Europe Stock Markets Potential Turbulance Ahead

Stock-Markets / European Stock Markets Jun 16, 2014 - 06:56 PM GMTBy: Tony_Caldaro

Using OEW we have been tracking 8 of Europe’s most important stock market indices: England, France, Germany, Greece, Italy, Spain, Switzerland, and the hybrid STOX 50. In general, since the 2011 low in most indices, and the 2012 low in some other European indices, all of these stock markets have been rising. Over the past year, however, we have been noticing some fairly negative, and potentially completing, long term patterns unfolding.

Using OEW we have been tracking 8 of Europe’s most important stock market indices: England, France, Germany, Greece, Italy, Spain, Switzerland, and the hybrid STOX 50. In general, since the 2011 low in most indices, and the 2012 low in some other European indices, all of these stock markets have been rising. Over the past year, however, we have been noticing some fairly negative, and potentially completing, long term patterns unfolding.

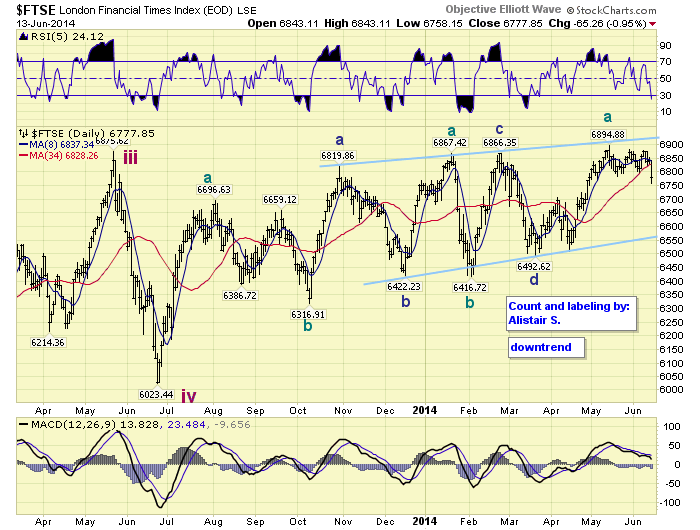

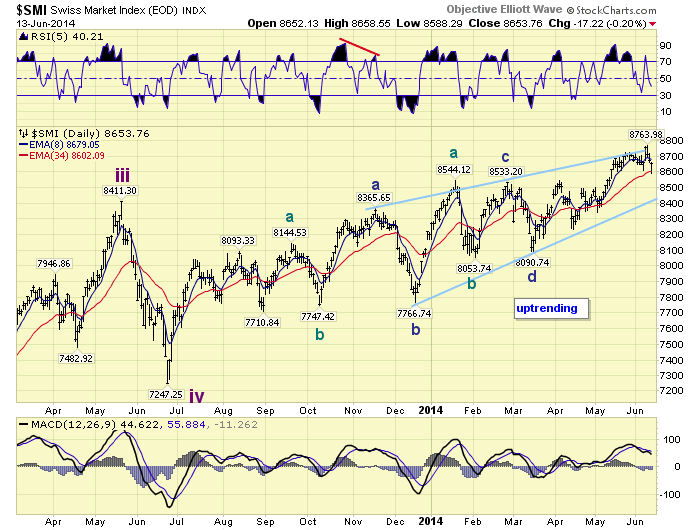

England and Switzerland, in particular, have had very choppy patterns since their highs in May 2013.

In fact, the wave activity since their June 2013 low looks like a large fifth wave diagonal triangle.

