Sell in May - Stock Market Seasonal Trading Myth Busters

Stock-Markets / Seasonal Trends Jun 14, 2014 - 04:49 PM GMTBy: Investment_U

Whatever happened to the old seasonality adage “Sell in May, go away”?

That’s what some seasonal investors do, with the idea that the summer months tend to be weak for the stock market.

But from May 1 to June 9, 2014, the S&P 500 actually charged 3.6% higher, reaching a new all-time high.

Market timing, foiled once again!

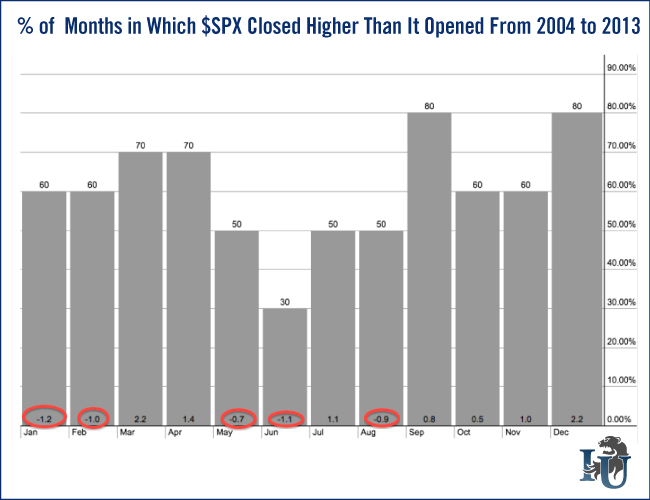

With the S&P 500 recently bucking the seasonal trend, I decided to check out the index’s average monthly performance over the last 10 years. It looks like we currently find ourselves in what’s typically the biggest stinker in terms of frequency of gains - the month of June.

The chart above shows June being an up month in only three out of the last 10 years, with an average performance of negative 1.1%.

Here are a few other discoveries that might surprise you...

January, which has a reputation for being one of the strongest months, has been the No.1 percentage loser, down an average of 1.2% (although up six out of 10 years).

October, which has a reputation for being the dreaded month when crashes or major corrections tend to occur, doesn’t seem to be that bad after all.

Even with October 2008 included in the calculation, October has an average gain of 0.5% (above the average of 3.58% across all 12 months).

In fact, October was an up month in six of the 10 years (which is the average, across all 12 months).

Conclusion

As Emerging Trends Trader Editor Matt Carr teaches in his seasonal investing course, Prime Profit Secrets, it pays to focus on seasonal studies of more recent stock market cycles.

The recent seasonal trends show June as being a tough month. The first six months have shown an average performance of negative 0.4%!

But the next six months have shown an average of 4.7%, with five out of six months being profitable.

If recent history is any indication of the rest of the year, a June dip just might present a good buying opportunity.

Source: http://www.investmentu.com/article/detail/38101/seasonal-trading-myth-busters

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.