The Coming Crash Of the Financial And Monetary System

Stock-Markets / Financial Markets 2014 Jun 19, 2014 - 08:18 AM GMTBy: GoldSilverWorlds

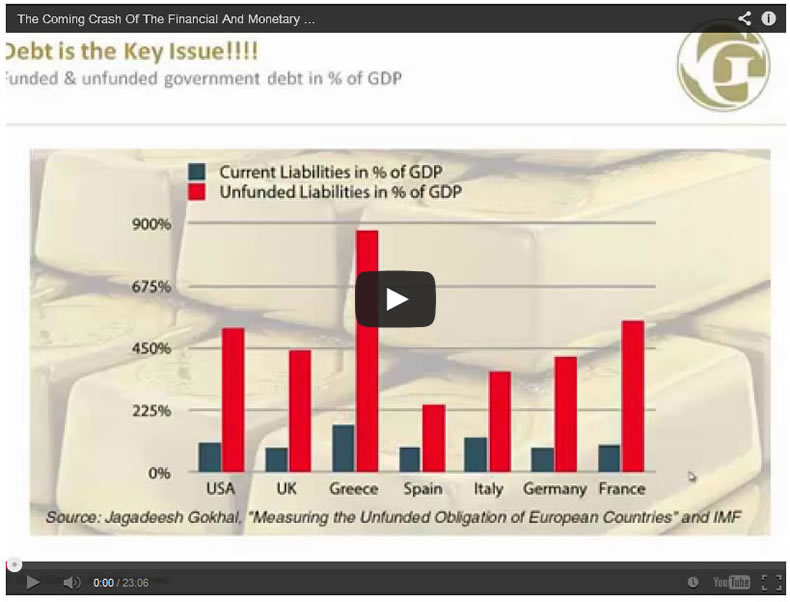

In an excellent video presentation, Claudio Grass, Managing Director at Global Gold Switzerland, explains why a crash of the financial and monetary system seems inevitable. The presentation covers all actual issues like currency wars, rigged markets, central bankers’ interventions, statistics manipulation, monetary mismanagement and financial repression. Claudio Grass does a great job “connecting these dots” but in a factual way. In this article, we collect several quotes and graphs. The full video presentation is 22 minutes long. Readers are highly recommended to watch the full presentation and subscribe to receive three exclusive reports for free on http://welcome.globalgold.ch.

In an excellent video presentation, Claudio Grass, Managing Director at Global Gold Switzerland, explains why a crash of the financial and monetary system seems inevitable. The presentation covers all actual issues like currency wars, rigged markets, central bankers’ interventions, statistics manipulation, monetary mismanagement and financial repression. Claudio Grass does a great job “connecting these dots” but in a factual way. In this article, we collect several quotes and graphs. The full video presentation is 22 minutes long. Readers are highly recommended to watch the full presentation and subscribe to receive three exclusive reports for free on http://welcome.globalgold.ch.

Claudio Grass explains that what we learn from history is that money doesn’t come into existence by force or legislation. It is in essence a market process; where participants decide freely which medium they want to use. It has to be easily recognizable and transportable. It has to be rare so it can’t be easily reproduced and so it can act as a store of value. Gold and silver fulfill these criteria, have an intrinsic value and are free of any counterparty risks. Therefore, it is clear why historically they were the most wide spread medium of exchange used over a time period of over 5000 years.

Even the USD became the world currency reserve because it used to be a property title for a certain amount of gold , now it is just a debt security. The Dollar as well as all other currencies worldwide have transformed from an “I-own-something” to an “I-owe-you”. Because we believe that history rhymes we are certain that the Dollar and all the other paper-money systems are going to collapse eventually.

The chart on the left hand side below comes from Ray Dalio from Bridgewater Associates. He believes that we are close to a collapse of the current long term debt cycle. He also believe that we are at the top of a long-term debt cycle, therefore it is likely that we will see some deflationary shocks in the future. However, it is our understanding that central banks will try everything to avoid this by printing money to cover up the current problems which will lead to hyperinflation in the coming years. A deflationary collapse would be a “Black Swan Event” which become more probable the more the system is centralized.

The chart on the right shows that the debt and the financial system have been completely decoupled from the real economy. It also shows that our current credit based paper monetary system induces excessive credit, which can be seen from the fact that credit has increased exponentially since the gold window was closed.

