Bitcoin Possible False Calm

Currencies / Bitcoin May 16, 2014 - 11:02 PM GMTBy: Mike_McAra

In short: we still support short speculative positions in the Bitcoin market, stop-loss $470.

In short: we still support short speculative positions in the Bitcoin market, stop-loss $470.

At least 10 members of the Bitcoin Foundation have left in the wake of the election of Brock Pierce as a new director, Reuters reported. We can read:

Some of the members cited Pierce’s troubled past. That includes allegations in lawsuits from three employees of Pierce’s first company, bankrupt web video business Digital Entertainment Network, that he provided drugs and pressured them for sex when they were minors.

Pierce has denied the accusations, which first surfaced in 2000.

“The allegations against me are not true, and I have never had intimate or sexual contact with any of the people who made those allegations,” Pierce told Reuters via email.

This is probably not the kind of attention the Bitcoin Foundation had hoped for. But it is not surprising that such a media storm has followed given the kind of past allegations against Pierce. The Bitcoin Foundation doesn’t seem to have a good track record now. Two of its board members, Charlie Shrem and Mark Karpeles resigned their seats earlier this year. Shrem was indicted for money laundering, while Karpeles lost track of the exchange’s customers’ money to the tune of $450 million, the matter being investigated by courts in both Japan and the U.S.

Of course, it’s “innocent unless proven otherwise” so neither of the trio is a convicted felon but the choices the Bitcoin Foundation has made as far as its board members are concerned don’t help in building a strong reputation. The current fuss over Pierce might hurt the organization, which had already had problems following the departures of Shrem and Karpeles.

There have been calls for vetting candidates in order to avoid such negative publicity in the future. Right now it seems that the troubles of the Bitcoin Foundation are linked to the general troubles Bitcoin has with getting more widespread attention. Bitcoin is still perceived as a novelty but the recent cases linking it to money laundering or other kinds of criminal activity taint the currency’s image with the general public.

If the Bitcoin Foundation isn’t able to address some of these issues effectively, we might see its position in the Bitcoin community waning.

Now, let’s take a look at the charts portion of today’s alert.

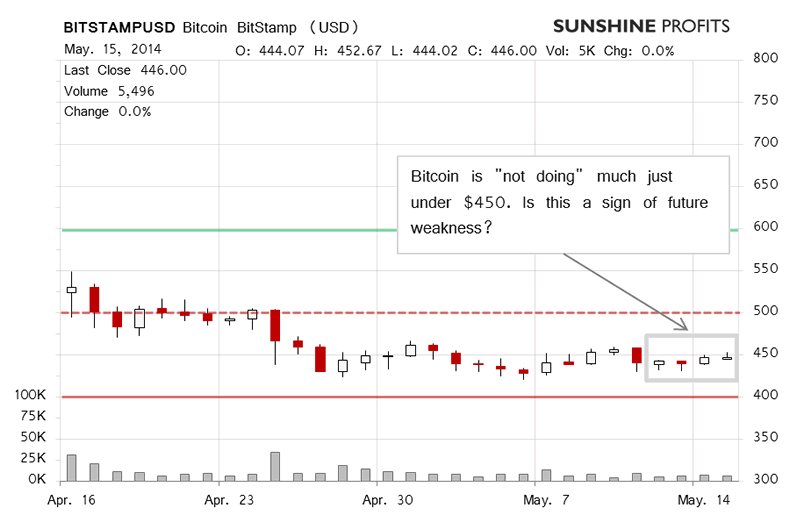

On BitStamp we saw something quite unique yesterday. The currency closed the day exactly where it had closed the day before yesterday, at $460.00. While this is a rare event, it does not necessarily have implications for the short-term trend. Perhaps a more important fact is that the volume fell yesterday which suggests that the recent moves up might not be indicative of where Bitcoin is headed in the near future.

Today, the volume has been down but the price has been marginally up (this is written before 9:30 a.m. EDT). This fits quite well with the recent move pattern. If you take a look at the chart above and focus on the grey rectangle, you’ll see the recent four days (not counting today), since May 12. During this time and today Bitcoin has been more or less flat with a slight bias toward appreciation. In our opinion the fact that this prolonged but weak move up has taken place on low volume and that we haven’t seen even one daily close above $450 doesn’t actually bring about excessive optimism as far as the short-term moves are concerned.

If you recall, we even titled our yesterday’s alert “Why This Move up Is Not Bullish Enough” and wrote in it the following:

Bitcoin actually went temporarily above $450 already but has come back down since then. We won’t be surprised to see another intraday move above $450 and it would even be possible for the currency to close above $450 but we wouldn’t see that as a downright bullish indication unless it was followed by more closes above $450.

And this is still the case today. Even a close above $450 would not be an immediate bullish indication for the short-term.

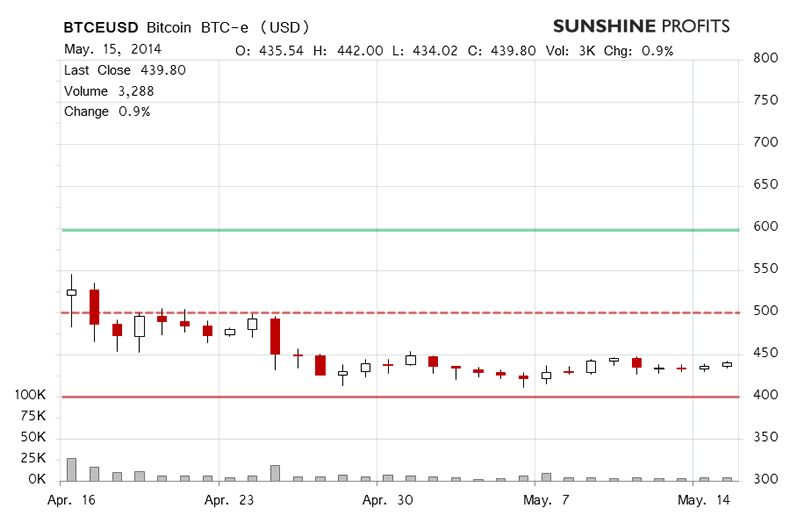

On BTC-e we saw more appreciation than on BitStamp yesterday but the volume was still down which didn’t make the move overly bullish, even less so if we take into account the fact that the daily top was below $450 and the currency closed below $440.

Today, the action has been weak and at the moment of writing Bitcoin hasn’t really moved much at all. One difference between BTC-e and BitStamp today is that the volume looks like it might increase on the former exchange today (the day is far from being over, though). Does this make the implications different for BTC-e? Not really since there hasn’t been much movement. If we don’t see a confirmation in the exchange rate, we won’t view that as a significant divergence.

Summing up, in our opinion speculative short positions in the Bitcoin market might still become profitable.

Trading position (short-term, our opinion): short, stop-loss at $470. We expect Bitcoin to depreciate, possibly following a move above $450.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.