Silver Price Bottom Targets $37.5

Commodities / Gold and Silver 2014 Jun 09, 2014 - 12:26 PM GMTBy: Clive_Maund

The public are now extremely bearish on silver, with a widespread perception that it is "done for", but as we will see, even if there is some further short-term weakness, the longer-term outlook for silver is very bright indeed.

The public are now extremely bearish on silver, with a widespread perception that it is "done for", but as we will see, even if there is some further short-term weakness, the longer-term outlook for silver is very bright indeed.

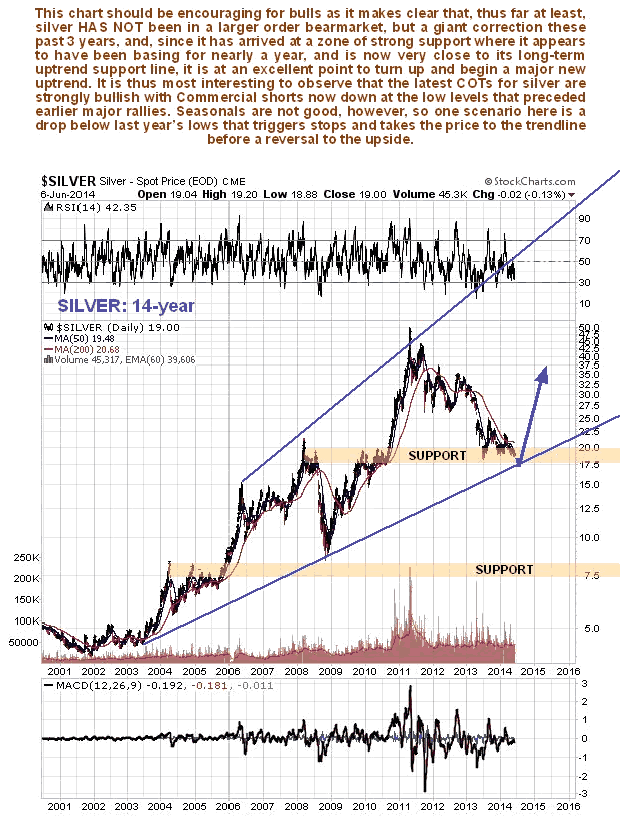

On its 14-year chart, which shows all of the bullmarket in silver from its inception, we can see that, although the drop from the 2011 peak has been severe, involving losses of more than 60% from the highs, it has not thus far resulted in a breakdown from its long-term uptrend, which remains intact. Over the past year silver appears to have been basing in the zone of strong support shown with its supporting long-term trendline gradually coming into play to provide additional support. This is in fact the perfect setup for a major new uptrend to begin, and the only further supporting factor required is a favorable COT structure - and that we now have.

