American Empire on FIRE! SOVEREIGN credit market action Simply UNBELIEVABLE

Stock-Markets / Financial Markets 2014 Jun 13, 2014 - 10:20 PM GMTBy: Ty_Andros

This week’s news certainly WASN’T BORING. Big events and small add up to unfolding CHAOS around the WORLD.

This week’s news certainly WASN’T BORING. Big events and small add up to unfolding CHAOS around the WORLD.

It is clear that US FOREIGN POLICY and unfolding military weakness is creating a vacuum that is quickly degenerating into what could be the beginnings of World War III. The biggest victim will most certainly be the US DOLLAR. Dennis Gartman repeatedly emphasizes the World’s Reserve currency also must be the dominant MILITARY power. HE IS CORRECT. They have gone hand in hand in EMPIRES throughout history. Now the administration in Washington is on RECORD saying we will no longer be the dominant military power. They have demonstrated this repeatedly over the last 6 years. Egypt, Syria, Libya, Iraq, Afghanistan, the Taliban prisoner swap, Ukraine, and the South China Sea are abject surrenders to belligerents in one form or another. Now that these patterns are firmly established, escalation by all can be EXPECTED. The administration is openly committed to downsizing the military and removing the ability to fight on two fronts around the world. No American allies can reliably expect the US to honor defense treaties. They are now written on DISAPPEARING INK! Some realize it and some are WAKING UP rapidly.

BARELY covered in the Main stream media the news out of IRAQ is of MASSIVE CIVIL WAR. Al Qaeda has captured the two largest cities after Baghdad. The Kurds have taken Kirkuk and armies are marching on Baghdad (just 80 miles away) as I write this. Previously captured territories have handed insurgents many oil fields and billions of dollars from captured banks. Bottom line is that this country is breaking apart along sectarian lines into pieces: Sunni, Shite and the Kurds.

Regional conflicts are spreading like WILDFIRE. Iraq has broken up. The idea that the central government in Baghdad will reunite the country and restore order is now just a pipe dream. Oil is spiking outside recent trading ranges as we speak; Iraq is responsible for over 10% of the oil OPEC supplies to the market. This production will go the way of the dodo bird just as oil production in Libya has done. What price will oil have to go to ration demand by this amount? Only God knows. Go fill up your GAS tanks today. This is GOOD NEWS for Vladimir PUTIN and RUSSIA!

The President ABANDONED IRAQ early in his administration and now all the US spent in BLOOD and treasure is GONE. The same fate awaits the US in Afghanistan. The very idea that the US has returned the most bloodthirsty and ruthless commanders of the Taliban to the battlefields in exchange for a DESERTER foretell hundreds if not thousands of deaths and casualties in the near future. Americans are now targets for kidnapping as a result of this insanity. He said it was because we leave NO MAN BEHIND. To that I say what about Benghazi? New information from a retired commander reveals troops were on alert in Germany, with transport at hand, 3 hours away and where told to STAND DOWN.

The president has conducted the foreign and military affairs of the US in a political rather than practical manner since his inauguration, and PREDICTABLY the world is descending into CHAOS as a result. If you think China or Russia is going to retreat you should reconsider. These challenges are set to continue. You can predictably expect the president to retreat from them all. As continued US military weakness unfolds you can expect the dollar to go right along with it. THIS IS BIG NEWS; tattoo it to your brain.

