Are Homebuilder Stocks a Buy Ahead of the Spring?

Housing-Market / US Housing May 14, 2014 - 06:11 PM GMTBy: Investment_U

David Becker writes: Homebuilding stocks are down nearly 5% so far in 2014, but as spring approaches, an increase in sales could just be the remedy these shares need. Unfortunately, homebuilders generally underperform in May and June, and higher housing prices and recent disappointing sales data could further erode the prices of homebuilder stocks.

David Becker writes: Homebuilding stocks are down nearly 5% so far in 2014, but as spring approaches, an increase in sales could just be the remedy these shares need. Unfortunately, homebuilders generally underperform in May and June, and higher housing prices and recent disappointing sales data could further erode the prices of homebuilder stocks.

Seasonal Returns

The exchange-traded fund SPDR S&P Homebuilders ETF (NYSE: XHB) is down 4.5% so far in 2014, and seasonal returns on this ETF point to lower prices in May and June. Over the last 10 years, it has been down 60% of the time for an average loss of 5.5%. In June, it has been lower 90% of the time, for an average loss of 6.7%. Generally the best month for homebuilding stocks is December, when the ETF has been higher 100% of the time over the past 10 years for an average return of 5.3%.

Sales Are Low and Prices Are high

Recent data on new home sales has shown that consumers are waiting for prices to fall. Sales of new single-family homes dropped sharply in March, falling 14.5% to their weakest level since mid-2013, according to the Commerce Department. The annual sales rate was 384,000, down from February's revised pace of 449,000. Economists had expected an annual rate of 450,000 for March.

Most economists expected a rebound in March after the frigid winter weather helped hold down sales in February. Affordability seems to be the issue as both sales prices and mortgage rates have ticked up over the past year. The Commerce Department reported that the median price of new homes sold last month was $290,000, which is 13% higher than the median price in March 2013.

The climb in mortgage rates has also hindered new home sales. Over the past 12 months, the 30-year fixed-rate mortgage has climbed 1%. In 2014, rates have increased 0.25% and currently stand near 4.3%.

Although the housing market typically improves this time of year, the spring buying season has shown little strength so far in 2014. The National Association of Realtors reported recently that existing home sales last month fell 0.2% to an annual rate of 4.59 million. That was the third straight monthly decline and the lowest annual sales rate since July 2012.

Additionally, the National Association of Home Builders/builder sentiment index was 47 in April, about where it has been for three months. Readings below 50 indicate that sentiment is weak rather than strong.

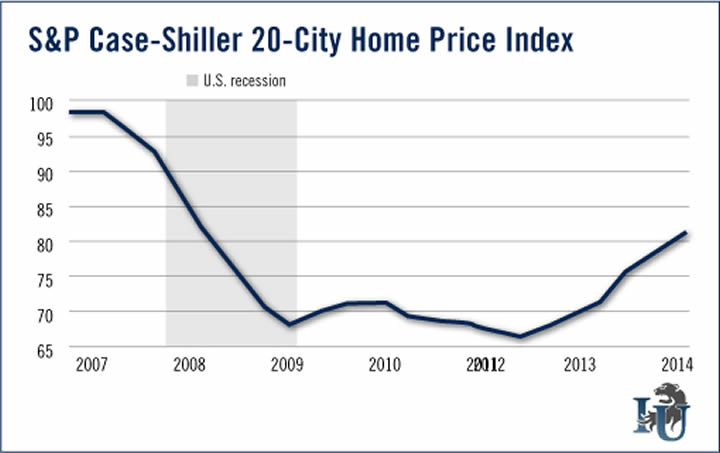

Since 2012, prices of homes have increased, according to the S&P Case Shiller 20 City Home Price index. The index has climbed nearly 13% over the course of the last 12 months. Builders thought they could raise prices given the low levels of inventory available on the market in 2013.

For sales to increase, builders will likely have to lower the prices of new homes. Lower prices will initially mean lower revenues for homebuilders, which will not sit well with investors. Until builders find a price that will increase sales to a sustainable rate, homebuilding stocks will likely underperform.

Source: http://www.investmentu.com/article/detail/37397/invest-homebuilders-spring

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.