Gold Summer Heat (?)

Commodities / Gold and Silver Stocks 2014 Jun 18, 2014 - 06:45 AM GMTBy: HRA_Advisory

From the HRA Journal: Issue 215:

From the HRA Journal: Issue 215:

Ok, it could be another head fake (there have been plenty) but the latest move in the gold stocks looks strong enough to be the real thing, even though its just begun.

If it is it will represent a very different outcome for the sector though the summer than most are expecting. Of course that is the thing about markets. They have a disconcerting habit of doing precisely what most traders don't expect.

A couple of HRA list companies that released economic studies have gotten good reactions that don't seem like one day wonders and a few companies that have released good drill results are also seeing traction that lasted. That is a better outcome than anyone was seeing a month or two ago. Nothing convinces management teams its time to get into the field again like seeing another company clocking big gains on exploration results. The more of that we see the tougher it will be for companies to blame the weak market for their decision to hang back.

Of course, the above comments apply to companies that actually have money to spend. Most don't but the list of companies at least moderately cashed up has been growing. Companies are still hesitant but that can change overnight if a few more companies get good receptions to discovery news.

Eric Coffin

A couple of the markets we follow closely appear to have resolved their former range bound states. Both did it in the direction I most expected, unfortunately for the gold market. Don't despair though. Notwithstanding a mountain of negative sentiment (I think because of it) gold soon found a bottom and is moving up again. I think we are overdue for the juniors to break out of their torpor and could have a much better summer than most expect. Let's deal with the large markets first though.

The S&P broke out of its range in late May and got to 1950 before backing off in the past few sessions. Most of the readings out of the US have been positive, though I would classify most as only moderately positive.

Revisions have largely been negative but no one pays attention to them. There would be a lot less "surprises" when major data points were released if traders checked revisions too but don't hold your breath waiting for that sort of patience.

Traders were pleased by the latest monthly payroll report though the job gain was slightly larger but hardly the big bounce back maybe expected when winter ended. The weather excuse is getting a little old.

I'm not bearish on the US economy but there will have to be substantial acceleration later in the year if we're going to see a 3% print for 2104 GDP growth. The numbers the US is putting up are decent but not good enough to generate that sort of growth rate by year end with Q1 growth coming in at -1.0%.

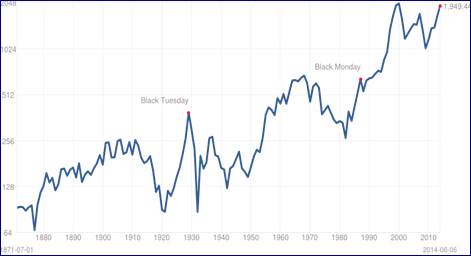

If you want some real long term perspective on the US market you can find it on the chart below. This 134 (and counting) year chart shows the price level of the S&P in real (inflation adjusted) terms using constant 2014 dollars.

It's a handy reference point and widely beloved by perma-bears. Because it uses inflation adjusted pricing the "real" S&P peak is in 2000, not last week, though you can see it's not far off even in inflation adjusted terms. The real S&P all time high is 2038, about 5% above current levels.

Do we get to 2038? 5% isn't much in a market with tons of liquidity sloshing about but 2000 will be a big psychological hurdle for traders. It may take a few attempts to clear it, if it even does. Getting through it would be bullish enough that it might carry the index to a record. I'm agnostic on the subject of whether we're in a secular bull or bear market. I think it's a new bull market. More to the point, when a market has a near 200% rally like the S&P has I don't see the sense in sitting it out because it might be a "bear market rally".

A new high in inflation adjusted terms is the last line in the sand for many permabears. It will be interesting to see if any in the secular bear camp change their tune if the S&P does breach 2038. I suspect they will come up with a new reason to maintain this isn't a "real" bull market.

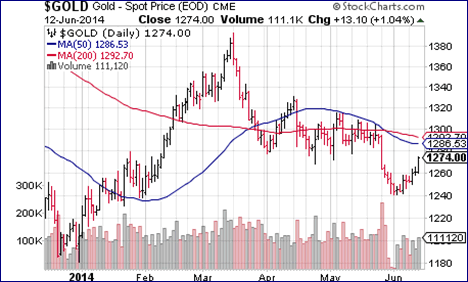

Alas, the picture was less bullish in the gold market. Gold did break out of its narrowing channel and, as I feared, the break was to the downside.

The cause for the drop from the $1280s to the $1240s was comments by ECB head Mario Draghi that he was really, really going to get serious about stimulating the European economy. I noted in a couple of Special Deliveries sent after those comments that I was skeptical he would bring out the big guns.

Draghi did make good on his promise to cut interest rates--a little--going so far as to take the deposit rate for banks that hold funds with the ECB into negative territory. That was an expected move but the "Euro QE" that traders were hoping for never arrived.

Draghi promised more in his post rate decision news conference. That helped gold bounce off its lows and reversed the drop in the Euro. That surely wasn't intended. Getting the Euro to drop would be one of the main goals of a QE program in Europe. The difficulty is that the bond markets in Europe aren't that integrated so Draghi would have to decide which bonds (issued by which government) would be favored with large scale ECB purchases. That brings way more politics into play.

