Hammering the ECONOMY, Unfolding Constitutional Crisis, European Banks Still in DEEP Trouble

Stock-Markets / Financial Markets 2014 Jun 06, 2014 - 03:00 PM GMTBy: Ty_Andros

It's been a wild and wooly week for students of the economy and politics. A lot of significant developments on a number of subjects took place: ALL OF THEM NEGATIVE for the private sector and public. I will be covering a number of subjects in this week's Weekly Wrap:

It's been a wild and wooly week for students of the economy and politics. A lot of significant developments on a number of subjects took place: ALL OF THEM NEGATIVE for the private sector and public. I will be covering a number of subjects in this week's Weekly Wrap:

- Hammering the ECONOMY

- Constitutional crisis Unfolding

- European banks still in DEEP trouble and economies as well.

- Beware Suppressed Volatility

- ECB meeting: NO SURPRISES - A "Let them eat cake" moment for the Eurozone

"Government is not reason, it is not eloquence, it is force, like fire it is a dangerous servant, and a fearful master." - George Washington

Hammering the economy

The latest ECONOMIC death sentence from the District of Corruption was announced by the chief executive this week. The EPA has announced new rules and regulations issued by executive order crippling conventional energy production in the United States. The president says he is battling CLIMATE CHANGE to save the children. It will cost all of us dearly, especially our children. Unable to pass anything through congress due to bipartisan opposition the EPA is taking new authority based upon reinterpreting the plain language of the Clean Air Act passed in the early 1970s. Just like those living in the land of George Orwell where words have no meaning, laws can now be interpreted in any manner they wish. The US has firmly entered this land and the evil coming from our masters inside the beltway knows no limits. It's all politics all the time, practical considerations be damned.

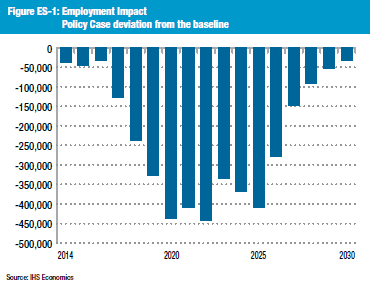

This PROGRESSIVE administration consists of blind ideologues and paid-for academics who write fairy tale analysis to justify any policy they wish to impose upon the country. This is a wholesale attack on inexpensive and affordable energy and MANDATES a 25% reduction in greenhouse gases by 2020 growing to 30% by 2030. They claim it will REDUCE electricity costs by 8% but don't hold your breath. The problem is that there is no technology currently available that can achieve this mandate. The Chamber of Commerce is reporting that it will cost $50 Billion dollars a year and 250,000 jobs lost each and every year. I believe the job losses will be much greater. 40% of all electricity generated in America comes from CLEAN COAL. The United States hasn't had any problems with coal fired plants since the days of acid rain during the Nixon administration. Projected Job Losses by these regulations:

The job losses are too large a price to pay to prevent something that we have absolutely no ability to prevent. Climate change is far from settled science contrary to the government assertions. In my opinion, it is a hoax cooked up by socialists and academics that have run out of other people's money and need new sources of money to loot and redistribute to their cronies in crime. Putting climate change into prospective for people that can't/don't/haven't been taught to think:

- The earth is about 9 billion years old (9 million million)

- Climate has changed throughout that period - hotter, colder, ice ages, tropical etc.

- Carbon has fluctuated wildly during this period. Man was not present for most of this time.

- Humans exhale Carbon Dioxide which is the air that plants breathe. Plants create oxygen that we breathe. It is a symbiotic part of nature between man and plants. God's masterful planning.

- Man is a part of nature not a virus to it.

- More carbon dioxide is emitted from a VOLCANIC ERUPTION than man has ever generated and plants breathe this also.

- Man has been out of the caves maybe 3000 years of the 30 million million

- Man has really burned fossil fuels about 75 years since the auto was invented

- Climatologists have very little accurate information going back over 30 years

- What percentage of 9 million million is 30 years? .0000000000000000003

- What SCIENTIFIC conclusions can you reach from a sample that small? NONE

If you can wade through those FACTS and conclude that academics can say anything is SETTLED SCIENCE then you are a fool, a useful idiot and deserve the FATE and heartache their guidance will create for you. We all want clean air and environments, and anyone who knows history knows they have improved steadily through the decades as the US has matured. Carbon emissions have fallen steadily since 1992 and will continue to do so without help from the EPA and the District of Corruption. Man has no ability to affect climate change through carbon reduction. Man does not know what causes climate change, mother earth is far more complex than our pea brains can understand. Climate change is nothing but a hoax, a wealth and freedom confiscation scheme, another nail in the world's greatest capitalist economy by the CENTRAL government that the constitution was meant to PREVENT. When I was a child in the late 60s, the government was warning us school children about an unfolding ICE AGE. The administration cannot get the legislature where laws must come from to pass a bill, so they are decreeing it. It is a just another constitutional crisis created by a lawless executive branch. They like to use FEAR to control the dumbest among us. What's wrong with this picture?

