Delusional Stock Investors and Credit Crisis Vultures

Stock-Markets / Credit Crisis 2008 May 05, 2008 - 04:43 PM GMT The actions of Central Banks over the past six weeks have helped global markets rebound from their mid-March troughs. Markets that were down 20%-40% from their peaks of last year have now rebounded 8%-10%. So are we now about to launch into a new bull market or are we merely experiencing a counter-trend rally in a bear market?

The actions of Central Banks over the past six weeks have helped global markets rebound from their mid-March troughs. Markets that were down 20%-40% from their peaks of last year have now rebounded 8%-10%. So are we now about to launch into a new bull market or are we merely experiencing a counter-trend rally in a bear market?

A Reuters article (28th April, 2008) ran the headline... “Feasting vultures say market may have bottomed ... The allure of rotting mortgage bonds has grown so strong that Wall Street's vultures have begun picking over the carcasses... these intrepid investors have begun betting billions on a hunch that mortgage security prices have fallen enough.”

Lehman CEO Richard Fuld is also sure “The worst is behind us. The last time an opportunity of this nature existed to buy bank stocks this cheap was in 1990...this is a once-in-a-generation opportunity (to buy).”

This opinion is at odds with that of Scott Anderson, Wells Fargo's chief economist, who states that some of the newly reinvigorated bulls are “ bordering on delusional! ” Anderson believes the credit crunch still has futher to play out and will inflict a lot more pain; that markets haven't yet fully factored in the economic downturn we're now sliding into; and points out that of the $1 Trillion dollars of losses the International Monetary Fund expects from the credit debacle... “ only a quarter of these potential losses have been recognized .”

Goldman Sachs' chief strategist, David Kostin (replacing perma-bull Abby Cohen), is also pessimistic. His latest research bulletin titled “ Fasten Seatbelts ” fears the U.S. Market will fall another 15% in the “near term” in an extension of an “ equities bloodbath ”. Considering that Goldman Sachs was the only major player on Wall Street to dodge the fallout from the credit crunch, bulls should take heed of Kostin's warning.

Elliott Wave's Robert Prechter is even more bearish. He disputes Fuld's “once in a generation (to buy)” comment with... “For some it will be the last pleasant thing that happened before a rout sets in that will be remembered for generations to come.”

Blue Sky Credit Card.

In the mail today I received an application form from American Express offering me their new” PRE-APPROVED BLUE SKY CREDIT CARD ”. The card relates to redeeming air travel rewards but might just as well relate to the hopes and aspirations of the major financial institutions as they wait with bated breath to see if the American consumer, and indeed consumers around the world, are about to recant their spending ways.The big fear now is that the meltdowns in the housing and financial sectors will spread deeper into the credit sector.

I know of one person who has been surviving over the past two years by maxing out one credit card after another. Once the credit limit was reached on one, he applied for another, using fresh credit to pay off the minimum payments required. He now has ten credit cards. The latest card was applied for over the internet one night in desperation. The application process apparently was of the “no doc” type with no verification of the financial information requested. Next morning he was notified by email that he was now the proud owner of a new card with a credit limit of $20,000.

Ahhh...Thank Goodness...breathing space! Problem is...he's now in debt $60,000 all up...he still can't sell his apartment (which has been up for sale for eight months now with signs of property prices weakening)... and full payment for the large plasma TV puchased fourteen months ago (NO DEPOSIT, NO REPAYMENTS, INTEREST FREE FOR 18 MONTHS) falls due very soon. Talk about drowning in debt!

Looking at the share price of General Electric ( a major player in the credit market) over the past few years, one has to wonder what lies ahead. GE peaked in 2000 at over $60, only to plunge 65% to $21.30 by February 2003. Since then it has clawed its way back up over $40.

Going forward, Robert Prechter's (Elliott Wave Financial Forecast April 2008) analysts don't see blue skies ahead for GE, but rather see the stock plunging once again to possibly take out the February 2003 low of $21.

Rachel Nickless' article (Australian Financial Review 28th April, 2008) highlights the prayers of both retailers and credit card financiers when she describes how ... “The fashion industry hopes market turmoil will encourage people to seek solace in retail therapy... 'If people are going through a bit of stuff financially they want to put a bit of fun back in their lives, and what do you do when you are a bit stressed but go and shop?”

Sounds like a lot of sectors are still relying heavily on consumers to come to the rescue, all though more than a few shoppers are already showing signs of being tapped out. Meanwhile, Warren Buffett, world's richest man and investment legend is warning that ... “In the retail business...if anything, they've gotten a little worse...my general feeling is that the recession will be longer and deeper than most people think.”

The Sorcerer's Apprentice.

The well known orchestral piece “ The Sorcerer's Apprentice ” was written in 1897 by French composer Paul Dukas. Its popularity soared when Walt Disney brought the story to the big screen in his animated film Fantasia in 1940.

Most of us know the story of the young apprentice to the wise old sorcerer who, frustrated that his days seem to be frittered away cleaning around the castle and carrying buckets of water to fill the bath and water tank, takes matters into his own hands one day while the sorcerer is away.

