How to Profit From the Iraq Crisis

Companies / Oil Companies Jun 22, 2014 - 12:22 PM GMTBy: Investment_U

David Fessler writes: ISIS, the terrorist group that makes Al-Qaeda and the Taliban look like pussycats, has Iraq embroiled in an all-out civil war.

David Fessler writes: ISIS, the terrorist group that makes Al-Qaeda and the Taliban look like pussycats, has Iraq embroiled in an all-out civil war.

It's the largest security threat that Iraq has faced in years. Last week ISIS, in a surprise attack, took over the Iraqi city of Mosul, terrorizing its 2.8 million residents. More than 500,000 of them fled.

On their way through the city, the militants stopped at Mosul's central bank to make a withdrawal. Incredibly, the bank had 500 billion Iraqi dinars on hand. That's equivalent to US$425 million.

According to the International Business Times, ISIS stole untold additional millions from other banks in Mosul. They also took a "large quantity of gold bullion." IBT called ISIS the "World's Richest Terror Force."

ISIS then turned its sights on Iraq's largest oil refinery in nearby Baiji. It was easy prey. Militants in black masks and wielding AK-47s simply told the 250 men guarding the facility to leave.

They didn't argue. That immediately took 300,000 barrels per day (b/d) offline.

This week ISIS troops came to within 40 miles of Baghdad.

Energy Stocks to Keep Climbing

The energy sector was a great place to be in 2013. And, partly due to this crisis, the rest of this year is shaping up to be another good one.

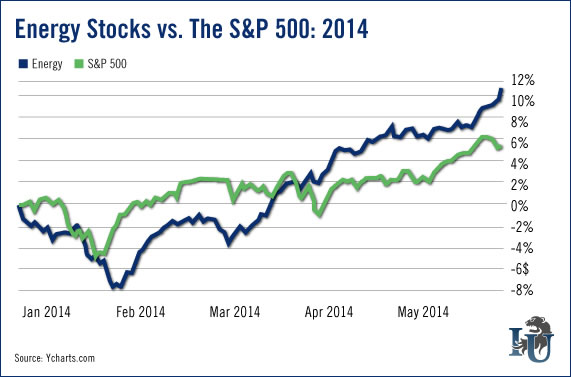

Take a look at the chart below. It shows the year-to-date performance of the energy sector versus the S&P 500 Index.

Although the energy sector underperformed the S&P 500 in the first quarter, it's more than made up for that since. Year-to-date, energy stocks are outperforming the S&P 500 by 2-to-1, and most of that gain was achieved before the crisis flared in Iraq.

The world is much less dependent on Iraq's oil than it was a decade ago. As my colleague Andrew Snyder pointed out in a note to Oxford Club Members this week, thanks to "the widespread adoption of fracking and a slew of fresh shale discoveries... everybody from Australia to Mexico and now even Germany and Poland is tapping fresh sources of crude and gas."

True. Yet the mess in Iraq is just getting started. It's going to get a lot worse before it gets better.

The same goes for Libya, where oil production is a mere trickle at this point. I expect the energy sector to continue to outperform the general markets for the remainder of 2014.

How to Play It

The simplest way to play the energy markets is the Energy Select Sector SPDR Fund (NYSE: XLE). It seeks to provide returns that generally correspond to the yield and price performance of the Energy Select Sector Index.

The index is made up of oil, natural gas, petroleum products, energy equipment and energy services businesses.

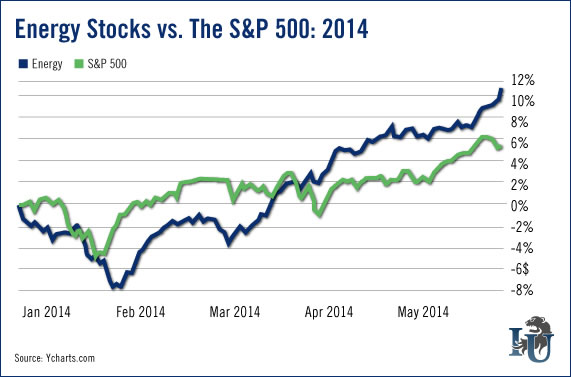

Take a look at the chart below.

Notice that this chart is very similar to the previous one. An investor who bought the S&P 500 would be up 4.75% year-to-date.

However, an investor who bought shares of the Energy Select Sector SPDR Fund would be sitting on gains of 11.2%. And we're only halfway through the year.

With Iraq's oil supply under threat, and Libyan oil output at a mere trickle, there's significant upward pressure on global crude prices. Neither of these problems will be solved in the near future.

That's bullish for oil prices and for U.S. oil producers.

What do you think? I'd like to hear your thoughts on this growing threat. Send in your comments to Mailbag@InvestmentU.com, or comment below. I promise I'll read every one.

Good investing,

Dave Fessler

Editor's Note: Even as America's fracking revolution has reduced our dependence on foreign oil, we still haven't entirely broken OPEC's grip. But that may soon change, thanks to a secret pact among six companies to alter forever how we drive. And when they succeed, they'll make their investors very, very wealthy. Read Dave's special report on it by clicking here.

Source: http://www.investmentu.com/article/detail/38242/energy-sector-nyse-xle-profit-from-iraq-turmoil

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.