Constitutional Crisis

Even though we are just barely into the dog days of summer there are lots of events unfolding which bear careful scrutiny and must be kept in mind as the greatest manmade crisis in human history continues to unfold. Few issues are greater than the unfolding CONSTITUTIONAL crisis in the United States, which is basically unreported by the media. The rule of law is damned and the rule of man has become the reality. The EPA power crab without legislation from Congress is the latest LAWLESSNESS out of the Executive branch. The federal takeover of property through misuse of wetlands legislation is up next. Look no further than the Affordable Care Act also known as OBAMACARE which has been modified over 38 times at last count with plainly no legislative basis. The NSA spying which violates the PLAIN language of the constitutional right to privacy, the IRS deployment against political rivals (this got NIXON impeached!), the latest prisoner swap by the president (plainly in violation of the plain language of the law)... the Justice department is just enforcing laws the administration agrees with and ignoring those it doesn't. The dream act is another example of law made by executive order. This list is endless and growing by the day. If the executive branch was held by republicans, impeachment proceedings would already be in motion and the main stream media would be shouting it to the hills. But, since it is being done by their socialist masters, not a word is said. None of these things are being done with the advice and consent of your elected representatives.

In our system of government, laws originate in congress, are passed by them, then signed into law by the executive branch. Once done they can only be amended by the same process. Now they have become mere SUGGESTIONS to be handled at the discretion of the executive branch. Congress has abandoned most of its oversight RESPONSIBILITIES and only performs them when FORCED to do so by HEADLINES. Then, in most cases, it is all puff and hot air for the masses and a quick return to unaccountability to the public they claim to serve. "Go along to get along" from both sides of the aisle. It is SIGNALING a frightening and rapid descent into totalitarianism. This is happening all around us and I am dedicated to bringing it to you and outlining it.

European banks still in DEEP trouble.

The rush for YIELD continues to astound as even the weakest and most insolvent can raise funds if the rates are right. Piraeus Bank (Greece's biggest bank) just issued its first bond in 5 years for 1.75 Billion Euro. No roadshow was necessary as it was oversubscribed by a factor of 2 in less than 48 hours. Totally unsecured lending from off shore institutions is setting the stage for the next run on the banks.

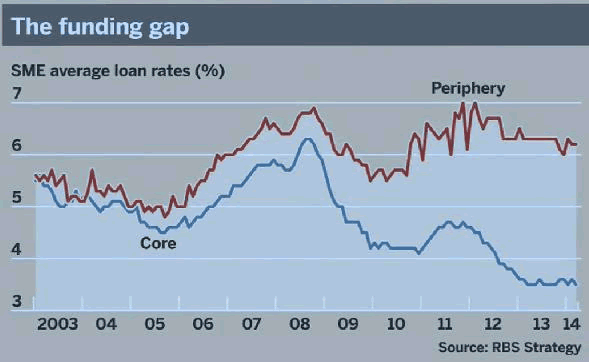

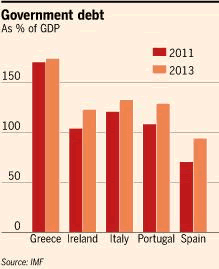

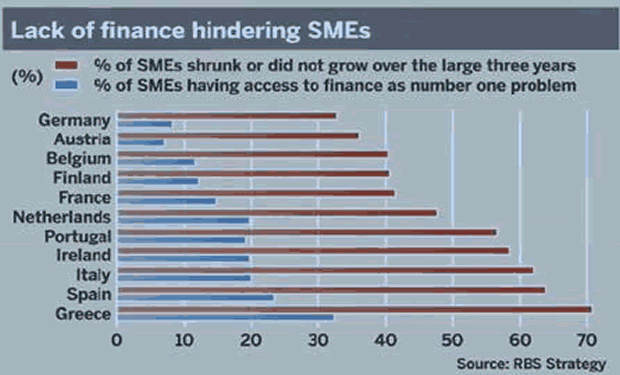

"Right now everyone is a yield hog," says a senior London-based debt banker. "Institutions don't care what they're buying, they need that yield." ...Which could be problematic for UNSECURED LENDERS as non-performing loans represent 32% of all Greek loans, 27% of all Irish loans, 12.6% in Spain and 16.9 % in Italy. Looking at those numbers, most banks are operating in BANKRUPTCY since OFFICIAL reserves are not above 10%. These countries' banking systems range from 250 to 400% bigger than the size of their domestic economies so those percentages foreshadow future banking rescues. When the ECB stress tests are conducted, it will be interesting to see how they SWEEP THIS UNDER THE RUG. One whiff of trouble and we will see who is swimming naked as foreigners run. They are all swimming naked, the banks and the investors in the bonds are in a game of Russian roulette. When you have problem loans of that magnitude, building your loan book is not an option. Managing the losses becomes all that is important. It is also why lending to the private sector is contracting as ZOMBIE banks are unable to do so or take risk. Take a look at the bifurcation from healthier banks lending in the core of the Eurozone and the ZOMBIES on the periphery.

