Smoking Gun From The U.S. Federal Reserve - Murder Of The Middle Class

Politics / Social Issues May 19, 2014 - 11:56 AM GMTBy: James_Quinn

“Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling.” - Ben Bernanke

“Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling.” - Ben Bernanke

“The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.” – Alan Greenspan

There you have it – the wisdom of two Ivy League educated economists who are primarily liable for the death of the American middle class. They now receive $250,000 per speaking engagement from the crooked financial parties their monetary policies benefited; write books to try and whitewash their legacies of failure, fraud, and hubris; and bask in the glow of the corporate mainstream media propaganda storyline of them saving the world from financial Armageddon. Never have two men done so much damage to so many people, so quickly, and are not in a prison cell or swinging from a lamppost. Their crimes make Madoff look like a two bit marijuana dealer.

The self-proclaimed Great Depression “expert” Ben Bernanke peddles pabulum about inflation being too low and posing dire risk to the economy, but is blasé that swelling the Federal Reserve balance sheet debt from $900 billion in 2008 to $4.4 trillion today with his digital printing press poses any systematic risk to the country and its citizens. Either his years in academia have blinded him to the reality of his actions upon the lives of real people living in the real world, or his real constituents have not been the American people, but the Wall Street bankers that pulled his puppet strings over the last eight years.

Now that he has passed the Control-P button to Yellen, he is reaping the rewards of bailing out Wall Street and further enriching them with QEfinity. Ben earned a whopping $200,000 per year as Federal Reserve chairman. He now rakes in $250,000 per speech from the very financial interests who benefited from his traitorous monetary machinations. I don’t think he will be invited to speak at any little league banquets by formerly middle class parents whose standard of living has been declining since the 1980s. Is it a requirement that every Federal Reserve chairperson lie, obfuscate, misinform, hide the truth, and do the exact opposite of what they say they will do?

“It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.” - Ben Bernanke – October 2007

Greenspan, Bernanke and Yellen have always been worried about deflation, while even the government suppressed CPI calculation reveals that inflation has risen by 108% since the day Greenspan assumed office in August 1987. The dollar has lost 52% of its purchasing power in the last 27 years of Fed induced bubbles and busts. And these scholarly academic bozos have been worried about deflation the entire time. Since Nixon closed the gold window in 1971 and unleashed the two headed inflation loving gargoyle of debt issuing bankers and feckless self-serving politicians upon the American people, the dollar has lost 83% of its purchasing power (even using the bastardized BLS figures).

Any critical thinking person with their eyes open knows the official inflation figures have been systematically understated since the 1980’s by at least 3% per year. Should the average American be more worried about deflation or inflation, based upon what has occurred during the 100 years of the Federal Reserve controlling our currency?

I’m sure Greenspan is content and proud, as he succeeded through his own endeavors in rewarding, encouraging and propagating excessive risk taking by the Wall Street cabal during his 19 year reign of error. He exited stage left as the biggest bubble in history, created by his excessively low interest rate policy, blew up and destroyed the 401ks and home values of the middle class. This was the second bubble under his monetary guidance to burst. The third bubble created by these Keynesian acolytes of easy money will burst in the near future, further impoverishing what remains of the middle class and hopefully igniting a long overdue revolution.

Greenspan’s pathetic excuse for a career has benefitted those who owned him, while leaving a trail of casualties that circles the globe. His inflationary dogma, Wall Street enriching doctrine and Keynesian motivated schemes have drained the savings and confiscated the wealth of the middle class through persistent and devastating inflation. And it was done by a man who knew exactly what he was doing.

“Under the gold standard, a free banking system stands as the protector of an economy’s stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation” – Alan Greenspan – 1966

The abandonment of the gold standard in 1971 set in motion four decades of consumer debt accumulation on an epic scale, currency debauchment, and real wage stagnation. The consumer debt accumulation was a consequence of the American middle class being lured into debt by the Too Big To Trust Wall Street banks and their corporate media propaganda machine, as a fallacious response to stagnating real wages when their jobs were shipped to China by mega-corporations using wage arbitrage to boost quarterly profits, their stock prices, and executive bonuses.

The bottom four quintiles have made no progress over the last four decades on an inflation adjusted basis. The middle quintile, representing the middle class, has seen their real household income grow by less than 20% over the last 43 years. And this is using the understated CPI. In reality, even with two spouses working today versus one in 1971, real household income is lower today than it was in 1971.

The more recent data, during the Greenspan/Bernanke inflationary era, is even more disconcerting and destructive. Real median household income has grown at an annualized rate of less than 0.5% over the last thirty years. During the bubblicious years from 2000 through 2014, while Wall Street used control fraud and virtually free money provided by the Fed to siphon off hundreds of billions of ill-gotten profits from the economy, the average middle class family saw their income drop and their debt load soar. This is crony capitalism success at its finest.

