Tense Days Ahead for Bitcoin Price

Currencies / Bitcoin Jun 18, 2014 - 06:33 AM GMTBy: Mike_McAra

Briefly: we don't support any short-term positions in the Bitcoin market at this time.

Briefly: we don't support any short-term positions in the Bitcoin market at this time.

Yesterday, we wrote about the worrying aspects of the fact that GHash.IO, a Bitcoin mining pool, had temporarily reached 51% of mining power, a phenomenon which could have potentially disastrous consequences, including the possibility to double-spend coins and reverse transactions.

The Bitcoin community has been cagey about GHash.IO's rise above the 51% mark, which is understandable given the kind of reputational damage double-spending could inflict on Bitcoin. GHash.IO reached 51% of mining power and stayed above this level on Jun. 12, going down to around 31% today (estimate based on Blockchain data). The company, however, didn't respond to the fears of the community until yesterday.

In a statement addressed to Ars Technica, GHash.IO wrote:

Rapid growth of GHash.IO mining pool, seen over the past few months, has been driven by our determination to offer innovative solutions within the Bitcoin ecosystem combined with signi?cant investment in resource. Our investment, participation and highly motivated staff con?rm it is our intention to help protect and grow the broad acceptance of Bitcoin and categorically in no way harm or damage it. We never have and never will participate in any 51% attack or double spend against Bitcoin. Still, we are against temporary solutions, which could repel a 51% threat.

(...)

We also recognise however that a long term preventative solution to the threat of a 51% attack does have to be found, the current situation we ?nd ourselves in (essentially being punished for our success) is damaging not only to us, but to the growth and acceptance of Bitcoin long term, which is something we are all striving for.

To that effect we are in the process of arranging contact to the leading mining pools and Bitcoin Foundation to propose a 'round table' meeting of the key players with the aim of discussing and negotiating collectively ways to address the decentralisation of mining as an industry.

The statement doesn't do much in a way of alleviating the fears of another move to 51%. GHash.IO is not inclined to limit its mining pool. This means that the threat of centralization is still here in the short term. On the other hand, the intent to set up a "round table" is indicative of a possibility of a long-term solution.

The key takeaway here is that no short-term solution has been implemented. There is a possibility of a long-term fix but this might still be months away. Because of that, it is still best to closely monitor the centralization of mining power and be particularly cautious when any mining pool gets above 40%.

For now, let's take a look at the charts.

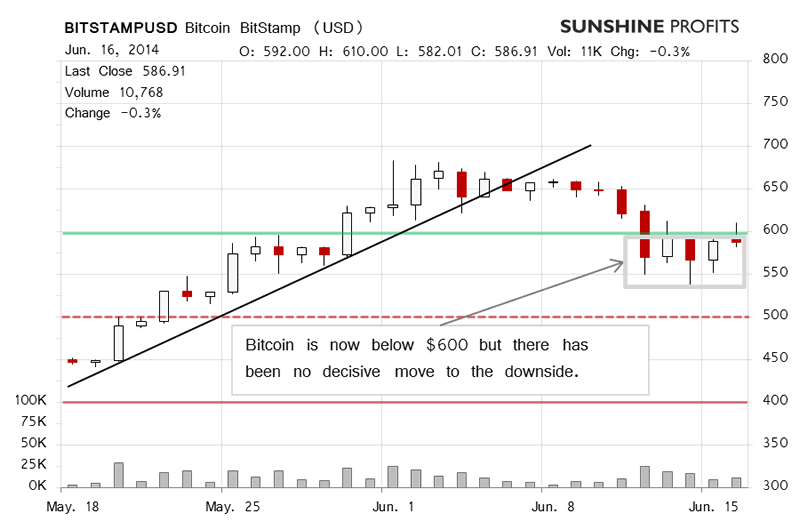

Yesterday, we saw Bitcoin go down on BitStamp by 0.3%. The volume was higher than on the day before yesterday. All in all, a move up was invalidated and Bitcoin closed below $600 (solid green line on the chart above). This smacked of possible bearish implications.

Today, however, Bitcoin has been on the rise (this is written before 10:45 a.m. EDT), 1.9%. If the move itself looks convincing, the volume on which the move has taken place does not. The currency is still below $600. All of this is more bearish than not.

Currently, it seems we're seeing a stop or pause in the recent move down. The current period seems to be particularly important - a move above $600 could be indicative of a continuation of the rally. On the other hand, if we see a move down away from $600 might be a beginning of more declines.

Our best bet now is that we'll see a rebound and a move above $600. This could be a buying opportunity.

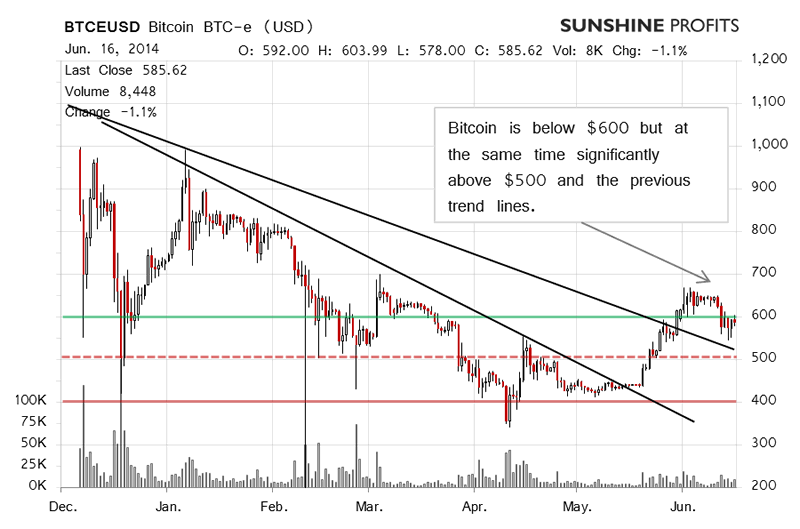

On the long-term BTC-e chart, we're seeing a situation that has dual traits. Firstly, we're still below $600 and the current price moves suggest that the depreciation might not be all over and a move to around $500 could still be possible.

Secondly, however, we look at the long-term trend and still see a significant breakout. The recent depreciation hasn't even reached the higher of the two trend lines visible on the above chart, let alone the 50% mark of the recent rally. As such, even though the short-term trend is down and more depreciation might be just around the corner, the situation is tense enough not to suggest going short at this time. This is primarily because of the possibility of a strong move above $600 such move could mark the beginning of another strong rally, possibly to $700 or even higher.

If you recall what we wrote yesterday:

Based on the action over the weekend and what we've seen today the depreciation scenario seems all the more possible. Once this depreciation is over, we might see another rally in the market.

This is still up to date and we keep monitoring the market for signs of strength or weakness.

Summing up, in our opinion the current situation is tense and no short-term positions should be held at this moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.