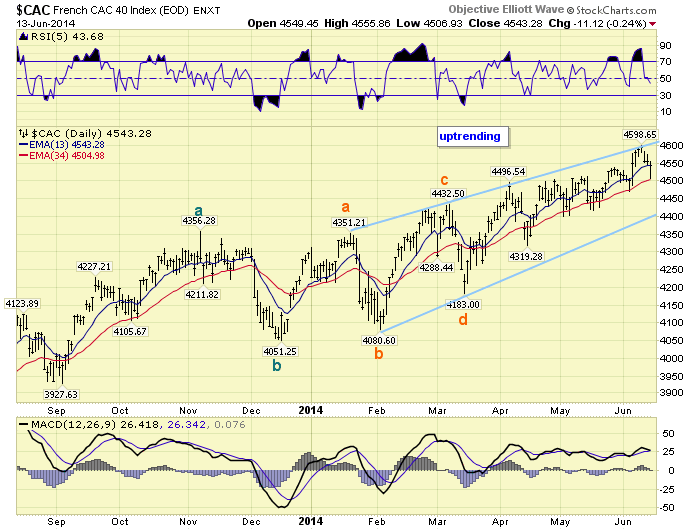

While France has risen more than England and Switzerland in percentage terms, its 2014 rise also looks like a diagonal triangle.

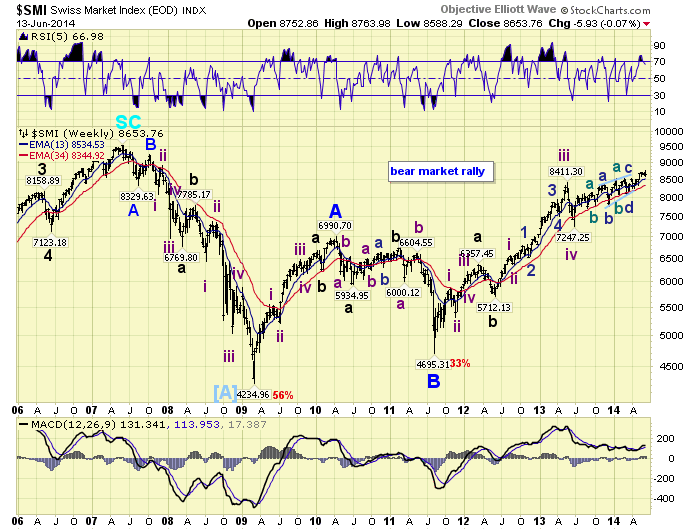

To put these daily charts into perspective, we offer the cleanest long term wave pattern of the three: Switzerland. This long term pattern suggests the rise from 2011 has been a Primary C wave, of an ABC pattern from the 2009 low. This pattern, as well as many other foreign indices, look nothing like what has been occurring in the US. When these diagonals complete, these three indices should have their largest corrections since 2011. The charts of Germany, Italy and Spain support this potential scenario.

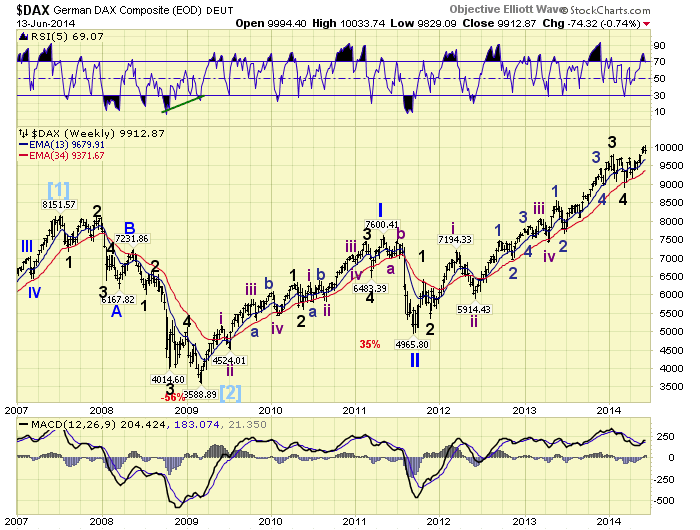

Germany has been rising in a five wave pattern since 2011. This is quite similar to the five wave pattern, over the same period, in the US. Recently it has been in a Major 5 uptrend since March. When it concludes it is likely ending Primary wave III.