Mind the GAP! HOW IN THE WORLD CAN THE PRIVATE SECTOR on the PERIPHERY CREATE THE GROWTH NECESSARY for Eurozone RECOVERY? No recovery can take place when only government is growing! All wealth creation and growth comes from the PRIVATE sector. The banks buy local government debt and, BY LAW, call it RISK FREE so no reserves are required to hold it. The government regulators are happy as government spending is funded until the charade of insolvency is exposed. And it will be exposed SOONER or LATER! Regulating lending to the GOVERNMENT.

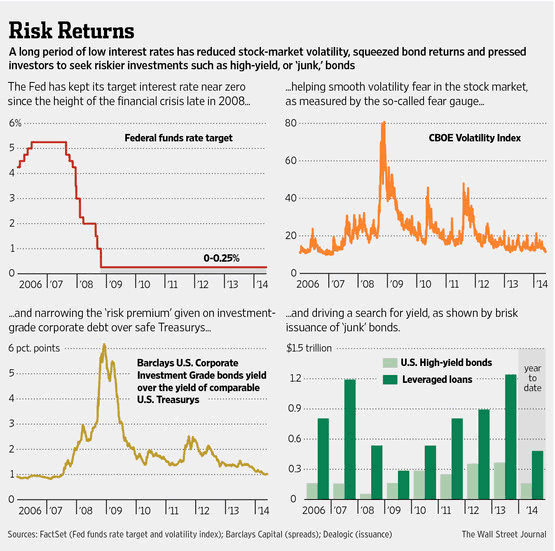

Beware Suppressed Volatility

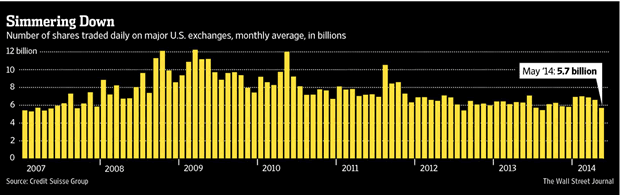

There is simply NO FEAR in the markets as many markets are hitting or exceeding pre-crisis peaks, corporate spread over treasuries, high yield bond issuance, vix, leveraged loans. This is all happening as tightening is occurring in the US, Eurozone (as inflation falls real rates are rising by definition) and China. Everything is priced for perfection in a QE world.

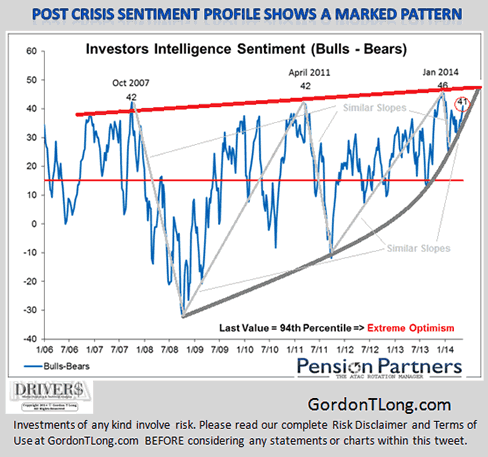

Gordon T. Long has several major turn dates clustered around July 16,17,18 and is looking for markets and the economy to turn decisively at that time. You are looking at a bull market in complacency. Anyone who knows history is frightened. Suppressed Volatility is KILLING the banks proprietary and market making revenues, revenues they cannot afford to lose. It is at pre-crisis levels of 2007 just as the lending and leverage insanity is:

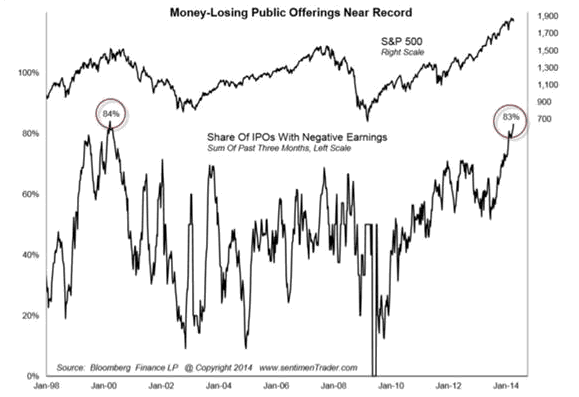

I would daresay that we are staring the next crisis in the face, with utter destruction to be fully priced sometime in the next two years. Rarely, if ever in history, have investors paid more money for less returns. Moral hazard is an epidemic among investors and Bernanke put is alive and well. The only question is when does the tide turn? Here is another view of insanity in action courtesy of Mauldin economics and www.sentimentrader.com:

The last time we saw this must insanity was 2000, which preceded a 50%+ decline. This decline should be much worse as leverage is much higher. The taper sets the stage for a big fireworks show and a challenge to Yellen's leadership. Expect a REVERSAL SOON in the markets and economy. Is this coming collapse being engineered by the powers that be? Creating a crisis to be exploited?

