HUI Gold Bugs Low Imminent

Commodities / Gold and Silver Stocks 2014 May 30, 2014 - 10:55 AM GMTBy: Austin_Galt

With the gold price recently embarking on its next move down, I thought it would be a timely opportunity to investigate the AMEX HUI Gold Bugs Index and see if anything can be gleaned from is chart.

With the gold price recently embarking on its next move down, I thought it would be a timely opportunity to investigate the AMEX HUI Gold Bugs Index and see if anything can be gleaned from is chart.

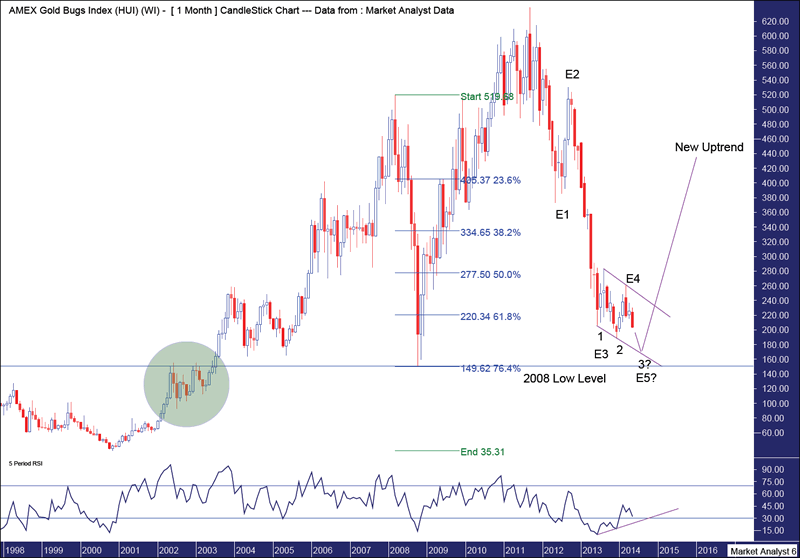

MONTHLY CHART- AMEX HUI GOLD BUGS

This is the monthly chart. Now I don’t like my charts too cluttered so I’m pushing it to the limit here but there is a lot of interesting information to process. Firstly, I want to examine the past before getting to the present. I have drawn a horizontal line at the 2008 low level. Looking in the circled area we can see how this level intersected around the same level as the 2002-03 highs. As Gann noted, old highs often become support in the future.

Also, I have added the Fibonacci retracement levels from the 2000 low to 2008 high. We can see how the 2008 low was virtually a direct hit on the 76.4% level. So both these pieces of evidence suggest the 2008 low was a major low. Now that seems easy in hindsight knowing what has taken place in recent years. However, I feel it is relevant to mention now as price is nearly back to these levels. And the point I want to make is the 2008 low, being such a solid low, should really hold the current down move. If the 2008 low is cracked then I would be starting to get the heebie jeebies about the long term uptrend sustainability of gold stocks.

Now moving forward to the present time, we can see the AMEX HUI Gold Bugs appears to be in a downtrend channel with the last low (2) lower than the previous low (1). It appears likely that price is now headed back down to the bottom of the channel which may set up the next low (3?). I have added a Relative Strength Indicator (RSI) and it can be seen that low points 1 & 2 coincided with less weak RSI readings. A low at point 3 appears as if it too will coincide with a higher RSI once again. So we can assume a bullish divergence is currently forming and once the next low is in a significant move up can be expected.

Now a common bottoming (and topping) pattern is three consecutive lows (and highs). I’ve nicknamed this the “three strikes and you’re out” pattern as once the third low (or top) is in a significant move can be expected which, in this case, may be a new bull trend. The bullish divergence in the RSI also supports this theory here.

Now I want to move on and look at the monthly gold chart in order to make some comparisons.

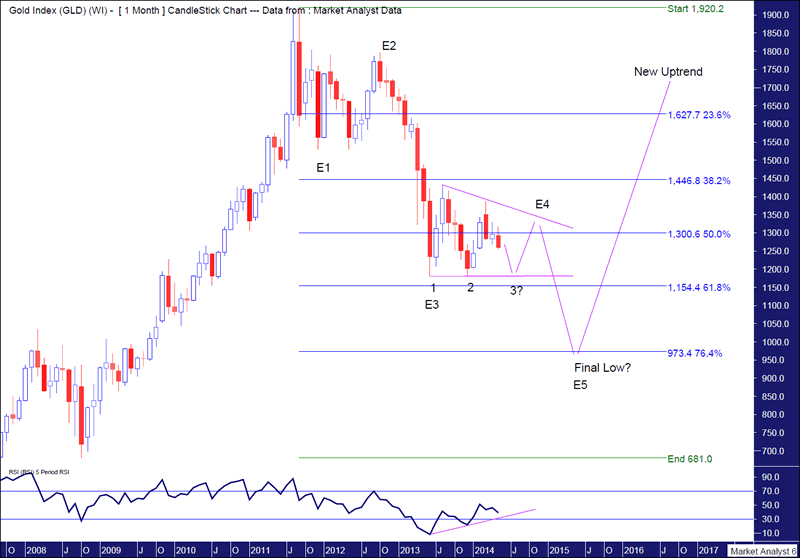

MONTHLY CHART – GOLD

Firstly, we can see the recent lows 1 & 2 and price currently appearing to head to point 3, just like the Gold Bugs chart. However, in this case the lows are part of a triple bottom and not lower lows as shown on the Gold Bugs chart. Both charts show a bullish divergence in the RSI so we can expect gold to rally as well after the next low is set. However, as Gann taught, triple bottoms rarely end trends and it is likely the fourth attempt at busting support will be successful.

I have also put Elliott Wave annotations on both charts denoted by E1, E2, etc. Now I’m not a massive fan of Elliott Wave analysis. Quite frankly, by the time we’ve gone into the second and third subdivisions my brain starts going fuzzy. So I try to keep it simple and get the overall feel of things. Now the interesting thing to note here is that while the AMEX HUI Gold Bugs chart appears to be in the final Wave 5, the Gold chart appears to still be tracing out its Wave 4. So perhaps the Gold Bugs will make its final correctional low while Gold is only making a temporary low at its point 3.

Moving out into the future, we could speculate based on these current observations that Wave 5 of the bear market in Gold, which could quite possibly be around the Fibonacci 76.4% retracement level of the 2008 low to 2011 high, may coincide with a Wave 2 in the Gold Bugs new bull market. Now this is purely speculation of course but it is worth keeping in mind. Besides, the Gold Bugs index and Gold both making their final correctional lows at the same time would seem too easy. And my experience over many years has shown me that the market is anything but!

Bio

I have studied charts for over 20 years and currently am a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts there seemed to be a dearth of technical analysts, at least ones that had a reasonable idea of things. So my aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

I am available to be a paid contributor for a reputable outfit. Please register your interest in my website coming soon. Contact austingalt@hotmail.com

© 2014 Copyright Austin Galt - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.