Where $1 of QE Money Printing Goes: The Untold Story

Interest-Rates / Quantitative Easing Jun 03, 2014 - 02:38 PM GMTBy: F_F_Wiley

“We don’t understand fully how large-scale asset purchase programs work to ease financial market conditions.” - New York Fed President Bill Dudley

“We don’t understand fully how large-scale asset purchase programs work to ease financial market conditions.” - New York Fed President Bill Dudley

“I don’t think there’s any doubt that quantitative easing enabled the rich and the quick. It was a massive gift… It was deliberate in the sense that we were hoping to create the wealth effect… I hope that we do indeed succeed in being able to say in the end the wealth effect was more evenly distributed. I doubt it.” - Dallas Fed President Richard Fisher

“Just as I thought it was going alright, I find out I’m wrong when I thought I was right, it’s always the same it’s just a shame, that’s all.” -Genesis front man Phil Collins

Sometimes the most interesting results are the ones you didn’t see coming.

We recently picked through financial flows data looking for clues about where a dollar of quantitative easing (QE) ends up.

For example, we wondered who parts with the bonds that find new homes on the Fed’s balance sheet. Dealers sometimes pass bonds straight from the Treasury to the Fed, but are they buying other QE-ready bonds mostly from households, pension funds, foreigners or other financial institutions? Also, can financial flows help us to guess at how much (if any) a dollar of QE adds to spending?

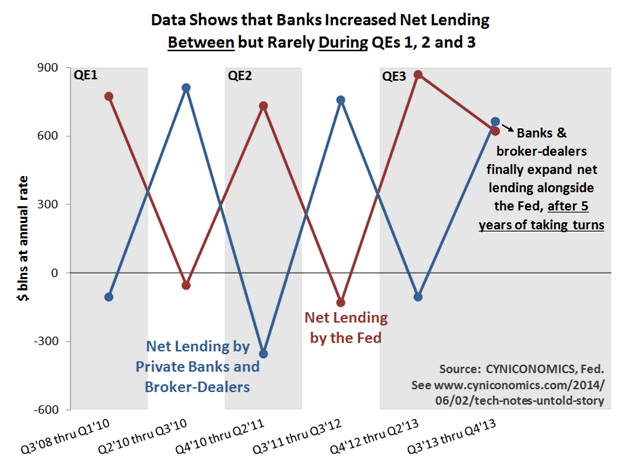

We didn’t expect clear answers and were surprised to stumble across this:

Needless to say, the chart raises a bunch of new questions, such as:

- Didn’t the Fed expect QE to complement other types of bank credit?

- What do they think of data suggesting it only displaced private sources of credit?

- Do they have any other explanations for the results in the chart?

Unfortunately, our direct line to the Eccles Building isn’t working this week, which prevents us from answering these questions. We’re left to form our own conclusions.

What to make of the “argyle effect”?

Our main takeaway is that the extra reserves created by QE aren’t so much an addition to bank balance sheets as a substitution. The addition story is the one we normally hear. It often leads to confused commentary, such as the mistaken ideas that banks “multiply up” or can “lend out” reserves. (We discussed these fallacies here.) But even without the confused commentary, the addition story doesn’t, well, add up.

According to financial flows data, it’s more accurate to say that QE’s extra reserves merely replaced other forms of balance sheet expansion. That’s a substitution story. It’s consistent with the fact that banks can neutralize QE’s effects with derivatives overlays and other portfolio adjustments. They can rearrange exposures to mimic a balance sheet of equal size and risk that’s not stuffed with reserves. (See this related discussion by blogger Tyler Durden.)

Think of it this way:

Your banker already knows how many slices of meat he wants in his sandwich. When the Fed shows up with a thick package straight from the deli, it saves him a trip of his own. He still makes the same sized sandwich, but it’s filled mostly by central bankers, and he adjusts it to his liking by varying the condiments.

Now, the full picture is more complicated than that, mainly because reserves move from bank to bank. For example, data shows a large amount of QE reserves accumulating at U.S. offices of foreign banks, where they appear to be funded by foreign lenders. You can think of these reserves as a means of recycling America’s current account deficits back into U.S. dollar assets. In other words, QE seems to encourage foreigners to swap other types of dollar assets for reserves at the Fed, supporting the substitution story.

Moreover, reserves can migrate from stronger banks to highly levered banks that are trying to improve capital ratios by lowering risk-weighted assets. This, too, is likely to result in balance sheet substitutions rather than additions.

Other banking practices may also help to explain the argyle effect, but there’s only so much we can learn from available data. For example, it’s impossible to determine how much banks were front running QE by buying bonds just before the Fed’s asset purchases began (although we consider clues in the appendix, which is linked below).

Bottom line

Whatever the interpretation, our chart fits nicely alongside Dudley’s and Fisher’s comments above. It says there’s much the Fed doesn’t understand, while at the same time showing that QE may have little purpose beyond providing a massive gift to wealthy traders and investors.

Getting back to our question of where a dollar of QE goes, the answer is “not far.” Outside of pushing up asset prices and encouraging an occasional luxury purchase, it doesn’t seem to escape the financial sector. Liquidity that might otherwise be offered by private institutions is instead provided by the Fed, and – as Phil Collins might put it – that’s all.

(Click here for an appendix with more discussion of the IS-LM model. Also, for empirical analysis of the differences between bank lending and other types of credit, see our earlier post, “3 Underappreciated Indicators to Guide You Through a Debt-Saturated Economy,” and the accompanying “technical notes.”)

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.