Gold and Silver - Why The State Might Prefer a Purely Digital Form of Fiat Money

Commodities / Gold and Silver 2014 May 31, 2014 - 11:57 AM GMTBy: Jesse

"This place is like somebody's memory of a town, and the memory is fading.

It's like there was never anything here but jungle." - Rust Cohle, True Detective

Gold and silver took it on the chin for this week, as we welcome the active month of June.

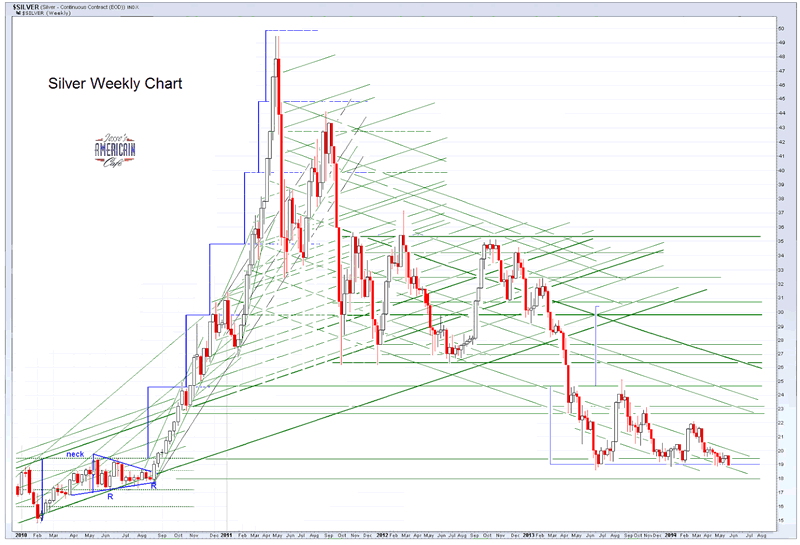

This is a historically weak period for precious metals, and the metals bulls should be glad of it, because contrary to the portraits being drawn on the paper charts, they are in a highly vulnerable position with regard to physical supplies. They are never so brazen as when they are desperate, and seek to put on a bold face, while quietly shitting their pants offstage.

I have been meaning to say something more about digital money, and the recent blurbs in its favor by some of the Western central banks, and their kindred voices amongst the economists. I intended to write a follow up to yesterday's Arbiters of Value, expanding the discussion to pure fiat in purely digital form, but became distracted by other matters. As I have noted before, sometimes procrastination has its benefits, because someone else speaks up, and says what one is thinking, and sometimes even better and more concisely.

I think Janet Tavakoli 'hit the nail on the head' with this recent letter she sent to The Financial Times with regard to Kenneth Rogoff's proposals for purely digital money. It was of course a nonsensical piece, but one might ask themselves why such a thing would be put forward now in this manner.

Here is an excerpt from the letter. You may read the entire piece at the link provided below.

It seems to me Kenneth Rogoff’s commentary, “Paper money is unfit for a world of high crime and low inflation” (May 28), is less about deterring crime and the problems of “low” inflation – food consumers in the US know double-digit inflation – than it is about eliminating the zero bound on interest rates and preventing people from bailing into cash.

In other words, Mr Rogoff proposes to machinegun one of the lifeboats by eliminating paper currency as an alternative to unlimited digital currency..His specious argument about the anonymity of paper currency facilitating tax evasion and crime is propaganda..."

Janet Tavakoli

Tavakoli Structured Finance

Chicago, IL USA

Read the entire letter at The Financial Times

'Negative interest rates' are a hightoned euphemism for systematic confiscation, a highly regressive form of bail-in.

I could not have said that better myself. When money is purely digital, the state obtains a significant control over all money everywhere, no matter what 'security' and 'algorithms' are said to be built into it. Digital anything requires a exceptional amount of trust in what those who manage the system do while no one is watching. And I would like to think that we are well beyond that point by now.

