Tech Stock Digital Utilities Investing, Amazon Bubble Danger

Companies / Tech Stocks May 18, 2014 - 03:49 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Thousands of investors just learned a painful lesson...

Dr. David Eifrig writes: Thousands of investors just learned a painful lesson...

They learned the word "exciting" comes right before big investment losses.

But there's one word that often comes right before investment gains, which I'll tell you about in a moment. But first, let's talk about Twitter...

Since the start of the year, Twitter shares are down 50%.

Last week, Twitter shares fell 17% in a single day.

I've never owned Twitter stock... and never will.

Twitter and a whole slew of technology stocks have high valuations even though they sell nothing but ways to waste time for people with nothing better to do.

Why would I care when a Hollywood celebrity goes out to eat dinner? Do I need a sports star to remind me to "pray" for the victims of some televised disaster?

Despite my thoughts on the matter, investors have lined up to buy stocks like Twitter. And now they are paying for it.

But at the same time these soaring tech stocks were collapsing, a different group of tech stocks were holding their value or even rising.

Companies such as Cisco (CSCO) and Intel (INTC) performed well. So did software giant Microsoft (MSFT), mobile-phone-technology developer Qualcomm (QCOM), software firm Oracle (ORCL), and others.

These tech companies aren't exciting to most investors... In fact, many would even call them "boring."

As regular readers know, I like to call these types of stocks "Digital Utilities." And although they may seem like "boring" businesses, the mountains of cash they produce and return to shareholders are anything but...

Rather than touting some hot new device or social-media service that wastes everyone's time, these companies provide technology services that are ubiquitous and a part of our daily lives.

For example, whenever you use your PC, you're certain to be using Microsoft's operating system. Whenever you connect to the Internet, the traffic is passing through Cisco servers. Whenever your smartphone makes a call, it's using a Qualcomm chip.

And separating these real businesses from the risky ones is simple. All you have to do is look for a few simple signs that show which tech stocks will deliver safe profits.

One of the most obvious ways to separate the risky stocks from high-quality Digital Utilities is their price multiples. Stick with companies that trade at low metrics, like price to earnings, book value, or sales.

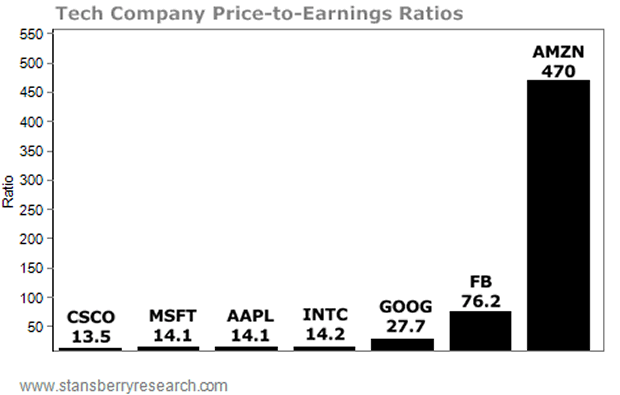

To show you what I mean, we'll look at price-to-earnings (P/E) ratios. But you can use almost any traditional measure such as price-to-sales or price-to-book ratios and see roughly the same thing. Look at how wildly overvalued Amazon (AMZN) and Facebook (FB) are compared with other big tech firms...

So while blue-chip tech firms Apple (AAPL), Cisco, Intel, and Microsoft all trade for 13-14 times earnings... Amazon trades for an indefensible 470 times earnings. Twitter has no earnings, so its ratio is infinite. Its P/E is literally incalculable.

Now, some people may be tempted by these high-flying tech stocks. After all, some of them could be the "next big thing" and grow many times over – making a fortune for you if you get it right.

That may be true... but as we've seen over the past few months, you can earn even better returns by sticking to the old, "boring" cash producers.

Although these companies may not be very exciting to most investors, the consistent returns they generate will protect you from the wild swings we've seen recently in stocks like Twitter... and help you sleep better at night.

To our health, wealth, and a great retirement,

David Eifrig Jr.

P.S. I recently produced a book with S&A Editor in Chief Brian Hunt. It lays out the exact options strategies I've used in my Retirement Trader service to deliver winning trades each year. Probably fewer than 1% of the investors in America know about, use, or understand these strategies. The book also lists the 25 best stocks to trade using these strategies. They're among the safest, highest-quality stocks on the market (and you shouldn't be surprised to learn several of them are Digital Utilities).

We believe these ideas are so important, everyone should know them. And when you read about them, you may never want to invest the traditional way ever again. For the full details on this book – including how to get your copy now – click here.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.