Conscious Uncouplings - Global Bad Economies

Economics / Global Economy Jun 10, 2014 - 12:12 PM GMTBy: John_Mauldin

It is with hearts full of sadness that we have decided to separate. We have been working hard for well over a year, some of it together, some of it separated, to see what might have been possible between us, and we have come to the conclusion that while we love each other very much we will remain separate.

We are, however, and always will be a family, and in many ways we are closer than we have ever been.

We are parents first and foremost, to two incredibly wonderful children, and we ask for their and our space and privacy to be respected at this difficult time.

We have always conducted our relationship privately, and we hope that as we consciously uncouple and coparent, we will be able to continue in the same manner.

Love, Gwynneth & Chris

With that simple statement, issued on March 25th, one of the world’s best-known celebrity couples, the Oscar-winning actress Gwynneth Paltrow and Coldplay lead singer Chris Martin, went their separate ways.

No muss, no fuss. On the contrary, it was clean, simple, and effective (unless you factor in the amount of ridicule the two were subjected to in the popular press for their choice of words).

Now, contrast that ending of a life lived together under the spotlight to the EU’s unholy alliance, clinging to a union which has long since deteriorated into frostiness and antipathy.

If that union were a marriage, its members would claim to be staying together for the sake of the kids — only this time, their stubborn refusal to acknowledge that they probably never should have gotten together in the first place is hurting those kids in ways that are clear to just about everybody except the “parents.”

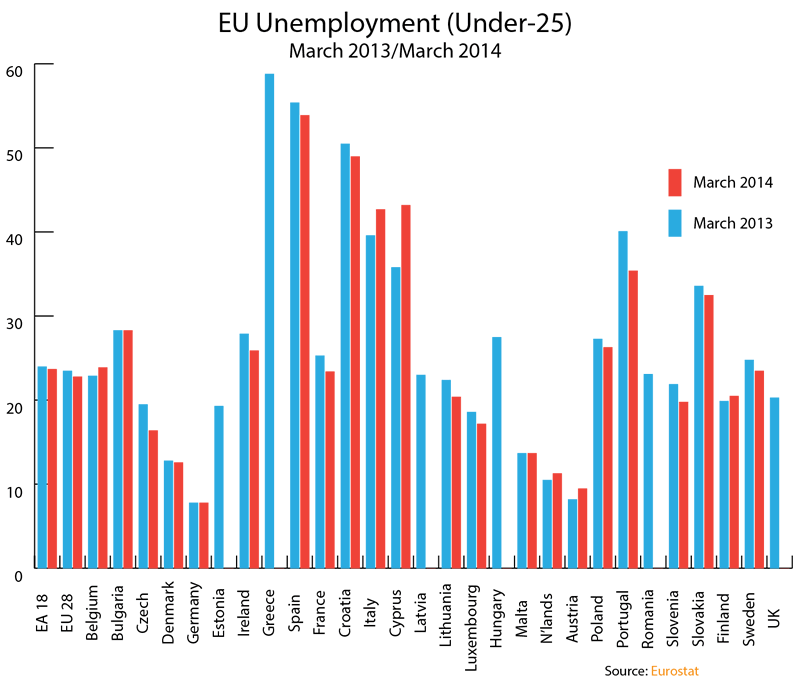

The latest Eurostat youth unemployment figures for the Eurozone show a drop in total youth unemployment for both the EU-28 AND the EA-18 — that’s the good news.

The bad news is this:

The EU-28 still has 22.8%, or 5,340,000, of its under 25s unemployed. In the EA-18 that percentage rises to 23.7%, or 3,426,000.

What’s more, the nations where that number has risen over the last twelve months are perhaps not those you’d expect.

Austria, Finland, Cyprus, the Netherlands, Italy, and Belgium all have more under-25s unemployed now than they had 12 months ago.

(For reasons explained with a simple “Data Not Available” footnote by Eurostat, data is missing for Greece in both February and March of 2014, but I’m quietly confident in stating that Greece’s number will still be above 50%.)