Out on a LIMB

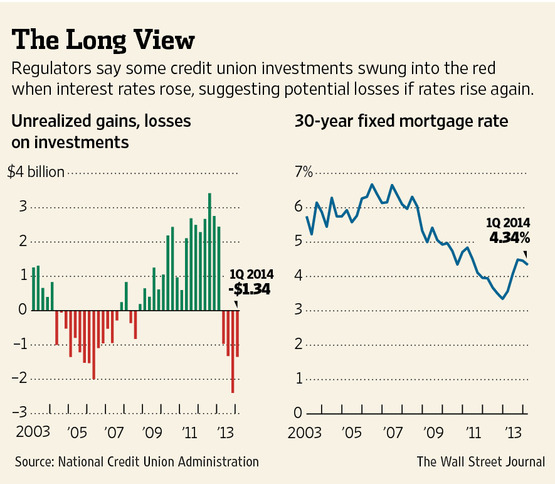

As new peaks in leverage accumulate, the firms in the line of fire when the leverage FAILS rises. The Credit Union industry is becoming EXTREMELY vulnerable as long term assets most vulnerable to CAPITAL losses are at dangerous highs of 36% of assets an all-time high.

Just another reason that I don’t believe interest rates will ever be allowed to rise appreciably. The solvency of the financial system would be challenged, and the Federal Reserve has been very vocal in its commitment to the stability of the financial system which is operating in insolvency if properly measured. Any back up in financial asset valuations would blow it up.

Everybody is talking and anticipating higher rates but, I ask you, from where is the income to pay the coupons going to come? There is over $12 trillion dollars in M1 in one form or another. The on the books liabilities of the US government top $17 trillion dollars. Combined it is $29 trillion (29 million million). A 2% overnight rate would require additional payouts of $580 billion a year. There is no income available to pay these yields.

Is rising indebtedness a sign of economic strength?

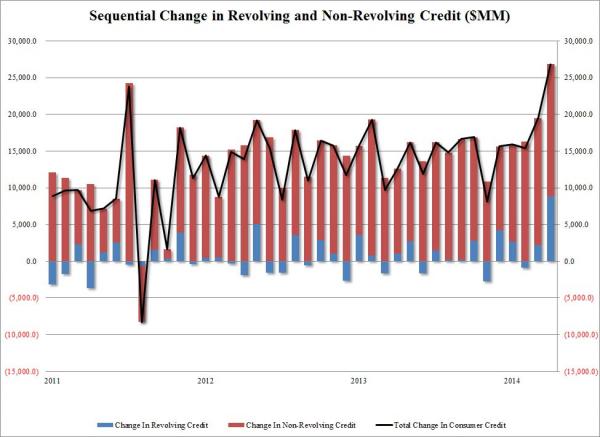

Last week we learned that consumer borrowing leapt higher in the last two months. It was reported as GOOD NEWS. Do you really believe it is good news when consumers borrow money for student loans and cars they cannot afford? For whom is it good news?... Overpriced and underperforming universities and auto dealers. 20 to 30% of all auto loans are subprime and virtually NO underwriting is done for student loans which have leapt higher. (Chart courtesy of www.zerohedge.com)

This is not good news, but will be reflected as exploding GDP. To the main stream media and government in a debt slave society, the further we go into debt the better the news. IT FEEDS THE ILLUSION of GROWTH. All growth today is debt in disguise. My good friend Gordon T. Long gave me a story of a friend of his whose son was buying a car. Thinking that he would have to cosign for the lending, the father accompanied his son (a student) who had picked out a $32,000 dollar vehicle. Upon entering the manager’s office the young man was asked to present his driver’s license and social security number. A few minutes later he was approved and signing the papers without any cosignatories or parental guarantees.

Although car sales are booming very little is mentioned that 20 to 30% of all car sales are to sub-prime borrowers. And, in this case, very little qualifications for purchase. Apparently, underwriting has gone the way of the dodo bird. This will be a debacle as the rise in car sales has driven a rise in sub-prime borrowing and leasing. CREATING Asset backed securities for those reaching for yield.

Shades of 2003 to 2007 housing markets. Imprudence is celebrated while living within ones means is not to be encouraged.

