This Week Ahead Should Be a Major Test For Gold

Commodities / Gold and Silver 2014 Jun 15, 2014 - 06:01 PM GMTBy: Simit_Patel

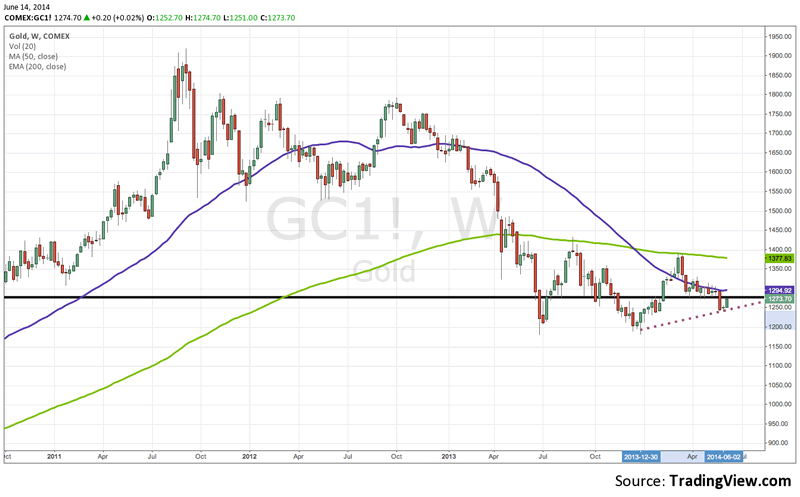

Gold seems to have found support at 1240, where we saw accumulation form, and has been rallying since. Gold closed the week forming a morning star pattern off the bottom trendline of an ascending triangle. It faces imminent resistance at 1280 -- the top resistance line of the aforementioned triangle -- and the 50 SMA just above that.

Technically, the stage is set for the next big battle between the bears and bulls in gold. $1280 remains the key level to watch for XAU/USD. I initially thought that bears would be pretty decisive in defending resistance at 1280, but the technicals going into next week leave me unsure in the near term. Of course, I remain bullish in the long-run and am buying between 1180 and 1280, and will likely continue to buy a bit more should we rally beyond 1280.

What do you think?

By Simit Patel

http://www.informedtrades.com

InformedTrades is an online community dedicated to helping individuals learn to trade the world's financial markets. Members earn prizes for sharing their knowledge, and the best contributions are compiled into InformedTrades University, the largest collection of free organized

learning material for traders on the web.

© 2013 Copyright Simit Patel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.