Back in late 2013, the World Economic Forum released its “Global Agenda Report,” and high on the list of priorities was youth unemployment:

(UK Daily Telegraph): A lost generation of jobless youth in the eurozone could tear the single currency apart if nothing is done to address chronic levels of unemployment, the World Economic Forum (WEF) has warned.

“There is a growing consensus on the fact that unless we address chronic joblessness we will see an escalation in social unrest,” said S. D. Shibulal, chief executive of Infosys, who contributed to the WEF’s Global Agenda Report.

“People, particularly the youth, need to be productively employed, or we will witness rising crime rates, stagnating economies and the deterioration of our social fabric,” he added.

John Lipsky, who served as acting managing director of the International Monetary Fund during the height of the Greek crisis in 2011, said the problem was likely to get worse before it got better.

He told the Telegraph: “Right now it’s hard to see any decisive move back the other way at a time in which everyone feels their circumstances are under threat and are worried about their economic future.”

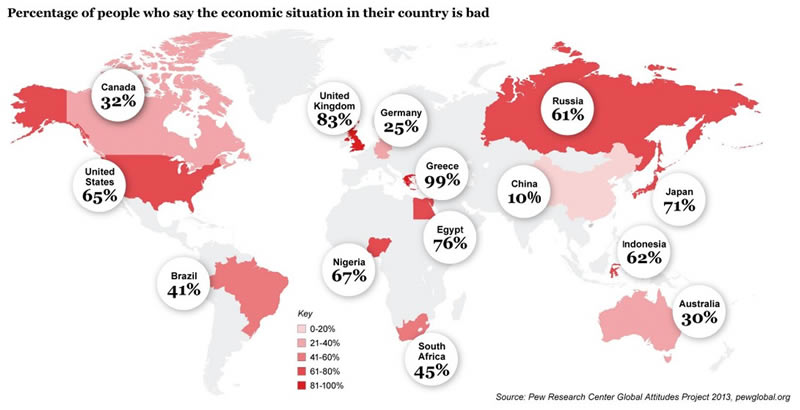

Across the world, the number of people who say the economic situation in their country is “bad” is climbing — despite the much-vaunted recovery we all keep hearing about from politicians.

No surprise in the numbers from Greece or China; Japan feels about right, despite the miracle cure of Abenomics; and the Brits will always have something to complain about; but in the US — where supposedly things are getting markedly better according to policymakers and central bankers — we find a surprisingly strong majority who claim things are not just “not good” — they’re “bad.”

Disenfranchisement amongst youth and disenchantment amongst the more reliable voting classes has led to a rather predictable outcome, one which was demonstrated beyond any doubt whatsoever in the recent EU elections.

When I wrote about what were then upcoming elections (“Behold Politics,” TTMYGH, Jan 27, 2014), I said that the previously ignored elections for the EU Parliament would be the single most important event of the first half of 2014. And, as the dust settles, it looks as though I was right.

Across the continent, electorates sought a cure for the ails they blamed upon the incumbent party.

They sought an antidote, and they found it in the anti-vote.

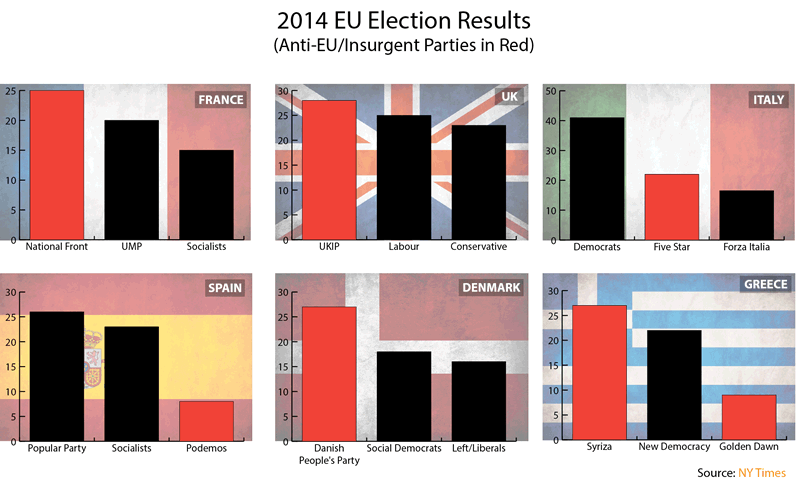

The one overriding theme as Europe went to the polls was a surge in votes cast for opposition parties. Not just parties IN opposition, but parties OF opposition — opposition to “Europe.”