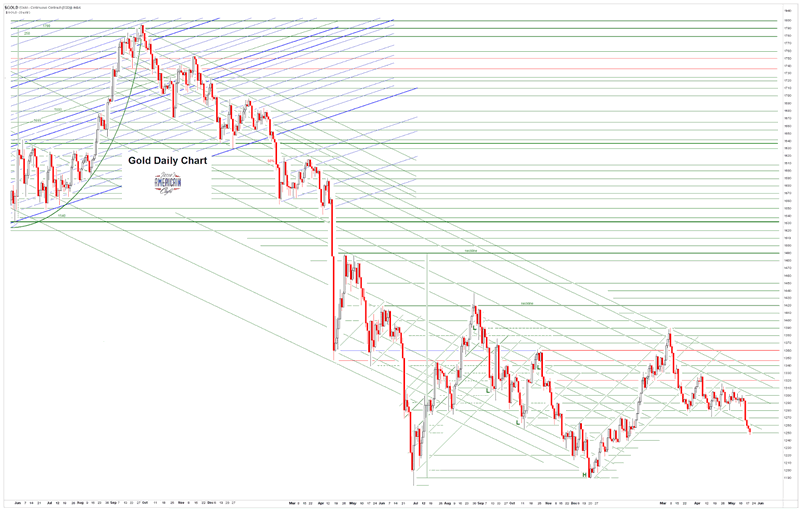

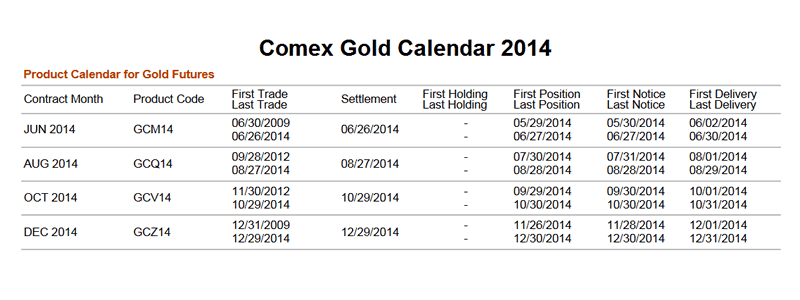

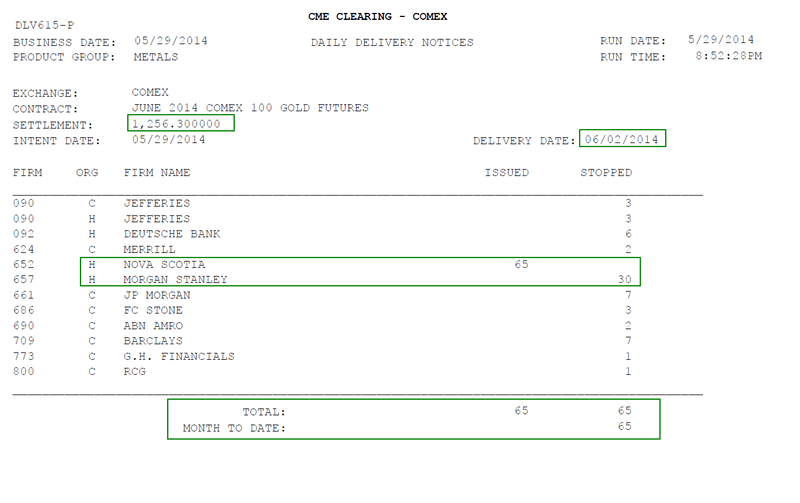

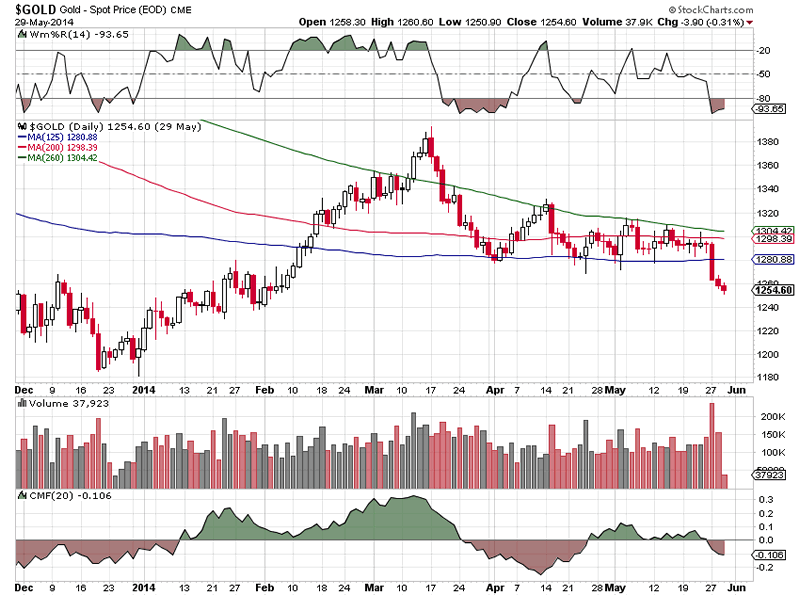

Non-Farm Payrolls report next week. We are now in the June delivery month, and the relevant chart shows the initial positions stood for below. Gold fell to a deeply oversold level on heavy volume for the option expiration 'mini-puke.'

As a reminder, the importance of the Comex is fading, and it will begin to fade even more quickly as the year progresses until it falls into irrelevancy, unless it is reformed.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.