For that reason as much as anything I remain a skeptic when it comes to Euro QE. Europe has the biggest deflation risk by far but I'll believe in QE there when I see it and not before.

Gold has reacted well to more recent data. We are entering the slowest period of the year for physical demand. We could see lower prices still before a bottom in the summer but there are reasons to be optimistic a new floor is in.

One reason is India. Now that Modi has won the election it's widely expected that import restrictions on gold will be relaxed. There was a cosmetic change but nothing like the wholesale cuts in import duties and scrapping of the 80:20 rule for jewelers gold bulls are hoping for.

There are many who believe changes will come when Modi brings down his first budget which is expected this month. The current duty regime means that gold trades at a large premium in India. Those premiums have dropped from $139/oz to about $30 since the election. Clearly there are a lot of market participants that expect a much less constrained market in India.

That's the good news. The bad news is that buying volumes will be light unless and until those changes happen.

If you think the government is going to loosen up the gold market in the near term you would not be buying now. You'll wait until the changes are in place and the price of bullion goes back down to something closer to the world price. India could provide badly needed buying volume but it won't happen until there are actual changes in the laws. That might come with the next budget. If it does we could see the traditional fall rally in gold starting a couple of months early.

Geopolitics, this time Iraq, is being blamed for the latest move up in gold. I'm not sold on that. There has been trouble brewing in Iraq for a long time and commentators always fall back on politics when they have a move in the gold price they can't explain.

The other potential short term support which I think is more relevant is the bearishness of western traders. Virtually all recent commentary on the gold market was negative. Everyone expects the gold price to revisit $1100 and many traders positioned themselves for exactly that.

Traders made large additions to the speculative short position in gold recently and huge additions to the shorts for silver. This set up was similar, though less extreme, than the prevailing situation late last year. Whenever a market gets as one sided as gold was a few days ago things tend to start swinging the other way. The market simply runs out of sellers.

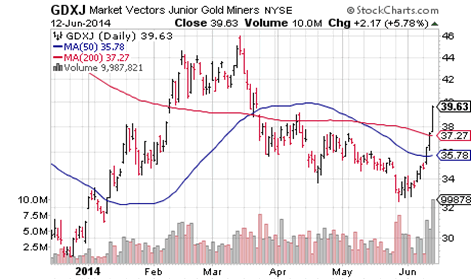

One highly encouraging aspect to the current situation is the behavior of gold equities when compared to the gold price. The GDXJ chart above is highly instructive.

When gold dropped to the $1240s in late May this index dropped too, but it found a floor very quickly. As soon as gold found a bottom the GDXJ started moving higher and moving much more strongly than bullion itself. As this is written gold is only back to the $1270s but the GDXJ is trading at levels not seen since gold was at $1320. The move has been similar but less pronounced in the GDX index which tracks the larger gold miners.

The GDXJ chart is close to parabolic so we may see it settle back but I am highly encouraged by the strong volumes. That looks a lot more like some long overdue sector rotation that short term panic buying. Some serious money moved in the direction of the gold sector, at least in ETF land.

I've noted many times that volume is critical when things are turning and that when there is a real move in the PM sector the stocks often see the stronger move first. I find it interesting that the junior ETF is moving more strongly than the senior one. Traders usually expect the big stocks to get the first move and position accordingly.

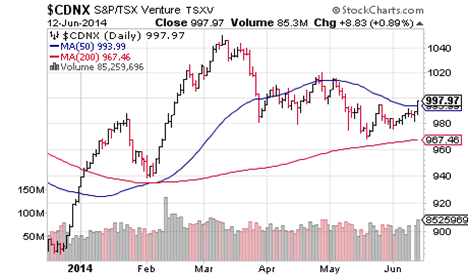

Unlike the GDXJ, the Venture Exchange has held its trading range so far. It too is seeing better volumes though and it also didn't fall back as much as many expected. That is a good sign going into the summer doldrums.

I'm still sticking with my prediction of a 30% gain this year for the Venture, though we need a continued gold rally to make that happen. News flows have started to increase and that is the necessary first step.

Like the gold market, everyone expects the Venture to have a weak summer. Just about everyone expects a moderate to strong rally in the fall now. Traders with that belief will want to position themselves ahead of a rally. That speaks to a better move up starting before the fall. If gold can manage to advance a bit farther we may, in fact, be seeing the very early stages of that move now. A bit of summer heat for this beleaguered sector is long overdue.

Best analysis of junior mining sector you'll see today - Eric Coffin from HRA Advisories chats with Vanessa Collette about the state of today's junior resource market and what investors need to be paying attention to. An absolute must-see for serious investors in this space.

To view Eric Coffin's recent video interview at the Canvest Vancouver Conference, please click here

By Eric Coffin

http://www.hraadvisory.com

Eric Coffin, editor of HRA Advisories, recently sat down with President and CEO of Colorado Resources, Adam Travis, to discuss more about the company, its recent successes and why investors should stay tuned to this story. Click here to download Eric’s interview with Colorado Resources now!

We think there will be more discovery winners but it's still a "show me" market. HRA understands that which is why we are offering you a chance to try out HRA for three months for only $10.00!

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com

©2014 Stockwork Consulting Ltd. All Rights Reserved.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.