In the UK, Nigel Farage’s Ukip party became the first party outside the Tories and Labour to win a national election outright; and, as he promised he would, he caused a “political earthquake”:

(UK Guardian): Nigel Farage has unleashed his much-promised political earthquake across British politics as Ukip stormed to victory in the European elections, performing powerfully across the country.

The Eurosceptic party’s victory marked the first time in modern history that neither Labour nor the Conservatives have won a British national election.

In a stunning warning to the established political parties, Ukip was on course to win as much as 28% of the national poll. That is a near doubling of the 16.5% it secured in the last European elections in 2009, when it came second to the Tories with 13 seats....

Twenty years ago, in its first European election, Ukip managed 1% of the vote.... Ukip polled strongly across the country, except in some urban areas, and was expected to take a seat in Scotland, which formally declares on Monday. The SNP showed no increase in its share of the vote on 2009, but topped the poll in the nation.

The Tories, Labour and the Lib Dems will acknowledge that this is a powerful symbolic moment: a party that was founded in 1993 has pulled ahead of all the established parties, whose roots date back more than 100 years.

Meanwhile, across the rest of continental Europe, anti-EU parties shook the establishment to its foundations:

(NY Times): An angry eruption of populist insurgency in the elections for the European Parliament rippled across the Continent on Monday, unnerving the political establishment and calling into question the very institutions and assumptions at the heart of Europe’s post-World War II order.

Four days of balloting across 28 countries elected scores of rebellious outsiders, including a clutch of xenophobes, racists and even neo-Nazis. In Britain, Denmark, France and Greece, insurgent forces from the far right and, in Greece’s case, also from the radical left stunned the established political parties.

Whilst the upstarts failed to win enough seats to control the EU chamber, they have ensured that the Eurosceptic voice will be heard louder than ever, and as the NY Times so beautifully put it:

... [T]he insurgents’ success has nonetheless upended a once-immutable belief, laid out in the 1957 Treaty of Rome, that Europe is moving, fitfully but inevitably, toward “ever closer union.”

It also threatened to redraw the domestic political landscape in several core members of the 28-nation bloc, putting pressure on mainstream parties, particularly in Britain and France, to reshape their policies to recover lost ground.

Nowhere was the establishment shaken more severely than at the very core of Europe — France — where François Hollande (arguably the least “presidential” leader to hold office in Europe in several decades) saw his socialist party trounced by the far right Front National, led by Marine Le Pen.

Hollande’s comments in the wake of what was a truly stunning defeat bore testament to the damage done to the status quo. Bemoaning the public’s “distrust of Europe and of government parties...,” Hollande hit the nail on the head when he said, “The European elections have delivered their truth, and it is painful.”

For some, François, for some.

Meanwhile in Greece, Alex Tsipras, the firebrand leader of the staunchly anti-EU (and radically LEFT-wing) Syriza, delivered on his pre-ballot promises, and the opposite end of the political spectrum had their day in the sun, too:

(Links): The victory of the radical left was not particularly surprising, although undeniably historic. The Coalition of the Radical Left (SYRIZA) is now the biggest party in Greece having received 26.56% of the vote and winning six members of the European Parliament (MEPs), whereas the leading governmental right-wing party, New Democracy, received 22.73%.

The neo-Nazi party, Golden Dawn, is now the third-biggest party in Greece (9.40%), electing three MEPs for the first time in modern Greek political history.

