Euro-zone Bond Market Madness as Spanish 10-Year Bond Yield Lowest Since at Least 1789

Interest-Rates / Euro-Zone Jun 10, 2014 - 04:14 PM GMTBy: Mike_Shedlock

Those searching for absurdity in government bonds can find it in a multitude of places.

Those searching for absurdity in government bonds can find it in a multitude of places.

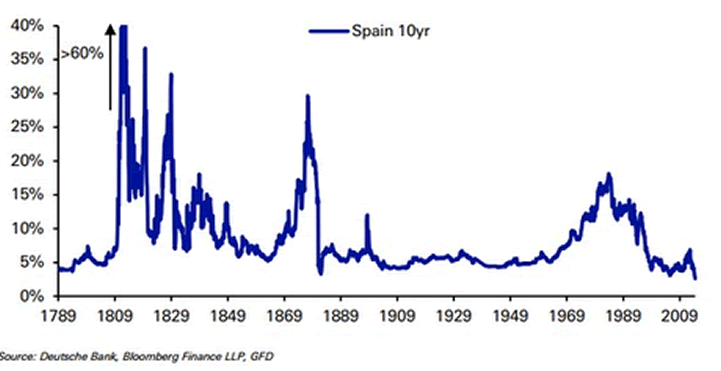

For example, and via translation from Libre Mercado (courtesy of my friend Bran who lives in Spain) please note Spanish 10-Year Bond Yield is Lowest Since at Least 1789.

The interest rate offered on the secondary market for Spanish bonds maturing in ten years is at historic lows, below equivalent yield in U.S. treasuries, which has not happened since April 2010.

The evolution of Spanish debt is even more striking when viewed from a broader temporal perspective.

Today the Spanish 10-year bond is the lowest since at least 1789, the year of the French Revolution, as noted in the graph above. This is something unprecedented.

Great Bond Insanity

ZeroHedge picked up on this as well, in his post: The Great Insanity In Context (200 Years Of European Bonds), citing France and Italy as well as Spain.

As Deutsche's Jim Reid notes,

Draghi has certainly made a huge impact on financial markets as Friday saw some landmark levels hit across different assets.

Many European bond markets hit yield lows with quite a few hitting fresh multi-century all time lows and many others flirting close to them. 10 year French yields hit 1.654 intra-day which was the all-time low covering our entire data history back to 1746. 10 year Spanish yields also hit all time lows with our data going back to 1789. Italy has only been lower in yield for a few months in early 1945 (data back to 1808).Reflections on Insane Risk Assumptions

Never has risk been so high and risk assumptions so low.

Spanish bonds are prices as if there is zero percent chance Spain leaves the Euurozone. Even if you believe the risk is low, I assure you it is non-zero.

And what about separatist movements in Spain. I guess that is a zero percent chance as well. It's the same for Italy. Apparently Beppe Grillo has a zero percent chance of getting his way in Italy.

Let's assume for a moment there is no chance of any of the above happening. What about further bailouts or more importantly bail-ins in Spain and Italy?

Are those zero percent risk as well? Apparently so.

Indeed, there is no risk anywhere in anything except gold, so go on margin and buy calls like the rest of the herd. You cannot lose (and that is exactly the same kind of central bank sponsored insanity that led to the housing crash and the global financial crisis).

I never thought it would come to this so soon again. How quick we all forget.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2014 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.