Silver Price at Critical Support

Commodities / Gold and Silver 2014 May 19, 2014 - 03:04 PM GMTBy: P_Radomski_CFA

Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

The previous week started quite favorably for precious metals bulls, but as the week progressed, the situation became less bullish, and finally we saw some bearish signs. Overall, the previous week didn’t change much. Let’s take a closer look (charts courtesy of http://stockcharts.com).

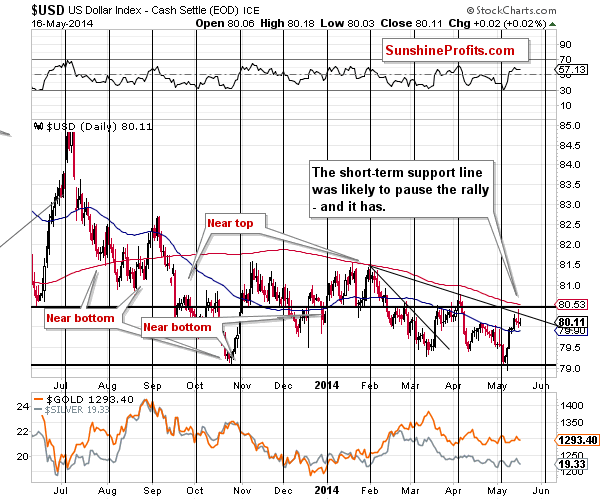

In the previous alerts we wrote a lot about gold, silver and miners’ reaction to the dollar’s rally (more precisely: about the lack of reaction) and the strength of the implications. In short, we didn’t think that the consequences were really bullish, because there had been many cases when the precious metals’ reaction was simply delayed, not absent. We saw some other bearish signs, but we’ll move to them in the following part of this alert. As far as the USD Index is concerned, we saw a pause after a strong rally. It was nothing surprising, as the previous rally was quite sharp and the index moved to the short-term resistance line.

What’s interesting is that while the first part of the last week was rather bullish for metals – they didn’t decline despite the dollar’s rally – the final part of the week was bearish as metals declined without a rally in the dollar. It could be the case that metals are starting to catch up as far as their reaction to the dollar’s rally is concerned.

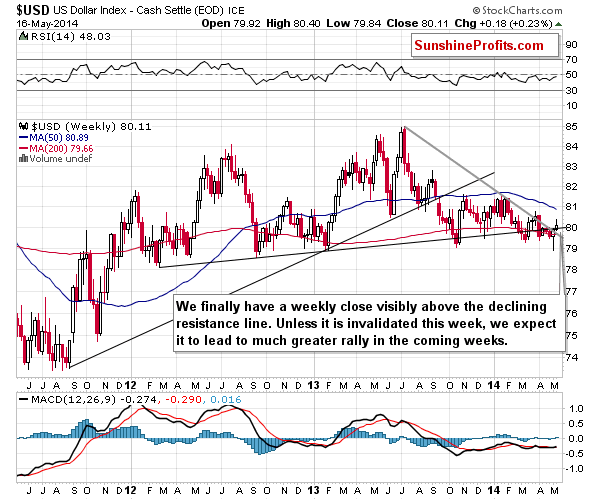

Has the USD Index really paused or is the rally already over?

The medium-term chart suggests that the move higher has just begun as we saw a breakout above the important resistance line, and we saw a weekly close above it. Another move higher will further confirm the breakout and likely convince more traders that the currency is really about to rally substantially in the coming weeks.

This means that the biggest (bearish) impact on the precious metals sector is still ahead of us.

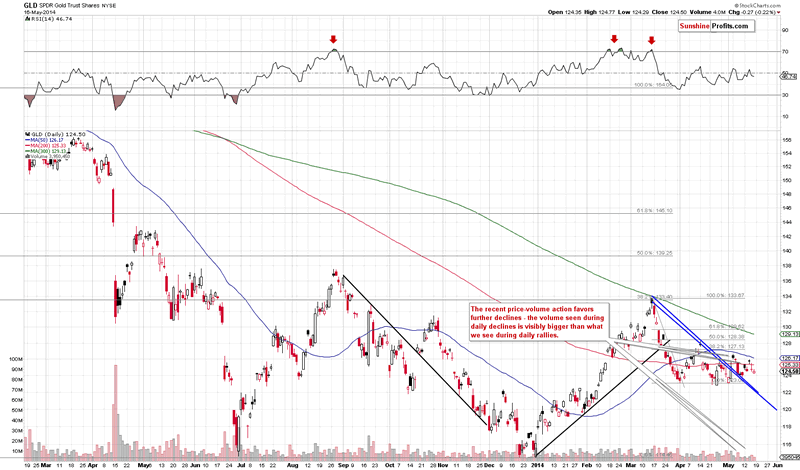

The situation in the gold market didn’t improve on Friday, and what we wrote in Friday’s alert remains up-to-date:

Yesterday, we wrote that GLD ETF had moved higher on tiny volume, which was a bearish sign. Another bearish sign (or more precisely: not a bullish one) was that we didn’t have gold above the previous local high. Moreover, we emphasized that this week’s small upswing hadn’t made gold move above the 50-day moving average and that the small move higher still seemed to be a counter-trend move.

