FATCA Causing Chaos Worldwide For Americans

Politics / Taxes May 14, 2014 - 08:18 PM GMTBy: Jeff_Berwick

The Illegitimate Revenue Agency (IRS) has just announced that the Foreign Account Tax Compliance Act (FATCA) has been postponed from July 1, 2014 until January 1, 2016.

The Illegitimate Revenue Agency (IRS) has just announced that the Foreign Account Tax Compliance Act (FATCA) has been postponed from July 1, 2014 until January 1, 2016.

This is good news in many ways for both those with assets that they wish to internationalize as well as for the dollar and US banking system itself but in many ways the damage has already been done.

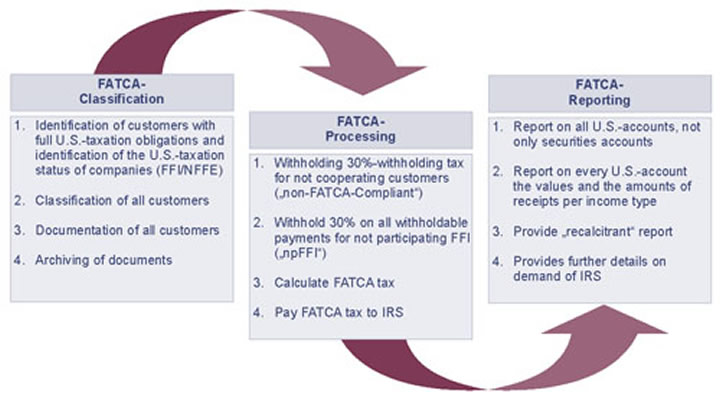

FATCA, signed into law in 2010, ensures that, if you don't tell the US government where your assets are and how much is there, your bank will no matter where that bank exists. FATCA has been acknowledged as the death of the dollar by many experts including our own FATCA expert, Jim Karger, who recently stated such at our recent TDV Wealth Management Crisis Conference in both Panama and Mexico. Many foreign banks simply won't comply. The cost and risk of complying outweighs the benefit of accepting American clients.

By requiring banks all over the world to become unpaid employees of the IRS and keep tabs on American citizens FATCA is perhaps the most egregious, overarching and draconian "law" put into effect by the US government crime organization to date.

We've heard story-after-story of banks all over the globe that are simply not taking on American clients. In many cases, they are telling their current American clients their accounts will soon be closed. The account holder's crime? Being American.

But there has been some temporary reprieve for those who will be affected by the law.

The recent IRS guidelines regarding FATCA give many of the companies and financial institutions implementing FATCA another 18 months to be in compliance. Of course, as with all government laws it will be selectively enforced. Any banks not appearing to be doing their best to comply will likely find themselves in contention with the IRS. At any rate, what this effectively means is that if Uncle Sam doesn't like you or wants your money he might come after you. Nothing new here...

A recent Thomson Reuters survey of 500 European and US tax professionals showed 74% believed there to be a lack of clarity in the IRS regulations for FATCA. This would impede compliance, they predicted.

The notice from the IRS states:

“Calendar years 2014 and 2015 will be regarded as a transition period for purposes of IRS enforcement and administration of the due diligence, reporting, and withholding provisions…

With respect to this transition period, the IRS will take into account the extent to which a participating or deemed-compliant FFI, direct reporting NFFE, sponsoring entity, sponsored FFI, sponsored direct reporting NFFE, or withholding agent has made good faith efforts to comply with the requirements of the chapter 4 regulations and the temporary coordination regulations.

For example, the IRS will take into account whether a withholding agent has made reasonable efforts during the transition period to modify its account opening practices and procedures to document the chapter 4 status of payees, apply the standards of knowledge provided in chapter 4, and, in the absence of reliable documentation, apply the presumption rules of §1.1471-3(f).”

CAUSING CHAOS WORLDWIDE FOR AMERICANS

FATCA has already affected many Americans with accounts abroad. They have seen their accounts closed at a moment's notice, have been unable to open accounts and perhaps even worse hardly anyone even knows how to deal with the FATCA regulations even if they did want to deal with it.

I have just returned from the Cayman Islands where lawyers and accountants are running scared. They are slowly figuring out what FATCA means to their American clients, many of whom have a large amount of assets in the Cayman Islands that they do not want to repatriate to the US or be reported to the IRS. And, even if they wanted to adhere to all the rules under FATCA it is nearly impossible to understand and fraught with risk.

The lawyers in the Cayman Islands told me that company incorporation in the Cayman Islands is rock solid in terms of privacy and ease of setup (we will have more on that to subscribers soon) but the problem is banking in the Cayman Island. They told me that if an American is even involved, in any way, with a company that has a bank account in the Cayman Islands they will report all information on that account to the IRS.

I informed them of a few things.

First, any American with substantial assets should be running, not walking, to get a second passport to protect against all of the capital controls coming out against Americans. We have heard of some companies that have stopped working with Americans at all just because of the problems it causes them with their bank accounts.

Secondly, there are ways for Americans to have international structures and banking without falling under the FATCA legislation. We enlightened dozens of people recently at our Crisis Conference on how to do this. You can find out more by contacting TDV Wealth Management.

CONCLUSION

As you can see, the law will still go into effect...and January 1, 2016 is right around the corner. The IRS fines for FATCA non-compliance could result in fines or jailtime on individuals who fail to report. Already this coming July 1, 2014, foreign financial institutions risk being fined.

The next 18 months are merely a reprieve. Already foreigners are moving away from the dollar. The facade of the US government has fallen and the entire world recognizes that the US and the dollar is about to collapse because it cannot pay off its debts and printing money is the only way the game can continue on much longer. Countless movements are ongoing in Russia, China, the Middle East and more all moving away from the dollar and the US banking system... and this is exacerbated by FATCA.

If you were caught on your heels in the lead up to July 1, 2014, then don't be in the lead up to the next FATCA deadline. The folks at TDV Wealth Management are ready to help you today with any questions you might have.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.