But beyond the headlines, the result in Greece was a huge slap in the face for the austerity movement:

(Links): In order to grasp fully the significance of this result, we need to factor in the successes of the radical left represented by SYRIZA in the municipal and provincial elections that took place on May 18 and 25. SYRIZA managed to secure a victory in the largest province of the country (Attiki), where Rena Dourou marginally yet decisively beat the government-supported candidate, who has held the post for 12 years. Perhaps even more impressively Gabriel Sakellarides, a young radical economist supported by SYRIZA, secured an unprecedented 48.60% in the municipality of Athens, a traditionally conservative constituency. Further, candidates supported by SYRIZA managed to come first in the second round of the municipal elections in a number of working-class neighbourhoods.

Crucially, it is the first time in Greek political history that a left-wing party has clearly come first in the European election.... The victory of SYRIZA acquires added political and symbolic value given that it constitutes an anti-austerity vote with clearly left-wing characteristics in a wider European context of the rise of the extreme-right.

Whilst the anti-EU bloc failed to get enough seats to derail the bureaucracy of Brussels, they DID win enough to create some serious waves and make it far harder to railroad through policy the next time the wheels on the wagon start to wobble.

Overall, what the elections showed was the deep (and deepening) level of dissatisfaction with the EU project, and in the wake of some crushing results a couple of things have stood out.

Firstly, there was the marked willingness of certain previously pro-Europe politicians (who had been sitting conspicuously on the fence) to start pandering to the anti-EU crowd as if they’d been anti-Europe all along.

David Cameron, for example, in the wake of the Tories’ defeat to Ukip, started getting awfully (and very publicly) tough on Europe — calling for “real change” to Britain’s deal with Europe and even threatening the nuclear option of leaving the Union if things didn’t go his way (a stance guaranteed to play very well to the disgruntled Tory supporters who had defected to Ukip on the back of Nigel Farage’s antagonism towards “Mr. Barosso” and company:

(UK Daily Mail): David Cameron today signaled he would call for Britain to leave the European Union if Brussels refuses his demands for change.

Tough talk, Dave. Sadly, though, Cameron then exposed his naiveté:

But he repeatedly insisted he remains confident his plan to overhaul the EU’s powers will be successful.

Dave... you can’t “change” Europe — certainly not when there are people like Jean-Claude Juncker around.

(Bruno Waterfield): Jean-Claude Juncker was an architect of the troubled euro and has spoken of the need to mislead the public in order to advance the European Union’s cause.

If any individual represents the “old Europe” and the wheeling and dealing that led to the flawed euro and the EU constitution it is Mr Juncker, who is one of the last believers in a United States of Europe.

Mr Juncker, 59, was until last December the prime minister of Luxembourg and the EU’s longest serving leader until he was forced to resign last year in a bizarre scandal involving illegal phone tapping by the Grand Duchy’s secret service.

The longest serving veteran of Brussels deal-making, until last year Jean-Claude Juncker headed the powerful Eurogroup meetings of eurozone finance ministers firefighting the crisis in the EU’s single currency — an institution he had helped create, warts and all, in the Nineties.

“We decide on something, leave it lying around and wait and see what happens. If no one kicks up a fuss, because most people don’t understand what has been decided, we continue step by step until there is no turning back,” he said of the euro’s introduction.

At the height of the eurozone crisis, Mr Juncker was described as the “master of lies” for organising a meeting of finance ministers to talk about whether Greece could remain in the single currency and then trying to deny it was taking place.

Germany’s Suddeutsche Zeitung accused Mr Juncker of “taking the lead on the deception” and warned he had managed “to fritter away the last remaining trust the people of Europe still have”.

Mr Juncker has never hidden his view that the compromises and deals being worked out in EU meetings or leaders or ministers need be protected from public scrutiny, by lies if necessary.

“When it becomes serious, you have to lie,” he said.

“When it becomes serious, you have to lie.”

Juncker is now the de facto front-runner for the most powerful post in the EU based on a convoluted system of voting around blocs within Parliament.

The post Juncker craves so much — President of the European Commission, the most powerful position in Europe — is, of course, NOT entrusted to the votes of the European electorate but rather decided upon behind closed doors amongst unaccountable politicians.

Of COURSE! Why select the top job democratically? This is Europe.

Click here to continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

By Grant Williams

By Grant Williams