Strategic Investment - A Bubble In Complacency

Stock-Markets / Financial Markets 2014 May 26, 2014 - 06:28 AM GMTBy: John_Mauldin

Notes from SIC 2014

Notes from SIC 2014

I and many others are still trying to digest the massive amount of useful and original information that was offered at last week’s Strategic Investment Conference. In this week’s letter I want to recap some of what I learned but do so in a little different manner. I find it quite instructive to listen to and read what other people have to say about their takeaways from the conference. I have come across several very good summaries and reviews that I am going to excerpt rather liberally, along with sharing some of my own thoughts.

Nearly everyone noted that there was somewhat of a divide in the opinions as to whether things in the US and global economies are getting better or getting worse. Upon reflection, I think that John Nicola (my Canadian partner of the eponymous wealth management firm, who sent me his comments, which I will use freely below) had it right. If we all examine a glass that is filled up to the mid-level, some of us will describe it is half-full, and others will describe it as half-empty. And of course there is plenty of data to back up either the optimistic or the pessimistic position.

The simple fact is that we are in what I call a Muddle Through Economy. Things aren’t terrible, but they are not great, either. We’ve come through a devastating Great Recession caused by a crisis in the financial sector. It is quite typical for the effects of such a crisis to linger for a decade or more. So compared to where we were at the bottom of the Great Recession, the glass is half-full. But compared to the expectations we have for economic recovery and the resumption of vibrant growth, half-full seems like an exaggeration. And for many people, the glass is simply empty, while for others it is spilling over.

Steve Moore sent me a graph demonstrating that net new jobs since the onset of the Great Recession have come, in large measure, from the energy sector. Those are generally high-paying jobs, but the rest of the country and many industries have not done so well. According to a new report from the National Employment Law Project, the quality of the jobs that have been created since the end of the last recession does not match the quality of the jobs that were lost during that recession:

- Lower-wage industries constituted 22 percent of recession losses, but 44 percent of recovery growth.

- Mid-wage industries constituted 37 percent of recession losses, but only 26 percent of recovery growth.

- Higher-wage industries constituted 41 percent of recession losses, and 30 percent of recovery growth.

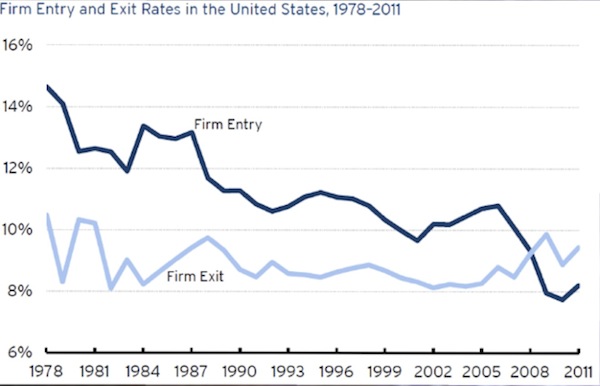

Yes, unemployment is down, but so is labor participation, and the simple fact is that outside of the petroleum sector new jobs are not being created to anyone’s satisfaction. In my presentation at the conference I showed a chart that illustrates the fact that we are losing businesses faster than we are creating new ones – an unprecedented statistic. This is a glass not only half-empty but leaking:

Richard Lehmann and Marty Fridson attended the conference and wrote an exceptionally well-done review in Forbes. (I was honored that they attended.) They started with the optimistic note that my good friend David Rosenberg offered as the very first speaker at the conference:

David Rosenberg, chief economist and strategist at Gluskin Sheff, sees reduced unemployment as a positive sign for the economy, despite objections that the decline in the unemployment rate reflects an unusually low participation rate. For one thing, says Rosenberg, the number of discouraged workers is down by 40% from the peak. At the margin, he adds, people are choosing to stay out of the work force in response to government incentives to remain idle.

The number of people collecting disability benefits, using food stamps, or collecting welfare payments is at a record high. Three-quarters of the reduction in the participation rate, says Rosenberg, is attributable to demographics, as the number of Baby Boomers reaching age 65 is rising dramatically.

Rosenberg further notes that unfilled job openings are at a five-year high. The U.S. government is granting fewer visas, college students are graduating without marketable skills, and the skills of many workers who have been laid off for long periods have become outdated. If all of the current openings could be filled, unemployment would drop to 4%.

The bottom line for Rosenberg is that the current recovery/expansion is in the fourth inning. Business cycles never die from old age, he maintains. He puts the probability of recession in 2015 at close to zero….

Richard Yamarone, senior economist at Bloomberg Economics, takes a less sanguine view on unemployment than David Rosenberg. He argues that the type of jobs being created makes a difference. Currently, job creation is skewed toward low-skill, low-income categories. To circumvent the Affordable Care Act’s requirement to provide health care to full-time employees, retailing, health care and food service employers are cutting workers’ hours. Consequently, new jobs are being created for people who now have to hold multiple part-time jobs, but that does not constitute a genuine increase in employment or GNP.

Yamarone’s view of the labor market leads to a comparatively bearish outlook on the economy. Since GDP began to be reported in 1947, he points out, the U.S. economy has slid into recession every time GDP growth has fallen to 2%, a level below which it currently stands.

Yamarone also reports unfavorable readings in four of five special data series that he has found to be accurate indicators of the economy—dining out, casino gambling, jewelry and watches, cosmetics and perfumes, and women’s dresses….

Lacy Hunt, executive vice president of Hoisington Investment Management, contends that the Fed’s strategy for boosting the economy is not working. Little wealth effect (the tendency of people to step up their spending when their wealth increases) has been observed. Hunt explains that the monetary policy cannot influence the economy unless the market rate of interest (represented by the Baa corporate bond yield) is below the natural rate of interest (the nominal rate of GDP growth). That has not been the case at any point during the recovery. Until it is, Hunt contends, consumers will have no incentive to take on debt to finance spending and economic growth will consequently remain sluggish.

Lacy believes all major developed countries are going to have deal with their “Minsky moments,” because not enough of their overall debt is productive. When all debt (government, corporate, and personal) is added up, it equals 350% of GDP in the US and 440% in developed countries on average. Lacy kept emphasizing his conviction that any number over 275% results in limited growth and eventual deflation.

David Zervos expects the Fed to keep interest rates low until it gets either inflation or solid economic growth. In fact, the private sector has been growing at more than 3% annually since 2010. His view is that savers will continue to be punished, because the interest rates they receive will remain artificially low. Gary Shilling was decidedly more upbeat and felt solid economic growth is at hand. (Nicola)

I noted an interesting theme in several speeches. Millennials, Jeff Gundlach noted, are different. They are less acquisitive. Neil Howe also talked about this and noted that we are in the middle of a “Fourth Turning,” which is a typically an isolationist period. He also notes that Millennials (1981-1994) like to rent (not just homes but cars, recreational property, clothing, etc.) They have less stress, often live at home with their parents, and are looking for meaningful work where they can be mentored. Ian Bremmer echoed Neil’s theme and stated that one of the important geopolitical trends at play is that the US is becoming more isolationist.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

The article Thoughts from the Frontline: A Bubble In Complacency was originally published at mauldineconomics.com.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.