Debt cycles and debt vs the real economy

Despite the gigantic monetary injection, it appears that the “newly created money” is not going where it should flow. The following slide shows that liquidity is definitely not going into the private sector. As you can see the monetary base spiked tremendously since the outbreak of our current crisis. Only in Europe it is visible that since last year the monetary base is contracting on a relatively high level.

monetary base vs bank lending

The picture becomes worse when takes into account the interventions of central planners in the markets. In a recent Federal Reserve study it was acknowledged that the historic correlation between the balance sheet of the FED and the S&P 500 prior to the beginning of QE1 stood at 20%. Since 2009, this correlation has increased to 86%. The FED study argued that without the intervention by the central bank, the S&P 500 would be 50% lower. The chart on the left shows how our markets are rigged by the FED! If you exclude the days prior, during and after the FOMC meetings of the FED you see that the performance of the S&P would be considerably lower: 440% vs 170% without FOMC. The chart on the right shows that the velocity of money is sinking so we are not yet seeing any considerable inflation. However it is visible that money is flowing into financial assets, such as stocks, and is creating inflation there.

Central bank interventions on the stock market and velocity of money

Then there is the manipulation of economic and financial statistics to hide the true state of things. The unemployment figures are one of the striking cases. In the US, the U-3 unemployment rate is the monthly headline number. The U-6 unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest unemployment measure, including short-term discouraged and other marginally-attached workers as well as those forced to work part-time because they cannot find full-time employment. Shadow Stats calculated the unemployment rate using the old US methodology, these figures are nearly 4 times higher than the U3 figures. Data manipulation anyone? With an unemployment rate of nearly 25% I think it is clear that we are far from any form of recovery.

the unemployment rate and manipulation of statistics

The truth of the matter is that central bank intervention and manipulation is only “kicking the proverbial can down the road.” In reality, the stimulus is not producing real growth, which should not come as a surprise. The following slide shows the previous four recessions and recoveries from 1973 to 2001. The red line, on the other hand shows the current recovery. Although the FED has injected trillions of dollars worth of liquidity, unprecented in history, the real economy is still worse off than in every other recession before and it is not foreseeable that this is going to change any time soon.

In this regards we should not underestimate the creativity of governments. The US for example decide to change the calculation method for the GDP by July 2013. Research and development costs and costs for creating intangible assets such as movies, books etc. have since then be considered as “investments” and have been added to the value of the GDP. The effect of this adjustment is USD500 billion or an additional 3% growth annually than if one uses the old methodology. This new and “improved” calculation method will become the international standard and will brining “growth”to Europe as well starting in September thisyear.

real GDP in five recessions

Where does all this leave us? And what is the role of precious metals in this?

Bottom line, if you believe that there will be no aftermath to past excesses, that the FED and other central banks will be able to navigate a clean exit from unprecedented money creation, that the skyrocketing government debt will be paid off without diluting currencies, that politicians will implement real solutions that balance government budgets and force them to live within their means, that the debt ceiling is irrelevant, and that inflation won‘t surface whether or not global economies improve, then maybe holding precious metals isn‘t the right choice.

However, if you are not confident with the current direction of the financial and monetary system, then the prudent response is to prepare for the inevitable fallout from monetary disorder and have meaningful exposure to gold – physically, in the format of your choice and consequently stored outside the banking system under your direct and unencumbered ownership. Under these circumstances it will fulfill its role as your monetary insurance. Gold and Silver have a value in itself, they are a store of value with no counterparty-risk and they don’t even need a rating agency.

The following figures show that strong hands are buying gold, so they belong to the second group of people we just explained. A look behind the curtain proves that point:

gold demand shows that strong hands are buying gold

In closing, we want to refer to John Exter, an American economist and former central banker who devised an inverted pyramid of asset classes in terms of risk and market size. At the bottom of the inverted pyramid is gold – the asset class with the least amount of risk but also the least available according to Exter, in a low risk market, with positive inflation, money moves up the inversed pyramid away from gold and more towards derivatives and paper markets. Conversely, in a bust, people flee down the pyramid to their safe haven, being gold.

Watch the full video presentation

Watch the full video on youtube or embedded below.

Readers are highly recommended to watch the full presentation and subscribe to receive three exclusive reports for free on http://welcome.globalgold.ch.

Source - http://goldsilverworlds.com/economy/the-coming-crash-of-the-financial-and-monetary-system/

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.