Bond YIELDS continue to collapse

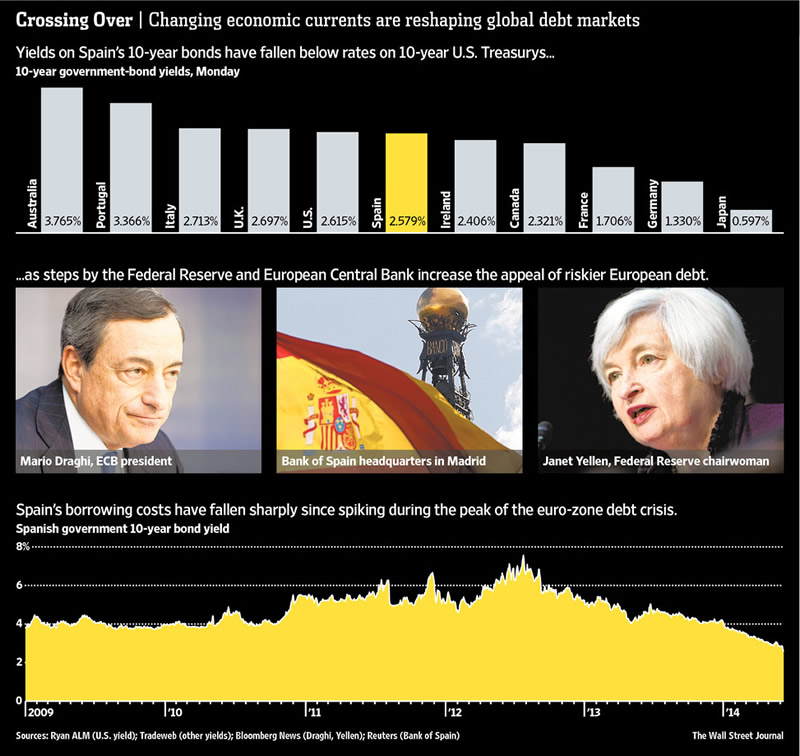

The reach for yield knows no limits as spreads continue to collapse while REAL economic growth continues to collapse. Spain’s 10 year note just dropped 2 basis points below US treasuries.

Don’t miss this video from this morning’s squawk box with Mark Grant outlining why interest rates have only one way to go: Down. I am in complete agreement. Fire hoses of hot money battling for yield. Insanity is afoot. http://video.cnbc.com/gallery/?video=3000282612 .

George Orwell in Action

President Christina Kirchner Creates a Secretary of National Thought for Argentina:

Belén Marty writing at panamapost.com, June 9:

On Tuesday [June 3], President of Argentina Cristina Kirchner appointed the philosopher and ruling-party supporter Ricardo Forster as head of the Secretariat for Strategic Coordination of National Thought, an entity that will fall under the purview of the recently created Ministry of Culture. . . . Forster, who holds a Ph.D. in philosophy, is one of the founders of Carta Abierta, a loose group of intellectuals from different disciplines who support the Kirchner's administration policies. Before being appointed National Thought Secretary, he ran for a national deputy seat as a Front for Victory (FPV) party candidate. . . .

In 2011, Forster had expressed his discontent with the designation of 2010 Nobel Prize winner Mario Vargas Llosa as Buenos Aires' book fair commencement speaker. "The Book Fair needs a plural, democratic voice, and Vargas Llosa today represents a huge provocation from the free-market right-wing, having uttered harsh criticisms about Argentina," Forster said at the time.

Isn’t this right out of George Orwell? Socialists and Marxists impoverishing and controlling every aspect of life they can GRASP including your thoughts. Argentina is just a short step behind Venezuela in this process of Socialist/Marxist societal destruction and totalitarianism.

Showdown looming at the OK corral!

As elites gather to Harpsund, Sweden to DECIDE who the next EU president, a firestorm is brewing as the CONSUMATE Socialist insider Jean-Claude Juncker ANNOINTMENT is being challenged by our friends in the UK. David Cameron can read the numbers and the UKIP shot across the bow has stiffened his spine in resisting the irresistible force of elites driving the process of gathering power to the central government in Brussels. Juncker is their inside guy. A true soldier for the socialists and would be totalitarians they aspire to be.

