Bitcoin Price More Appreciation to Come but Not Just Now

Currencies / Bitcoin Jun 10, 2014 - 04:21 PM GMTBy: Mike_McAra

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

John Donahoe, eBay’s CEO, told CNBC PayPal was “going to have to integrate digital currencies.” He also expressed the view that digital currencies would “play an important role going forward."

This is quite a big deal since PayPal is actually part of the eBay business. Even if you consider the fact that Bitcoin has been already supported by companies like Overstock or Dish, PayPal accepting Bitcoin seems like a whole different story. The company has some 140 million registered user accounts. Combine that with the range of goods offered on eBay and you’ll get all but the perfect marketplace for bringing Bitcoin to the wider audience.

The evolution of digital currencies might look like a slow process, at least to those who would like to see them implemented as soon as possible, but there might be landmark decisions along the way. If eBay figures out a way to make use of Bitcoin without interfering with the currency’s most loved characteristic, i.e. the ability to support cheap and seamless payments, we might as well see that as an important step forward, particularly given the fact that not only Bitcoin-lovers use this platform. In fact, the ability to pay for goods on eBay in Bitcoin could popularize the currency among people who are not familiar with it at the moment.

For now, let’s turn to the charts.

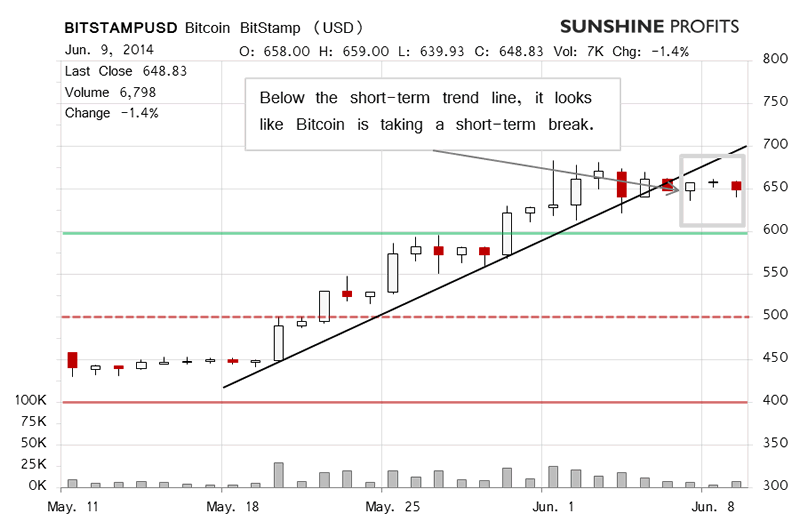

On BitStamp, we didn’t see any decisive action yesterday. The volume was up but it was not confirmed by a large swing. If you recall what we wrote yesterday:

Bitcoin hasn’t moved below $600 but we’re still in the “standby” mode – in the past 6 months most rallies were followed by rather sharp corrections. We don’t expect this to be the case now as the rally we saw in May and June seems to be different than the rallies we saw in the first half of the year. Caution is prescribed, nonetheless, since any sharp move up might be followed by a correction.

This is still the case today as Bitcoin hasn’t moved much (this is written around 10:15 a.m. EDT). If anything, the short-term picture is now slightly more bearish since Bitcoin seems to be lagging the recent trend (grey line on the chart above). This doesn’t have extremely bearish implications but doesn’t inspire to go long just now.

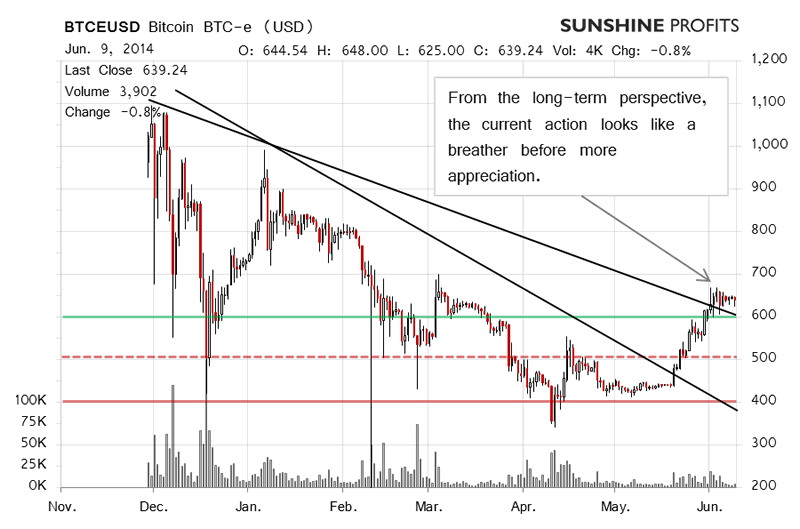

Has anything changed on the long-term BTC-e chart?

It doesn’t look like there have been any major changes in the outlook. Bitcoin is still consolidating above the trend line and, perhaps more importantly, above $600 (green line on the chart). All this looks like a pause before another move up.

If we combine the two outlooks, the short-term one and the long-term one, it seems that we might still see some weakness in the days to come or at least more sideway trading before a stronger move up materializes. Consequently, we’re waiting for a sign of short-term strength before opening long positions.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.