Silver to Gold Ratio as a Timing Indicator

Commodities / Gold and Silver 2014 Jun 15, 2014 - 03:00 PM GMTBy: DeviantInvestor

We all know the silver to gold ratio is important.

We all know the silver to gold ratio is important.

• The ratio is low at silver lows, and high at silver highs, because silver both rallies faster and falls deeper than gold.

• The ratio has been erratic over the past 40+ years but the highs and lows approximately mark turning points in the silver and gold markets.

• For more detail, read another article I wrote: Silver to Gold Ratio: 27 Years of Data.

TIMING:

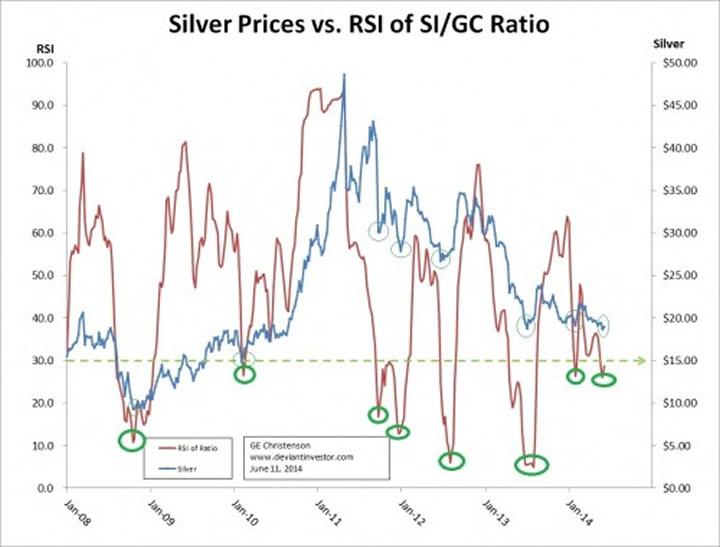

1. Take the weekly silver to gold ratio.

2. Plot the 21 week Relative Strength Index (RSI) of the ratio. This index is normalized from a low of zero to a high of 100.

3. Examine the lows in the RSI of the ratio – all lows below 30.

4. Compare to lows in the price of silver.

CONCLUSIONS:

• Since 2008 the RSI of the ratio has made 7 important lows below 30 that were also matched with a decent bottom in the silver price. There was also a quickly reversed bottom in the RSI in May of 2013 but silver prices were still falling and showed no sign of a bottom until early July.

• The RSI of the ratio made another low under 30 on May 30, 2014 and turned higher on June 6, 2013. Silver prices look like they have also turned up. This is the 8th such low since 2008.

• The RSI of the ratio is quite good at picking lows in the weekly silver prices. Now looks like a low in silver.

• The RSI of the ratio is NOT good at indicating how big the rally will be. Example: Will silver rally from below $15 to $48 as it did starting in February 2010 or from $18 to $24 as it did starting in June 2013?

• The RSI of the ratio is NOT good at picking tops. Please use it only for picking bottoms in the silver market.

Will silver rally this time for #8 of 8? I don’t know but silver has been beaten down for over 3 years, the S&P has rallied for over 5 years, and both markets seem tired and ready to reverse.

Richard Russell has seen it all in his 90 years. This is what he thinks about silver.

I would much rather be long silver than long the S&P at this time. Stacking physical silver makes a great deal of sense!

GE Christenson aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.