The above is up-to-date and yesterday’s session confirms it – the GLD declined on volume that was significantly bigger than the volume accompanying the previous daily rallies.

The price-volume signs continue to point to lower prices in the coming days.

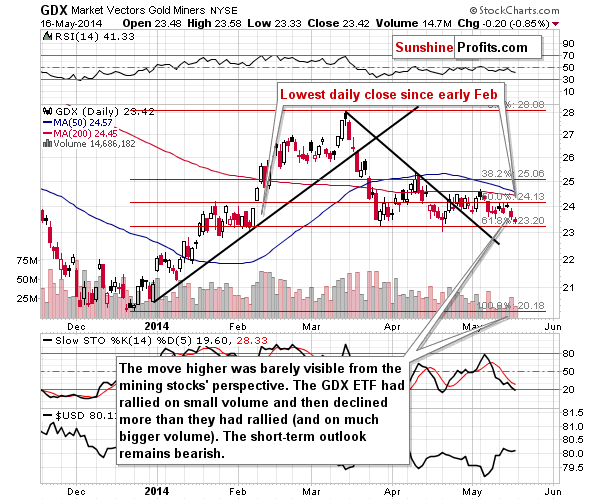

Mining stocks moved lower even more visibly than gold did. In fact, please note that while gold is above its March and April lows, the GDX ETF has just closed slightly below them. Mining stocks are showing weakness and suggest that another move will be to the downside.

What we wrote previously about the mining stocks sector remains up-to-date:

The “lower highs” observation applied to the mining stocks sector and the bearish price-volume implications were seen here as well. Just as it is the case with the gold market, the situation remains bearish, and yesterday’s decline on relatively big volume confirms it.

The precious metals sector usually declines in the middle of May, so we have bearish implications also from this perspective.

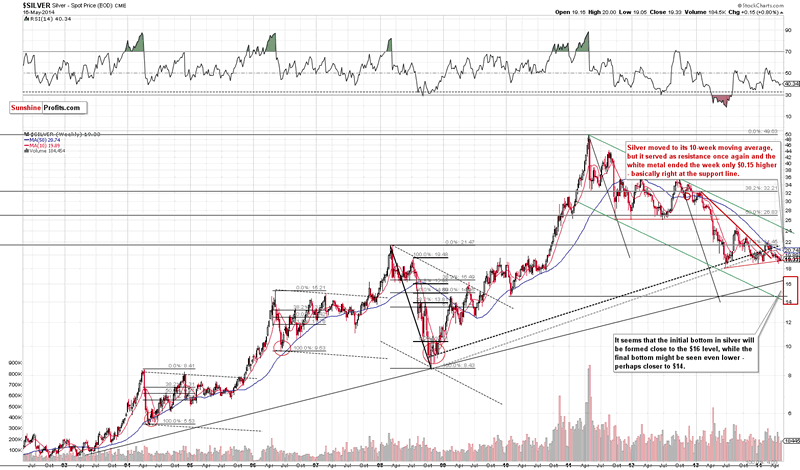

Before we summarize, let’s take a look at the long-term silver chart.

In the May 15, 2014 Alert we wrote the following:

Silver, on the other hand, has moved visibly higher this week. Is this a bullish factor? Not necessarily. Silver’s outperformance used to be a very bullish signal in the past years, but that was not the case in the more recent past. Since March all cases of silver’s outperformance (and many cases before that) have been the final sell signals for the precious metals sector.

History – the recent history – seems to have repeated itself once again. Silver moved sharply higher only to disappoint in the following days. Overall, the white metal moved higher by only $0.15, which means that it was basically flat.

The important factor to keep in mind here is that silver was (at the beginning of the week) and once again is right at its rising support line. Once this line is broken, we can expect a big (say, more than $1) move lower. It’s quite visible – many traders realize this. With this in mind, it’s no wonder that the current support was the start of a sharp rally. However, the fact that the rally was only very temporary and followed by an immediate move back to this line means that the strength of buyers is smaller than the strength of sellers.

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet. Precious metals are not responding strongly (we saw some reaction in the final part of last week, though) to the dollar’s rallies so far, but it seems that investors and traders are simply waiting for a confirmation of the breakout in the USD Index (there have been cases when the metals’ reaction was delayed in the past). Plus, silver’s strong performance and the lack thereof in the case of mining stocks, plus lower highs in gold and mining stocks, are a bearish combination.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.