U.S. Bank’s Silver Short Positions send Buy Signal

Commodities / Gold and Silver 2014 Jun 09, 2014 - 05:18 PM GMTBy: Submissions

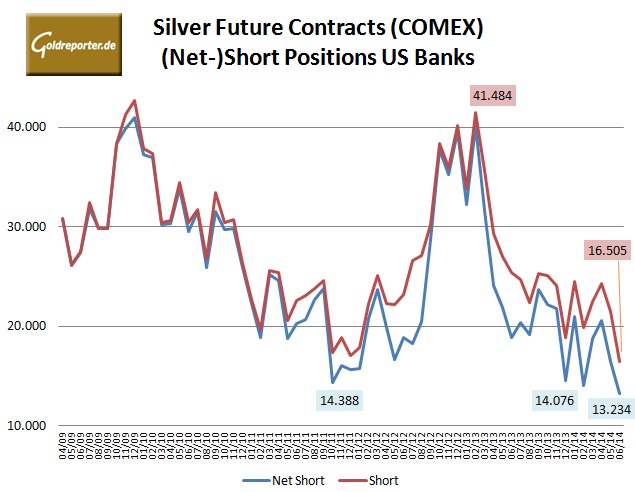

Gold Reporter writes: U.S. Bank’s net short positions have dropped to lowest value in at least 5 years. Could indicate short term anti-cyclic buy signal.

In early June, U.S. banks trading future-contracts at the COMEX, only held a total of 13,234 contracts in net short positions, which equals 2,057 tons of silver forward-sales and depicts the lowest value since Goldreporter started analyzing the monthly data 5 years ago (see chart). For comparison: In February 2013 U.S. banks were 6,249 tons short!

Compared to the previous month, short positions of those highly influential U.S. banks at the COMEX declined 23.35 % and net short positions declined by 19.72 %, according to the latest Bank Participation Report (BPR) from the CFTC, dated 3 June 2014.

The given data implies the disconnect between futures and physical silver, and indicates the limited down-potential of silver, since the experience of past years illustrates, that there had always been particularly high pressure on precious metal prices when U.S. banks had built up high short positions on respective metals. 2,000 tons of future sales might still be considered very high, since after all that’s an equivalent of 1/10 of annual silver mine production, whilst U.S. banks have already taken a net-long-position in gold since June 2013. But: In a historical context, the current silver short positions of U.S. banks have to be considered a rather (anti-cyclic) bullish signal.

© 2014 Copyright Gold Reporter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.