ECB meeting: NO SURPRISES - A "Let them eat cake!" moment for the Eurozone

Super Mario DID NOT surprise when he brought a squirt gun to a raging fire as economic activity will continue its collapse with this "too little too late" strategy. Lowering ECB deposit rates from 0% to -.1% and dropping the refinancing rate from .25% to .15%. This will have virtually NO effect as the LTRO money has mostly been repaid and funds on deposit at the ECB are nearing MULTI-YEAR LOWS. There is no money bank money balance sheets parked at the ECB to FORCE them to lend. In other words, he DID NOTHING. Take a look at the contraction in the private sector of the Eurozone over the last 3 years. It is breathtaking and it says two things:

- zero percent interest rates will do nothing to revive the economies of the EU

- fiduciary FAILURE of Brussels and the ECB to reform the system is criminality in action.

"Let me issue and control a nation's money supply, and I care not who makes its laws." - Mayer Amschel Rothschild, Founder of Rothschild Banking Dynasty

But the EURO and EUROZONE were never about practical solutions for the public good. They are political projects gathering unaccountable power over sovereigns and the private sector to centralized socialist authoritarians.

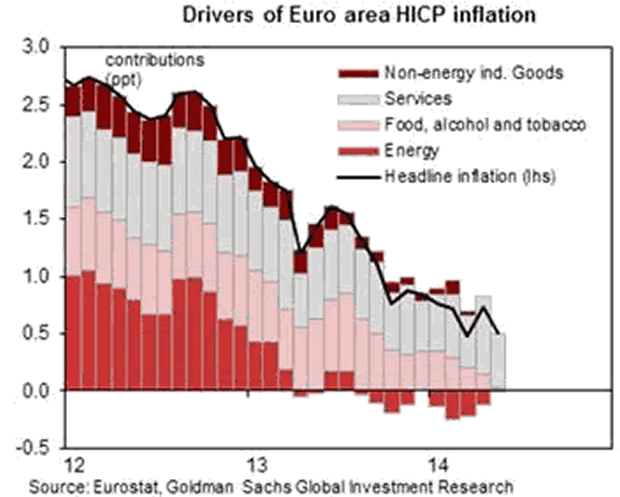

Look at that! Unbelievable! That is the FACE of an UNFOLDING DEPRESSION with three years of MOMENTUM! How can any self-respecting government or central bank not reform themselves and their policies till this is substantially REDUCED? Socialists would never dream of doing so as in their mind they are doing it for their OWN GOOD. Here is a look at Eurozone inflation adjusted for higher taxes and it is uglier than the Government number (as one would expect):

Once again, look at the MOMENTUM. The puny move the ECB has made is criminally short of what is required. Nothing will stop the freight train of economic collapse short of GOVERNMENT regulatory and tax reform combined with funding for the private sector through healthy banks. The zombies have NO LENDING capacity. The chances of these things happening are close to ZERO. Eurozone SOCIALIST governments NEVER return freedom or income once confiscated. Their goal is to seize and confiscate it. It is the source of the UNFOLDING societal unrest and the PLAN - Inflict pain until the public surrenders everything to their would-be masters in exchange for change. The public will give it up but the governments and central banks will not deliver them from their ANGUISH.

In closing

This week was a debacle for the developed world and their citizens. The punishment being meted out by our public servants and banksters was TORTUROUS to us all, a complete betrayal by the powers that be. Markets are poised for serious adjustments as complacency and moral hazard is an epidemic as are record mispricings of many assets. Historically speaking, malinvestments which produce very little income RARELY produce returns over the long-term. Be careful out there!

See you next week, Ty

I hope you enjoyed this second weekly wrap. It is a compendium of my daily exercises on my blog at www.TedBits.com. It is the second of MANY. Don't miss the next edition and my bi-weekly commentary, subscriptions are FREE: CLICK HERE.

Author's Note: Don't miss the next edition of Weekly Wraps and my bi-weekly commentary at www.TedBits.com. Check out the blog! Subscriptions are FREE: Sign up today!

In my opinion, the greatest man-made disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with your eyes shut? Are you prepared to turn this into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically? Hedging the printing presses impact on your paper money? This is what I do for investors - I help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.