The oligarchs count on the fact math challenged, iGadget distracted, Facebook focused, public school educated morons will never understand the impact of inflation on their daily lives. The pliant co-conspirators in the dying legacy media regurgitate nominal government reported income figures which show median household income growing by 30% over the last fourteen years. In reality, the real median household income has FALLEN by 7% since 2000 and 7.5% since its 2008 peak. Again, using a true inflation figure would yield declines exceeding 15%.

Greenspan and Bernanke’s monetary policies loaded the gun; Wall Street bankers cocked the trigger with their no doc negative amortization mortgages, $0 down – 0% interest – 7 year subprime auto loans, introducing the home equity line ATM, and $20,000 lines on dozens of credit cards; the media mouthpieces parroted the stocks for the long run and home prices never fall bullshit storyline, encouraging Americans to pull the trigger; government apparatchiks and bought off politicians and their deficit expanding fiscal policies, pointed the gun; and the American people pulled the trigger by believing this nonsense, blowing their brains all over the fine Corinthian leather interior of their leased BMWs sitting in the driveway in front of their underwater McMansions.

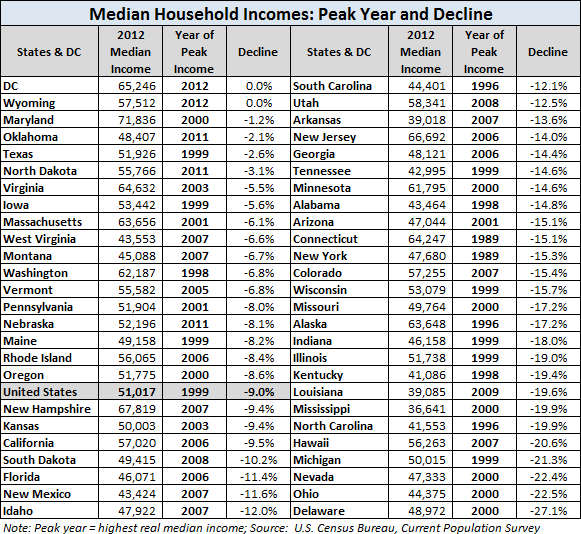

Median household income in the United States peaked in 1999. The internet boom, housing boom and now QE boom have done nothing beneficial for middle class Americans. They have been left with lower real income, less home equity, no savings, and no hope for a better tomorrow. Most states saw their median household income peak over a decade ago, with more than half the states experiencing double digit declines and ten states experiencing declines of 19% or higher. It’s clear who has benefitted from the fiscal policies of spendthrift politicians and the spineless inhabitants of the Mariner Eccles Building in the squalid swamplands of Washington D.C. – the pond scum inhabiting that town. The median household income in D.C. stands at an all-time high. Winning!!!!

A former inhabitant of Washington D.C. spoke the truth about inflation and the men who benefit from it in the 1870’s. He was later assassinated.

“Who so ever controls the volume of money in any country is absolute master of all industry and commerce and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” – James Garfield

The Federal Reserve, a private bank representing the interests of its Wall Street owners, has been in existence for 100 years. It has managed to diminish the purchasing power of the dollar by 95%, while causing depressions, enabling never ending warfare, allowing politicians to expand the welfare state to immense unsustainable proportions, and enriched its true constituents on Wall Street beyond the comprehension of average Americans. In 2002 Ben Bernanke made his famous helicopter speech where he promised to drop dollars from helicopters to fight off the ever dangerous deflation. After the Fed created 2008 worldwide financial collapse he fired up his helicopters, but dropped trillions of dollars on only one street in America – Wall Street. He dropped turkeys on Main Street, and we all know from Les Nesman what happens when you drop turkeys from helicopters.

Les Nesman: Oh, they’re crashing to the earth right in front of our eyes! One just went through the windshield of a parked car! This is terrible! Everyone’s running around pushing each other. Oh my goodness! Oh, the humanity! People are running about. The turkeys are hitting the ground like sacks of wet cement! Folks, I don’t know how much longer… The crowd is running for their lives.

Arthur Carlson: As God is my witness, I thought turkeys could fly.

The intellectual turkeys running this treacherous institution create a new and larger crisis with each successively desperate gambit to keep their Ponzi scheme alive. Even though Greenspan, Bernanke and Yellen are highly educated, they are incapable or unwilling to focus on the practical long-term implications of their short-term measures to keep this perverted financial scheme from imploding. Denigrating savings and capital investment, while urging debt financed spending on foreign produced trinkets and gadgets passes for economic wisdom in the waning days of our empire. Courageous and truthful leaders are nowhere to be found as the country circles the drain. Farewell middle class. It was nice knowing you.

“There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: “In the long run we are all dead.” And such shallow wisecracks pass as devastating epigrams and the ripest wisdom.” – Henry Hazlitt – Economics in One Lesson

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2014 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.