Donning the sorcerer's hat and picking up the magic cane and book of spells, he proceeds to cast a spell that brings inanimate objects to life and soon has his mop carrying the two pales of water...back and forth, back and forth. Trouble is, once the bath is full and overflowing he doesn't know how to command the mop to stop. In a panic to prevent the castle being flooded he takes an axe and chops the mop down only to see ever more mops sprout into action until an army of unstoppable-out-of-control mops carrying pails of water threatens to submerge the castle. Only the return of the sorcerer, who undoes the spell, saves the day and turns off the flood.

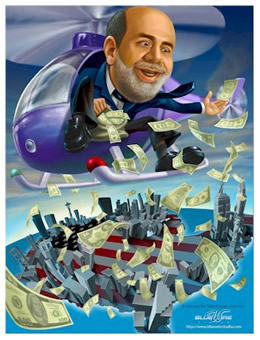

U.S. Federal Reserve Chairman Bernanke seems stuck with the nickname of “Helicopter Ben” since he vowed to banish any possibility of recession or deflation and opened up the money supply spigots and soon had central banks around the globe similarly flooding the the markets with money in an effort to keep their economies afloat.

U.S. Federal Reserve Chairman Bernanke seems stuck with the nickname of “Helicopter Ben” since he vowed to banish any possibility of recession or deflation and opened up the money supply spigots and soon had central banks around the globe similarly flooding the the markets with money in an effort to keep their economies afloat.

However, Bernanke seems also to be playing the role of “ Apprentice” to the departed “Sorcerer” (Alan Greenspan who is still busy running around trying to rewrite the history books so he doesn't get blamed for the mess he left behind)...only this time the world is awash with money and credit that now can't be turned off without the possibility of a catastrophic global collapse.

Perhaps what we desperately need is for a wizard or sorcerer to appear and come to the rescue of the apprentice. Someone of the caliber of former US Federal Reserve chief Paul Volker who knew what had to be done and had the intestinal fortitude to do it.

Paul Volker recently chided current US Fed chairman Ben Bernanke for taking the central bank to “the very edge” of its legal authority in orchestrating the bailout of Bear Stearns... “ transcending certain long embedded central banking principles and practices .” He also set the record straight about the performance of the previous “sorcerer” (Alan Greenspan)... “ Simply stated, the bright new financial system, for all its talented participants, for all its rich rewards, has failed the test of the marketplace .”

Many analysts agree and worry that by bailing out failed banks (e.g. the Fed bailout of Bear Stearns and the Bank of England bailout of Northern Rock bank) central banks are trying to underwrite the global financial system and stick the taxpayer with the bill. Well there's a fair chance the taxpayer won't take such a measure lying down.

On March 27th 2008 two hundred angry, homeowners (struggling under mortgage debt) invaded Bear Stearns' head office chanting... “ Help Main Street, not Wall Street! ”. Some protesters were wearing T-shirts depicting sharks, while others carried banners reading... “ My children need a home! ” Security guards tried unsuccessfully to lock the protesters out and had to call in police who then blocked the street to traffic. Meanwhile, Bear Stearns' employees looked on nervously from behind security barriers.

Hopefully this occurrence did not go un-noticed by Federal Reserve officials.

The Financial Times has certainly noticed the resentment welling up in Main Street... “There is anger about a system that permits bankers to earn huge bonuses when finance booms while taxpayers pick up the bill when banks fail.”

As Good as Gold?

Last month Tobias Levkovich, Citibank's chief US equity strategist, warned that the commodity “bubble” was on the verge of bursting... “A number of catalysts may be coming together to end the current commodities craze. The risk spills out to agriculture, mining machinery and energy equipment and services. We fully appreciate the China and India economic growth opportunities, but we wonder if people are taking it too far.”

Now we see major falls appearing in wheat, sugar, soybean, rice and gold futures. Gold, which had peaked at $1,032 on March 17th, has fallen to $869 as of April 30th... a drop of around 16%. Some analysts fear gold prices may slide further, with Robert Prechter the most bearish and tipping “The best target for the current sell off remains the area of the previous fourth wave...$560.50 - $728.00, basis the weekly continuation contract.”

Meanwhile, house prices keep falling relentlessly in the U.S. (prompting one bright spark to call for the government to start buying up and demolishing empty houses to help address the supply overhang); food riots are breaking out around the globe due to rising prices while the World Bank warns 33 countries are at risk of social upheaval; and mass sackings continue as black clouds roll in  over the economic scene.

over the economic scene.

In the midst of all the increasing turmoil, mayhem and uncertainty, a supply of the precious yellow metal may still prove to be a wise investment.

All the best, Joe.

www.lifetoday.com.au

Copyright © 2008 Dr William R Swagell

Disclaimer: This newsletter is written for educational purposes only. It should not be construed as advice to buy, hold or sell any financial instrument whatsoever. The author is merely expressing his own personal opinion and will not assume any responsibility whatsoever for the actions of the reader. Always consult a licensed investment professional before making any investment decision.

Dr William R Swagell Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Ben B

09 May 08, 21:18 |

Ben B

So Volker sez our system "failed the market place"? But they achieved exactly what they want! A complete takeover of the world! |