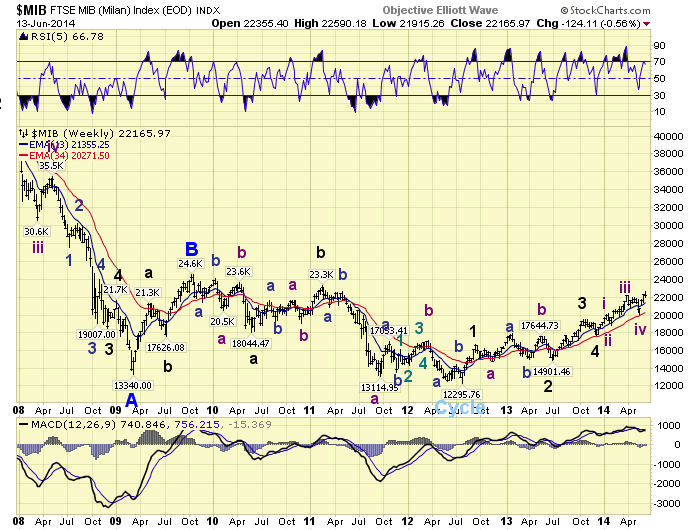

Italy and Spain have been in similar bull markets since 2012. Italy appears to be in its last uptrend from that low.

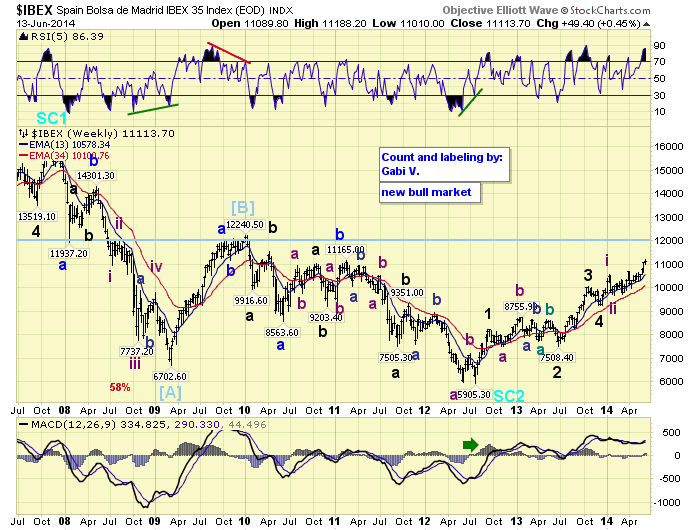

Spain appears to require one more downtrend, followed by another uptrend to complete its five wave pattern.

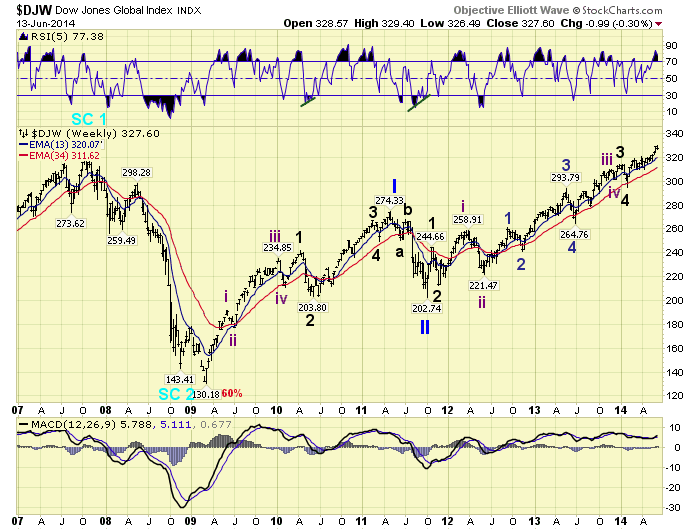

When we review the Primary III pattern in the DJ World index, it look quite similar to Germany. Its Major wave 5 is not subdividing either. It skipped the US downtrend in April, just like Germany. Therefore, when this uptrend ends it should also end Primary wave III.

Overall we observe that Europe is aligning for a significant market decline in the second half of 2014. This appears to fit with our projected Primary wave III top, in the US markets by Q3/Q4 2014.

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.