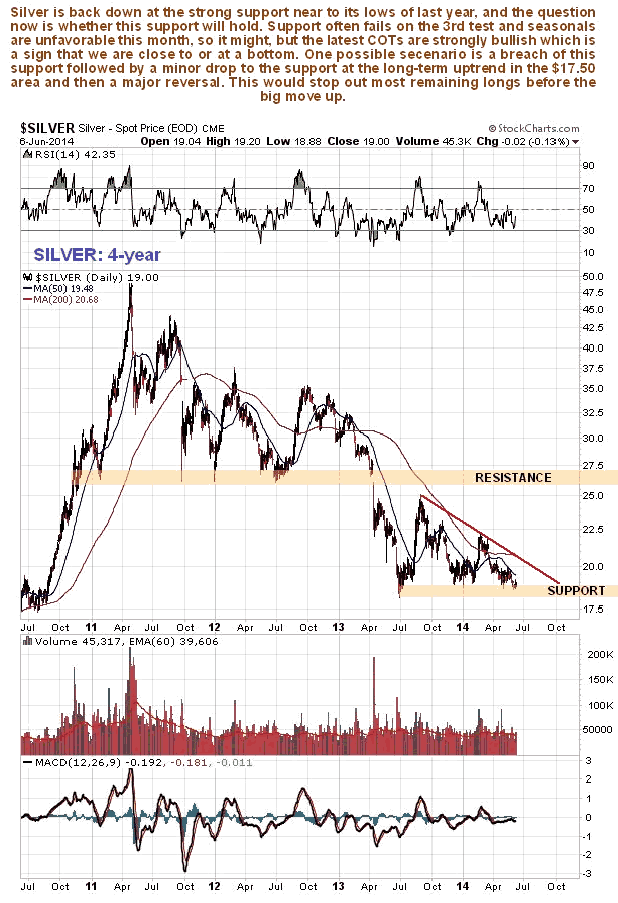

On its 4-year chart we can see the retreat from the 2011 highs in much more detail. When the support at $26 failed in April last year the price fell hard before establishing a new equilibrium. Now, with a Descending Triangle apparently forming above a line of support near last year's lows, it looks at first sight like another such breakdown is about to occur. However, we have already observed that there is strong support at and not far beneath the current price, arising both from earlier trading and the long-term uptrend line coming into play, and when you add in to the mix that sentiment towards silver is now extremely negative, and that the COT structure is now strongly bullish, it becomes clear that further significant downside is unlikely before a new uptrend emerges.

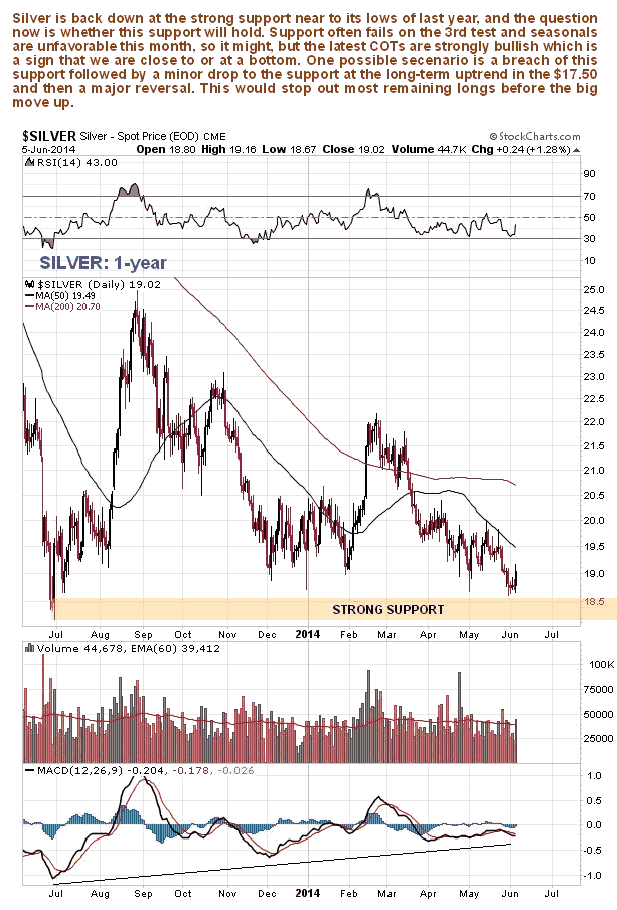

Admittedly, the picture on the 1-year chart does not look encouraging - this is the third test of support near last year's lows, and on the 3rd approach, support often fails, furthermore, recent upside volume has been weak and moving averages are in bearish alignment. All of this suggests an imminent breach of the support - but what we have observed on the long-term charts and on the COT charts is telling another much more bullish story. One scenario therefore thought likely is that powerful forces break silver down below the support at last year's lows, triggering the stops clustered just below them, and then mop up the liquidated holdings of weaker players, the price only going on to drop a dollar or so below the breakdown point before reversing dramatically to the upside again to start the expected major new uptrend.

