Bitcoin Price Depreciation or Reversal – Which Will Prevail?

Currencies / Bitcoin Jun 13, 2014 - 08:39 PM GMTBy: Mike_McAra

In short: no positions are suggested for the short-term.

In short: no positions are suggested for the short-term.

SwiftBoatVet, a Reddit user, posted a couple screens they got while filling out a survey for PayPal. It seems that the survey itself was revolving around Bitcoin, asking for direct comparisons of the two payment systems. While this fits in quite well with the comments made recently by eBay’s (owner of PayPal) CEO, John Donahoe, who expressed the opinion PayPal could integrate Bitcoin, the survey itself turned out to be somewhat unclear since it treated Bitcoin more as a PayPal clone than a currency or payment system.

The shortest explanation is that, perhaps, the survey was prepared without enough familiarity with Bitcoin and under the assumption that it was a payment system similar to PayPal. While this might have caused a few laughs here and there, particularly on the part of Bitcoin users who made fun of the schematic questions, it shows that PayPal is actually doing something to research cryptocurrencies.

The company most probably researches dozens of possible payment solutions but combine that with the words of Donahoe and you might come to the conclusion that the integration with PayPal is already worked on.

For now, let’s turn to the charts.

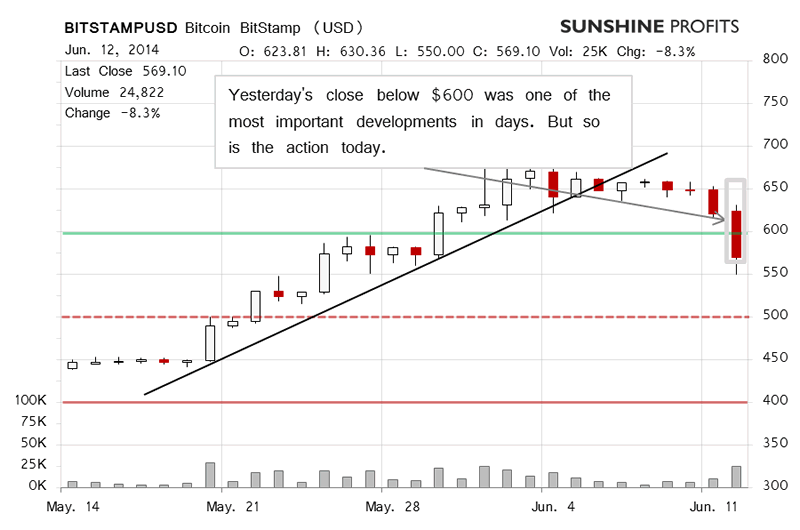

Yesterday was definitely one of the most important days following the recent rally on BitStamp. Bitcoin declined heavily on strong volume, losing 8.3%. Yesterday, we wrote:

It seems that Bitcoin will either fall further down, to $600, or trade sideways for some time before going up more decisively.

As it turns out, the first option materialized and Bitcoin actually closed below $600 (solid green line on the chart). This might have looked like a major breakdown but today’s action doesn’t confirm this point of view.

Today’s different as Bitcoin has gone up and recuperated part of yesterday’s losses (this is written around 9:45 a.m. EDT). The volume is lower than yesterday, though. Bitcoin is again above $600.

Based on the above our best bet at this moment is that Bitcoin will go up in the near future. If there’s anything worrying, it’s the fact that we’re still below the recent highs. We consider two scenarios: Bitcoin going up from here, perhaps following a few days of not much action, or Bitcoin dropping further to around $500, than rebounding.

The current situation seems to be providing a buying opportunity but the fact that today might be just a pause within a move down, makes us look a lot more cautious at possible short-term positions.

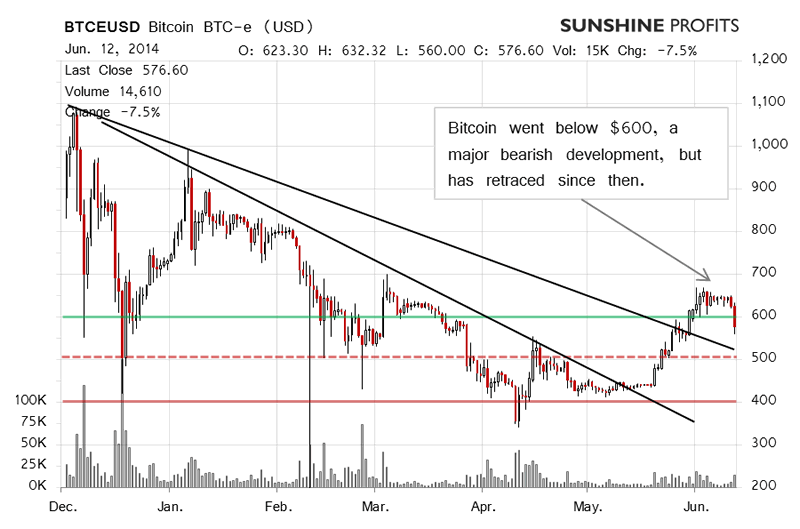

Now, let’s take a look at the long-term BTC-e chart.

The break below $600 was visible on the long-term chart and the exchange rate is still below this level (but only barely) at the moment of writing. The move down still hasn’t been denied. If Bitcoin declines more, it might stop at $500.

It is also possible that the currency will come back above $600 and trade sideways for a couple of days. We would be inclined to opt for the second possibility but the fact that a move back to $500 is not at all improbable at this time doesn’t suggest opening long positions is a good idea.

Yesterday we wrote:

Based on what we’ve seen on BitStamp and BTC-e, it seems to us that there still might be depreciation or a period of sideway moves ahead. The outlook, however, is still more bullish than not. If we see a strong move up, this could mark a beginning of another serious part of the rally.

It seems like we still can see some depreciation even though the short-term outlook is more bullish than not in our opinion.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market now.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.