Global Drag Threatens Worst U.S. Export Performance in Over 60 Years

Economics / US Economy Jun 20, 2014 - 10:48 AM GMTBy: F_F_Wiley

Ever since an über-strong U.S. dollar crushed the export sector in the mid-1980s, the U.S. economy hasn’t looked quite the same.

Ever since an über-strong U.S. dollar crushed the export sector in the mid-1980s, the U.S. economy hasn’t looked quite the same.

Exports picked up towards the end of the decade, helped along by the G-7’s historic 1985 powwow at New York’s Plaza Hotel, which led to a coordinated effort to slam back the dollar. Nonetheless, some export industries never fully recovered.

Fast forward to the present, and export performance may soon be as noteworthy as it was 30 years ago. Risks to the global economy (and exports) include turmoil in oil-producing nations, credit markets that are teetering in China and comatose in Europe, and the backside of Japan’s April sales tax hike.

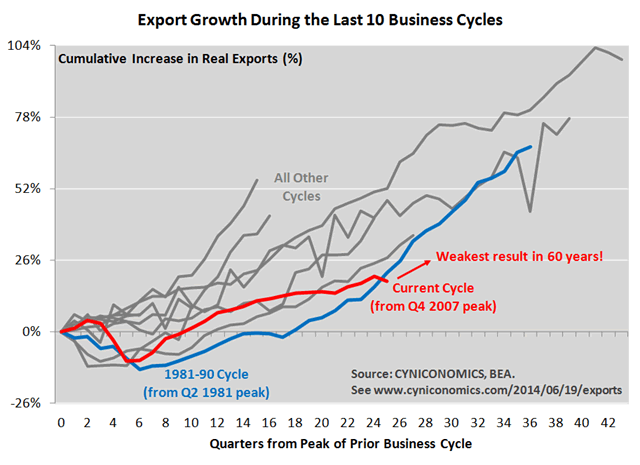

Worse still, export growth already lags behind every one of the past ten expansions, even the 1980s, thanks to a drop in the first quarter:

The chart shows that exports are no longer distinct from other parts of the economy (nearly all of them) that haven’t measured up to a “normal,” credit-infused, post-World War 2 business cycle.

Together with emerging global risks, it begs the question of whether sagging exports can drag the U.S. into recession.

We think it’s too early to make that call, especially while domestic lending continues to grow, credit standards remain relaxed, and most delinquency rates are falling. (For our research on links between lending and the business cycle, see “3 Underappreciated Indicators to Guide You through a Debt-Saturated Economy.”)

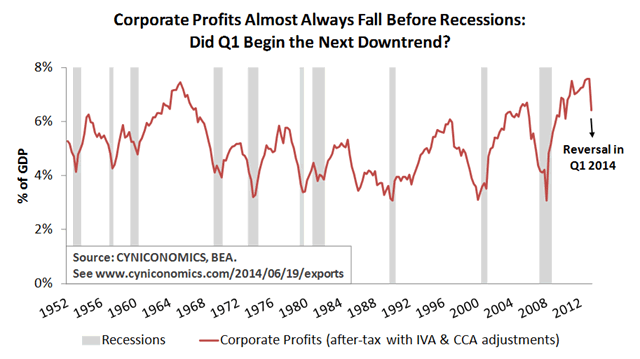

Nonetheless, export performance bears watching, and especially as the first quarter’s result mirrored a big drop in corporate profits. Falling export volumes surely contributed to the weak profits result.

Moreover, profits are an excellent leading indicator, as shown below:

Should exports and profits weaken further, that would cause us to reevaluate risks in both financial markets and the economy.

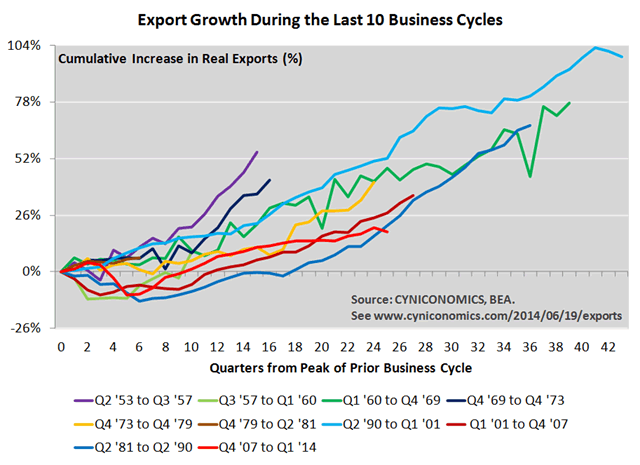

Extra chart (free)

Some readers may prefer this version of the export chart, with each cycle labeled:

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.