Bitcoin Price Reversal or No Reversal?

Currencies / Bitcoin Jun 04, 2014 - 11:15 AM GMTBy: Mike_McAra

In short: we don't support any short-term positions now.

In short: we don't support any short-term positions now.

The big news of the day is the relatively small change in Apple policy which might, nonetheless, suggest that the company is changing its stance on virtual currencies, most notably on Bitcoin. The Guardian reported that Apple had changed its application review guidelines. The most interesting bit for Bitcoin enthusiasts is point 11.17 of the new rules:

Apps may facilitate transmission of approved virtual currencies provided that they do so in compliance with all state and federal laws for the territories in which the app functions.

This is not an announcement that the company would immediately accept Bitcoin apps but it certainly is a change from the hitherto policy of not making cryptocurrency apps available for customers. There haven't been further announcements regarding Bitcoin that we know of, so the next move is on the app developers' side. It is possible that Apple will want to implement some system of ensuring that the currencies are in fact "in compliance with state and federal laws" and that the company will have to figure out which virtual currencies it deems "approved."

While having a Bitcoin app might not be the biggest concern for the currency users, it might make using Bitcoin all the more simple for those who actually have a compatible Apple device.

For now, let's leave the app world and focus on the charts.

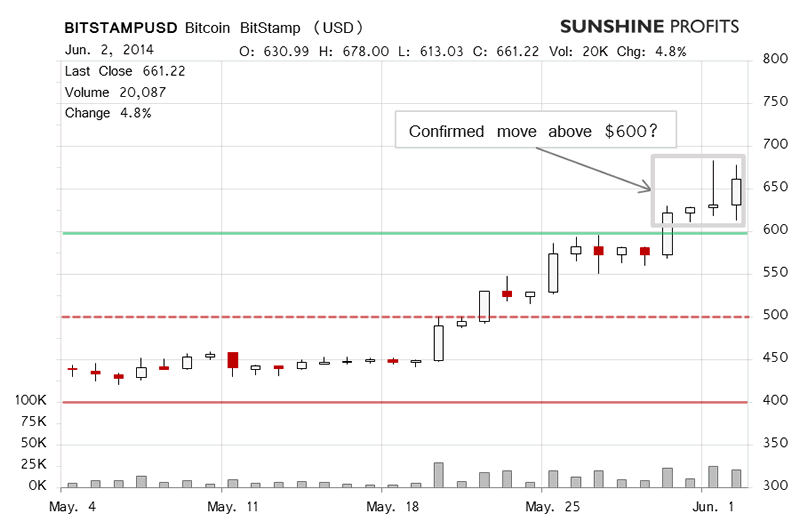

The exchange rate on BitStamp moved up in the late hours yesterday. The day ended above $650, 4.8% higher than the previous close. The volume at around BTC20,000 was lower than on the previous day but still relatively high. Yesterday was the fourth close above $600 and the first close above $650. This seems to confirm the breakout above $600 and a shift in the outlook to bullish.

Today, we've seen up and down movement (this is written after 10:00 a.m. EDT), a move to $680 and then a move down. The volume is relatively high but the move so far hasn't been indicative of a further strong move.

Right now it seems that the medium-term outlook might be bullish. As far as the short-term outlook is concerned, we expect to see some deterioration shortly, possibly to the level of $600. If the bullish medium-term outlook holds, this would be followed by more moves up.

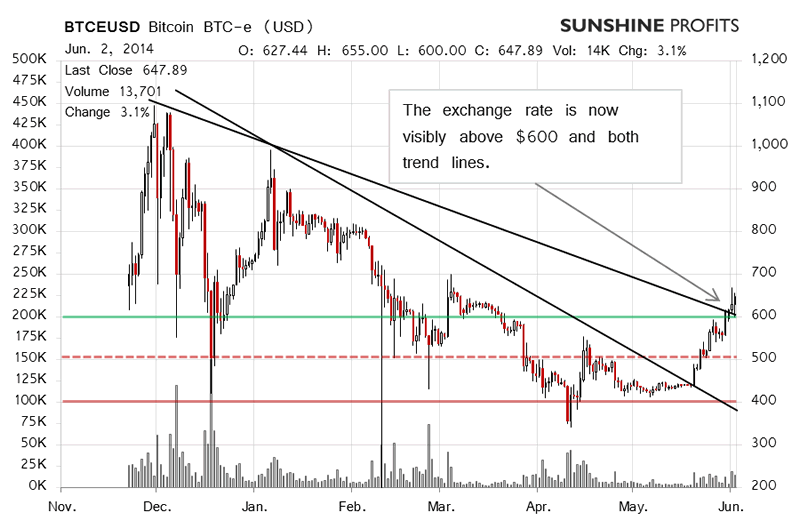

On BTC-e we now visibly see the exchange rate above $600 and both the trend lines we discussed recently. Yesterday we wrote:

The current move above $600, if confirmed which doesn't seem to far now, might change not only the short-term outlook but also the long-term one. If we don't see a move down below $600 in the nearest future, more appreciation might follow.

Right now, we're not seeing any indications of a move down. This would point to a change in at least the medium-term outlook. Because of the fact that we've just seen a strong period of appreciation, we might expect a pause in the nearest future, possibly a move back to $600 which would be followed by more appreciation.

At present, the short-term situation is still too unclear to open any speculative positions. A sign of weakness might point to a shorting opportunity. Such a move down could be followed by a short-term bottom which could be a buying opportunity.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. We expect a short-term move down and more appreciation to follow afterwards.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.