The Harpsund agreement is the blueprint for the next 5 years, the consummate BACK ROOM DEALS crafted WITHOUT regard to others whom have been newly elected. These people are the group working for centralized control and against freedom and competition. The whole idea behind the EU is socialist/Marxist/fascist control of the continent in all respects. But, most importantly, in charge of the money and economies (allocating demand) with the elites behind it as beneficiaries. It has been this way for decades, but now they smell the end zone and nothing will stop them, not even their constituents.

Britain is resisting this and they should, as to acquiesce to this villainy is to be assigned a back seat at the table. France looks to Brussels to redistribute finance from London to Paris. In socialist countries, demand is distributed to favored groups. It does not flow to those who serve their customers in the best manner. The ones who serve customers the best are what else: REGULATED OUT OF BUSINESS!

Incentives to produce were extinguished throughout the continent decades ago. It is why Europe cannot grow, produces few if any tech companies such as Google, Facebook, WhatsApp, Uber, etc. Entrepreneurs are mostly extinct on the continent, and under direct assault in the US where private industry is NO LONGER TRUSTED by the big government progressives inside Washington DC (District of Corruption), Brussels and European capitals. Anyone who knows Europe knows the impossible barriers put up to new businesses and interference with the employer/employee relationships so that virtually no hiring and firing can take place. Euro sclerosis is now becoming America sclerosis.

In socialist countries which do not respect markets and capitalism, the only way to success is to export your own poor policies onto that of your competitors. Placing the same hobbles plus a little bit more onto them. Brexit is but a matter of time as Brussels redistribution of financial business from the city to the continent will be relentlessly pursued by the morally and fiscally bankrupt European commission. Sooner or later the UKIP will take control in an act of sovereign SELF PRESERVATION!

Simply UNBELIEVABLE SOVEREIGN credit market action

Globally the carry trade is combining with HOT money, and the global panic for yields is sending RISKY sovereign debt to insanely low levels. “The ECB's easy money continues to lift up the euro-zone bond market” "People are desperate for yields in a low-yield world." - Robin Marshall, Smith and Williamson investment management

Take a look at this shocking turn of events:

The Verifiably insolvent countries of Japan, Spain, Ireland and France trading BELOW US 10 year rates. Certificates of confiscation. Based on these metrics EUROPE’S future is less RISKY than the US. IT COULD BE TRUE! Germany’s low rates I can understand as it is verifiably the most fiscally prudent country in the developed world as well as being the capitalist powerhouse of prudence in the EU. Its small and medium size enterprises are well tended by its leaders, creating the conditions and incentives for small business to thrive. Germany truly understands business and growth come from the private sectors and incentives of individuals.

Reforms to these countries regulations and taxes HAVE NOT and will not occur with rates at these levels and the urgency to do so is nonexistent at this point. Just another nail in the coffin of the EU.

PHANTOM GDP

It does not matter where you look, public servants always can be counted on to find new and imaginative ways to fool the useful idiots among us. Last year, the US found new and imaginative ways to BOOST GDP with the stroke of a pen and the Europeans are doing so today. Now underground economies such as sex, smuggling and drugs are about to boost GDP across the Eurozone.

None of this adds to government revenues, most is just a guess of statisticians looking for main stream media headlines to FEED the populations. Of course, it reduces debt to GDP calculations allowing them to borrow more and still hit EU policies. If these changes where adopted in the US, a 3% increase would appear. Look for it to happen soon. Just another politically correct, but practically incorrect, economic stat. NOTHING NEW!

Round and round we go and where this stops nobody knows. Junk bombs er bonds are making all-time lows as I write this. Much more to come as it appears that all the money printed out of thin air in the last 6 years looks to be coming off the sidelines.

