Agri-Foods Dramatic Price Rise During 2014

Commodities / Agricultural Commodities May 27, 2014 - 02:40 PM GMTBy: Ned_W_Schmidt

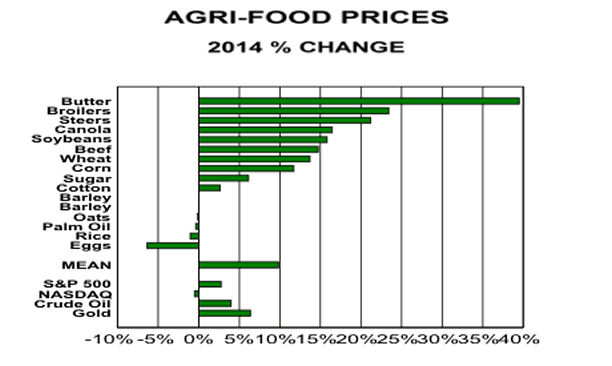

Agri-Commodities Prices Winning - Or, how long does it take the Street to identify an elephant in the room? Apparently the answer to that question is a time period longer than should be the case. As portrayed in the chart below, Agri-Food prices have been rising fairly dramatically thus far this year. With an average gain of about 10% since the beginning of the year, eating is becoming far more expensive. Rather than a short-term phenomenon, higher prices for Agri-Foods over time are part of the future, an unavoidable one.

Agri-Commodities Prices Winning - Or, how long does it take the Street to identify an elephant in the room? Apparently the answer to that question is a time period longer than should be the case. As portrayed in the chart below, Agri-Food prices have been rising fairly dramatically thus far this year. With an average gain of about 10% since the beginning of the year, eating is becoming far more expensive. Rather than a short-term phenomenon, higher prices for Agri-Foods over time are part of the future, an unavoidable one.

Prices rise for Agri-Foods when demand grows faster than supply. The world wants to eat more dairy products, butter included, and broilers, or table chicken. Supply simply does not respond in short-term to that increased demand. Response to higher demand by the marketplace is simply to raise prices for the commodity. A milk cow does not check the internet each morning for wholesale price of butter, and decide to produce more milk fat in response to higher quotes. And you can be assured that laying hens to do not try to lay more eggs when chicken prices are rising.

Prices rise for Agri-Foods when demand grows faster than supply. The world wants to eat more dairy products, butter included, and broilers, or table chicken. Supply simply does not respond in short-term to that increased demand. Response to higher demand by the marketplace is simply to raise prices for the commodity. A milk cow does not check the internet each morning for wholesale price of butter, and decide to produce more milk fat in response to higher quotes. And you can be assured that laying hens to do not try to lay more eggs when chicken prices are rising.

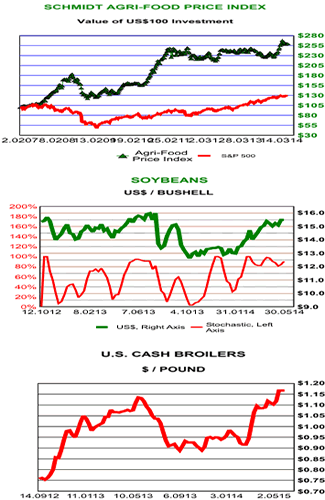

As chart to right portrays, prices for Agri-Commodities have been rising for quite some time, and recently reached a record high. That history suggests that something different has been happening with Agri-Commodity prices. That something different is that world demand for food is beginning to bump up against the world's long-term ability to supply food. Higher prices for beef will not change the reality that it takes about nine months for a calf to be born. The internet cannot change that fact. Higher prices for Agri-Commodities will not create another acre of arable land in either China or the U.S.

In top chart prices per pound for U.S. broilers, table chicken, are plotted. Those prices recently hit another new high. Chicken is both a price bargain relative to beef for consumers and an economic bargain to the world. To produce a kilogram of chicken requires slightly more than two kilograms of grain while with beef thirteen kilograms are required. (Agrimoney(2013), p. 150) Higher demand for chickens means that demand for feed grains should rise. As the price of soybeans shows in the second chart, strong global demand for animal feed has pushed up the prices of soybeans. Regardless of growth rate of China's GDP, the chickens in that country still eat every day. More than half of soybean harvest is destined to become chicken feed. Soybeans

And we can assure you that the internet cannot produce a single soybean. Still requires a farmer in the field using equipment, fertilizer, and seed. Still requires someone to gather, process and move those soybeans around the world in order to feed global consumers. In that process money, our real interest, flows from consumers to farmers. Agri-Equities are the ultimate benefit of this flow of money, and they remain largely ignored by the investment community.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2013 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.