this because his entire theory was based on the analysis of demand failure, and his prescription for putting life back into aggregate demand — namely, a fiscal stimulus (read: lower taxes and/or higher government spending).

Keynes was wildly successful. With the publication of the General Theory, the supply side of the economy almost entirely vanished. It was replaced by aggregate demand, which was faithfully reported in the national income accounts. In consequence, aggregate demand has dominated economic discourse and policy ever since.

Among other things, Keynes threw economics into the sphere of macro economics. It is here where economic aggregates are treated as homogenous variables for purposes of analysis. But, with such innocent looking aggregates, there lurks a world of danger. Indeed, because of the demand-side aggregates that Keynes’ analysis limited us to, we were left with things like the aggregate sizeof consumption and government spending. The structure of the economy — the supply side — was nowhere to be found.

Yes, there were various rear-guard actions against this neglect of the supply side. Notable were economists from the Austrian School of Economics,such as Nobelist Friedrich Hayek. There were also devotees of input-out put analysis, like Nobelist Wassily Leontief. He and his followers stayed away from grand macroeconomic aggregates;they focused on the structure of the economy. There were also branches of economics — like agricultural economics– that were focused on production and the supply side of the economy. But,these fields never pretended to be part of macroeconomics.

Then came the supply-side revolution in the 1980s. It was associated with the likes of Nobelist Robert Mundell. This revolution was carried out, in large part, on the pagesof The Wall Street Journal, where J.-B.Say reappeared like a phoenix. The Journal’s late-editor Robert Bartley recounts the centrality of Say in his book The Seven Fat Years: And How to Do It Again (1992) “I remember Art Laffer telling me I had to learn Say’s Law. ‘That’s what I believe in’, he professed. ‘That’s what you believe in.’”

It is worth mentioning that the onslaught by Keynes on Say was largely ignored by many economic practitioners who attempt to anticipate the course of the economy. For them,the supply side of the economy has always received their most careful and anxious attention. For example, the Conference Board’s index of leading indicators for the U.S. economy is predominantly made up of supply-side indicators. Bloomberg’s supply-chain analysis function (SPLC) is yet another tool that indicates what practitioners think about when they conduct economic and financial analyses.

But, when it comes to the public and the debate about public policies, there is nothing quite like official data. So, until now, demand-side GDP data produced by the government has dominated the discourse. With GO, GDP’s monopoly will be broken as the U.S. government will provide official data on the supply side of the economy and its structure. GO data will complement, not replace, traditional GDP data. That said, GO data will improve our understanding of the business cycle and also improve the quality of the economic policy discourse.

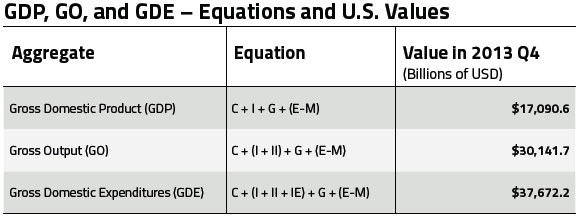

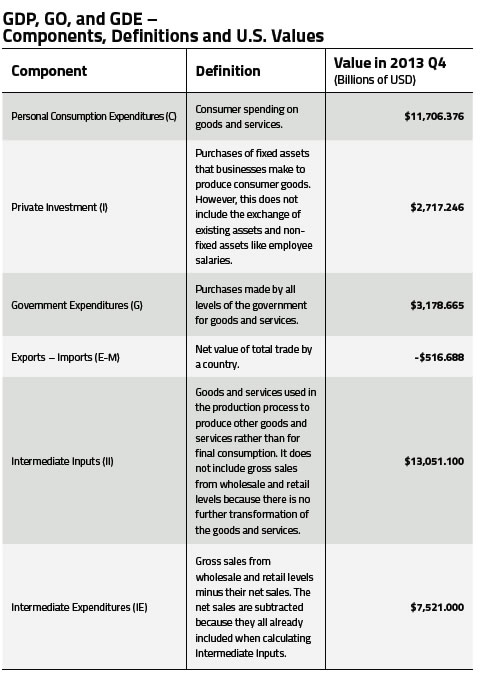

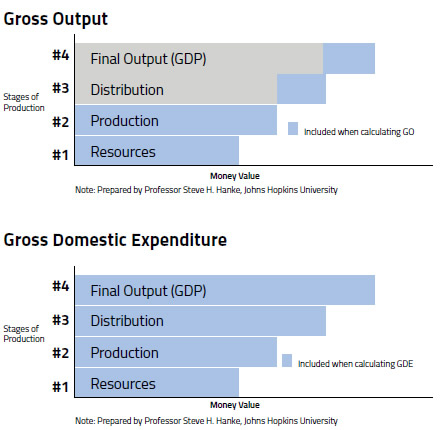

So, what makes up the conventional measure of GDP and the new GO measure? And what makes up the gross domestic expenditures (GDE)measure, a more comprehensive, close cousin of GO? The accompanying two tables answer those questions. And for readers who are more visually inclined,bar charts for the two new metrics — GO and GDE — are presented.

Now, it’s official. Supply-side (GO) and demand-side (GDP) data are both provided by the U.S. government. How did this counter revolution come about? There have been many counter revolutionaries, but one stands out: Mark Skousen of Chapman University. Skousen’s book The Structure of Production, which was first published in 1990, backed his advocacy with heavy artillery. Indeed, it is Skousen who is, in part, responsible for the government’s move to provide a clearer, more comprehensive picture of the economy, with GO. And it is Skousen who is solely responsible for calculating GDE.

These changes are big, not only conceptually, but also numerically. Indeed, in 2013 GO was 76.4% larger, and GDE was 120.4% larger, than GDP. Why? Because GDP only measures the value of all final goods and services in the economy. GDP ignores all the intermediate steps required to produce GDP. GO corrects for most of those omissions. GDE goes even further, and is more comprehensive than GO.

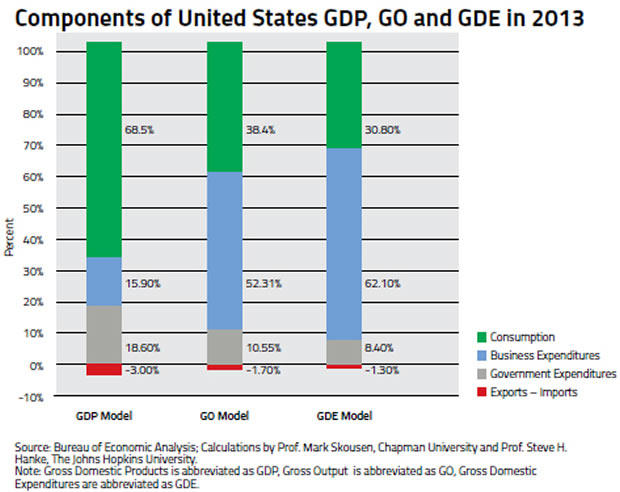

Even though the always clever Keynes temporarily buried J.-B. Say, the great Say is back. With that, the relative importance of consumption and government expenditures withers away (see the accompanying bar charts). And, yes, the alleged importance of fiscal policy withers away, too.

Contrary to what the standard textbooks have taught us and what that pundits repeat ad nauseam, consumption is not the big elephant in the room. The elephant is business expenditures.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2014 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.