In my opinion, the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

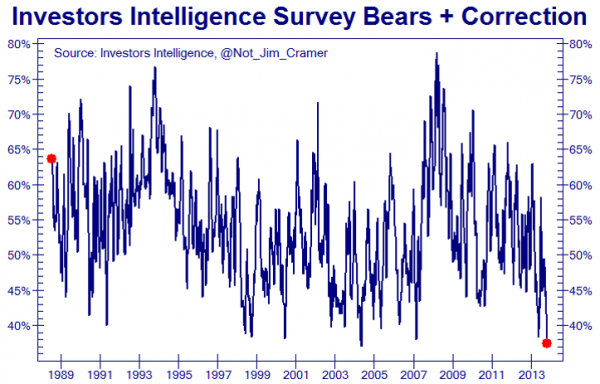

Rare INDEED

Complacency reigns supreme and all time extremes in many measurements continue to PILE UP. Take a look at this chart courtesy of www.zerohedge.com;

Quoting ZEROHEDGE: “Investors have never been less bearish or expectant of a correction.”

Now let’s look at a short quote from Peter Eliade’s of www.stockmarketcycles.com: “There are several other arguments to bolster the case for the possibility of an important top here. The latest survey from Investors Intelligence (investorsintelligence.com) reports:

‘Another higher reading showed the bulls to 62.2%, up from 58.3% a week ago. It was the fifth straight reading above the cautionary 55% level and the first in danger territory. It also just exceeded the 61.6% reading that ended 2013. Prior high levels were shown in August 1987 (60.8%), October 2007 (62.0%) and December 2004 (62.9%), after large rallies and ahead of sizeable corrections.’

Note that there is more outright bullishness now than there was in October 2007 just prior to one of the greatest bear markets in history. The evidence is too great to ignore. Although we must allow for the possibility that this is not a final top, there is a high confidence indication that if it is not the final top, it should still be a top of some significance.”

Thanks Peter. I recommend his publication to all. I remember listening to Peter when I first started my career in 1981 on the Financial News Network. The types of reading we are seeing throughout the markets in sentiment and volatility typically precede the final top by up to 6 to 8 months. They do not normally signal an immediate final high. The advance decline line would also say this is not the final high as it has confirmed recent prices with no bearish divergences.

Video interview with Charles Nenner

Do not miss this video with Charles Nenner from www.USAwatchdog.com . He talks about gold, the economy, the dollar, inflation, Deflation, and unfolding wars. He is one of the foremost cyclical experts in the world. Enjoy… http://www.youtube.com/embed/ME9TikqlKR4

Quoting Nenner: “In Cyprus, there was an example made that they could just confiscate your money. I am very worried about it (bail-ins). A couple of years ago, I said we should start a new crisis in 2014, and it will end in 2020. God only knows what governments intend to do. I think they should just leave the market alone, but they are not going to do it. So, they are going to make things worse.” Plan accordingly; he has been incredibly accurate in the past. His scenario for the dollar fall right in place with the demise of the American military outlined in the first vignette of this missive.

BANKING SYSTEM INSOLVECY

We have a short video from CNBC Europe outlining the toxic nature of European banks. This woman KNOWS her stuff and you should pay close attention or you could be CYPRESSED.

http://video.cnbc.com/gallery/?video=3000282359

In fact, if you are in large parts of EUROPE you can count on being CYPRESSED. In closing, the world is morally and fiscally BANKRUPT. A man made disaster. Nothing will stop the unfolding calamity. This episode is the greatest in history and the collapse will be as well. The opportunities are as great as the pitfalls. Stay alert, use applied Austrian economics to protect, preserve and build your wealth (and I don’t mean just mining stocks). If you are a high net worth individual who wants to use APPLIED Austrian Economics and store your portfolio in excellent REAL wealth that cash flows please give me a call. The greatest transfer of wealth from those who hold it in paper to those who don’t is on the horizon. We are simply waiting for people to wake up. Rest assured, they will.

Don’t miss the next edition of TedBits: America on the edge of a knife series. Or next week’s wrap. Subscriptions are free. I hope you enjoyed this info. It is a compendium of my daily exercises on the new www.Tedbits.com BLOG. Check us out! Far from being the doldrums of summer, the news is heating up.

Thank you for your time, Ty

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.