Crude Oil Price for the Bulls or Bears?

Commodities / Crude Oil Jun 02, 2014 - 06:29 PM GMTBy: Nadia_Simmons

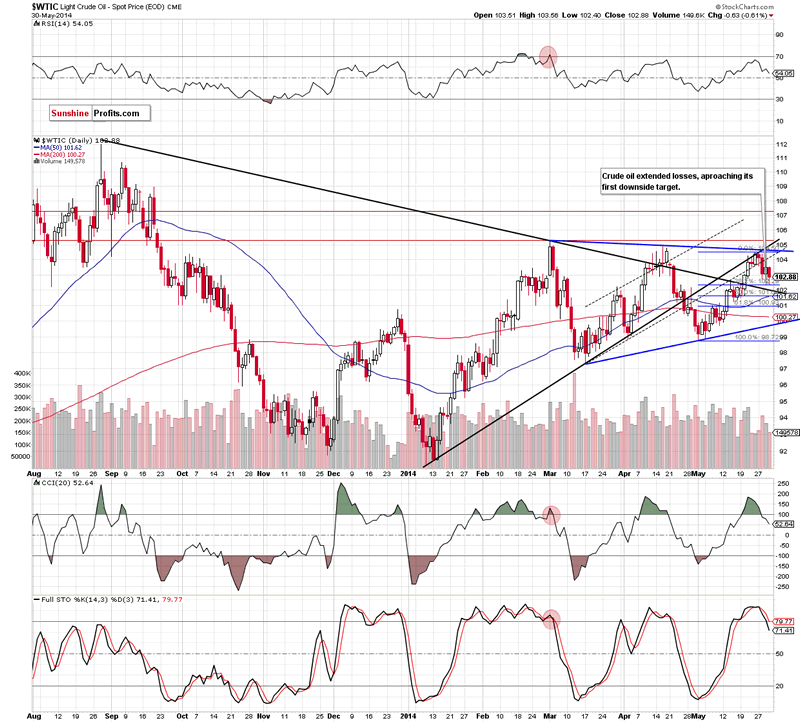

On Friday, crude oil lost 0.61% as disappointing U.S. economic data and profit taking weighted on the price. Thanks to these circumstances, light crude declined below $103, approaching its first downside target. What’s next?

On Friday, crude oil lost 0.61% as disappointing U.S. economic data and profit taking weighted on the price. Thanks to these circumstances, light crude declined below $103, approaching its first downside target. What’s next?

On Friday, the data showed that the Thomson Reuters/University of Michigan consumer sentiment index ticked up to 81.9, disappointing analytics expectations for a reading of 82.5. Additionally, the Commerce Department reported that personal spending in the U.S. dropped 0.1% last month, also below expectations for a 0.2% rise, while U.S. core personal consumption expenditures (without food and energy) rose 0.2% in April, in line with expectations. These disappointing data fueled worries that demand in the largest oil-consuming nation wouldn't be strong enough to reduce high supplies.

As a reminder, crude oil stocks climbed to 393 million barrels last week, not far from the record high of 399.4 million barrels reached in the week ended April 25, adding to demand concerns. Despite this build, the price of light crude moved higher as bigger-than expected drop in gasoline supplies and shrinking inventories in the Oklahoma overshadowed the above-mentioned increase in crude oil stocks. In reaction to this, investors locked in gains from Thursday's rally and sold the commodity for profits, pushing the price lower on Friday. Despite this fact and rising domestic supplies, crude oil ended the month up 3%, as traders focused on falling inventories in the Oklahoma.

North or south? Where will the commodity head next? Let’s look for answer on the charts (charts courtesy of http://stockcharts.com).

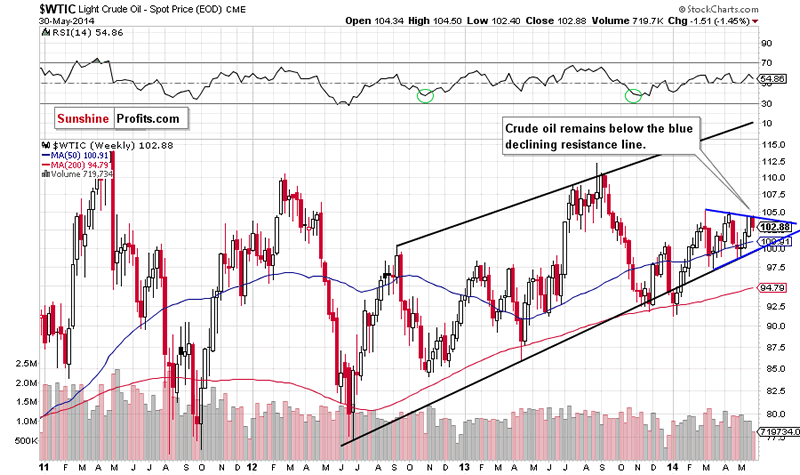

Looking at the weekly chart, we see that the medium-term picture hasn’t changed much as crude oil still remains below the blue resistance line based on the recent highs (the upper border of the triangle). Therefore, what we wrote in our last Oil Trading Alert is up-to-date:

(…) If this line holds, we will likely see a pullback and the nearest support will be the 50-week moving average (currently at $100.80) (…) the last week’s increase materialized on relative small volume, which questions the strength of oil bulls. On top of that, the RSI approached the level of 60. We saw similar reading in April and also earlier in March. Back then, such readings preceded declines. Therefore, if history repeats itself once again, we may see a correction in the coming week (or weeks).

Having said that, let’s focus on the very short-term picture.

Quoting our previous Oil Trading Alert:

(…) the previously-broken lower border of the rising trend channel successfully stopped further improvement and the commodity reversed. Additionally, sell signals generated by the CCI and Stochastic Oscillator are still in play. Therefore, we remain bearish and see this upswing as nothing more than a verification of the breakdown below the black dashed line. If this is the case, the commodity will extend losses in the nearest future and the first downside target will be around $102.30, where the 38.2% Fibonacci retracement based on the entire May rally is.

As you see on the daily chart, oil bears almost realized the above-mentioned scenario on Friday, pushing the commodity to the daily low of $102.40. If the support level created by the 38.2% Fibonacci retracement holds, we may see a rebound in the coming day. Nevertheless, if it doesn’t stop the selling pressure, we will see further deterioration and the next target for oil bears will be the black medium-term declining support line (currently around $102).

Summing up, crude oil extended losses, approaching its first downside target. Therefore, we remain bearish and see Thursday’s upswing as a verification of the breakdown below the resistance line (the lower border of the rising trend channel), which is a strong bearish signal that suggests that we’ll see lower values of crude oil in the coming day (days).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.