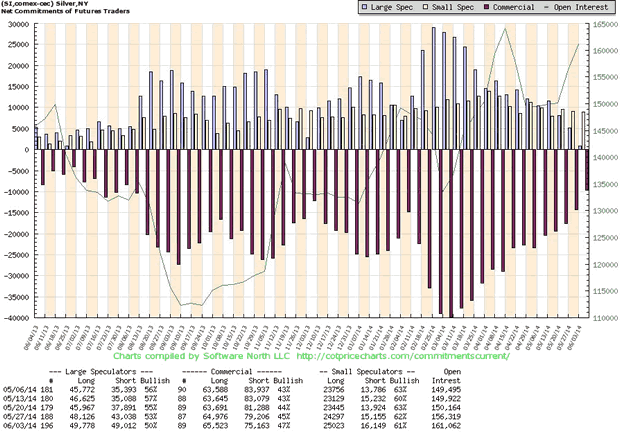

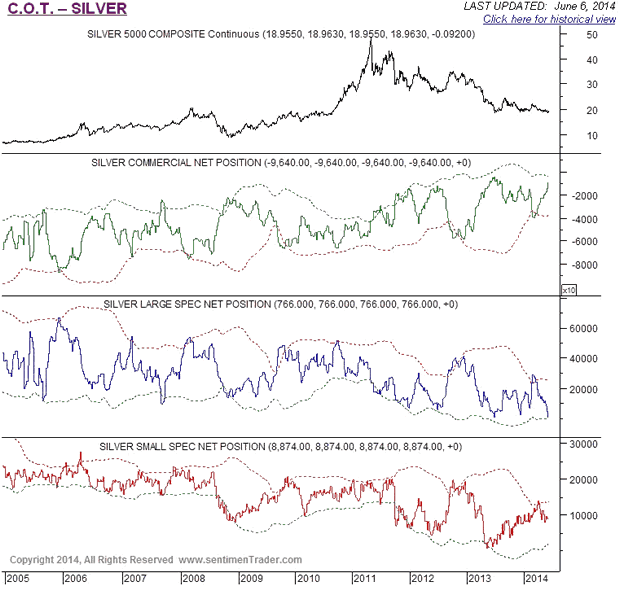

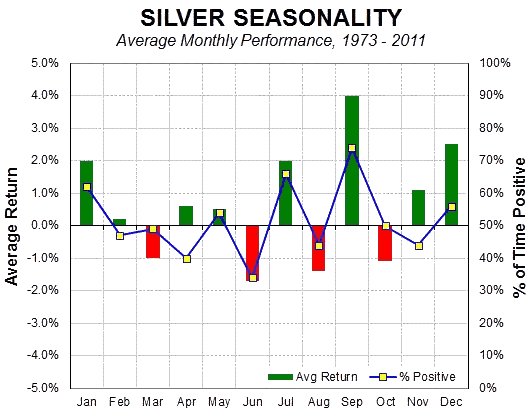

Turning now to the COT charts we can see the dramatic improvement in the COT structure on the chart below, with Commercial shorts falling to the sort of levels that prevailed ahead of the big rally last August, and the more muted but still significant rally of last February. Large Spec longs are now almost non-existent - they have "thrown in the towel" which is very positive sign indeed. This is a very positive COT structure indeed and the expected new uptrend could begin at any time, although we suspect there may first be a short-term drop, partly because gold's technical situation could still use some improvement, and partly because seasonal factors are not favourable this month.

The long-term COT chart below provides historical perspective with respect to how the Commercial short and Large Spec long positions have scaled right back in recent weeks. As we can see they are now at levels that must be construed as quite strongly bullish.

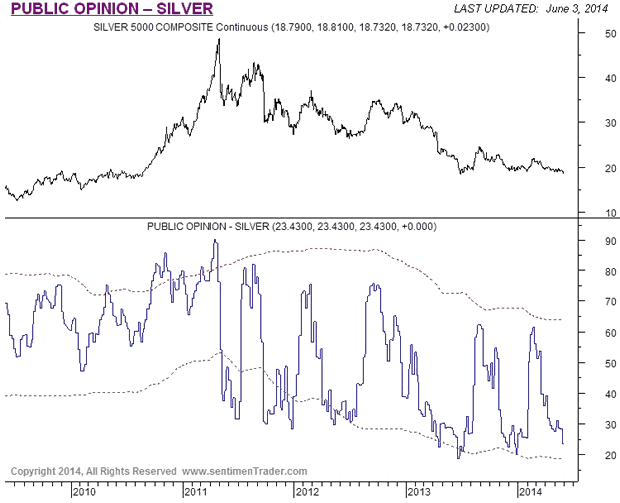

The chart for Public Opinion shows that it is now back in the basement, which is another important precondition for a big rally.

So, almost all the pieces are in place for a major rally in silver to begin soon, and the only factors that could use some improvements are the seasonal influences, which get better after this month, and gold's COT structure. If silver does break below last year's lows there is expected to be little downside follow through, and any such further short-term weakness will be regarded as throwing up a major buying opportunity in a wide range of silver investments. Finally it should be noted that such a breakdown may not now occur, given the big improvement in silver's COT structure to date. If we see any really big volume up days soon it will be a sign that the major new uptrend is beginning.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2014 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.